10 Tax Myths Causing You Stress

A leading cause of Q1 mood swings

EP 50: 10 Tax Myths Causing You Stress

There are two types of people who file tax returns, those who don’t understand what a ‘refund’ is and those who do. The informed cohort acknowledge the tax reporting and filing process for the anathema that it is. Dreaded, painstaking, irredeemable, and callous.

Learning the tax code is like watching educational videos demonstrating where meat comes from. No thanks. I’ll just outsource that little detail.

Most of us are uninformed because we just don’t want to look. It’s either too complex, too boring or both. It strains the brain in unnatural ways, so we create shortcuts to avoid the difficult work of reviewing the source code. We create myths and share them with enthusiasm like messages of hope.

Myths, like getting a refund is money from the government, spread at the spread of social contagion. Sorry to disappoint, but that is your tax overpayment being refunded to you – hence the term Tax Return. If you gave $100 to a friend to buy your lunch, would you also think they were being generous when they give you back your change?

Who am I kidding, no one uses cash these days but I’m out of analogies so it will have to do. Let’s move on to review a few other common myths we advisors encounter from time to time. They may be useful to know going into the April 15 tax filing deadline, but mostly for some 2026 tax planning.

Myth # 1 | Tax Deferral is Always Good

The problem with kicking the can down the road is the risk of developing back pain along the way grows with the weight of the can, making it more difficult to pick up. Sometimes, it’s best to not procrastinate and do the unpleasant work. Taxpayers cannot retroactively go back in time to fill up unused low-income bracket space. Letting that go unused by failing to realize gains or process conversions is inefficient.

Myth # 2 | You Must File a Return

There is only a requirement to pay taxes, not to file. So, if confidence is high that you paid enough in Federal income tax withholding to cover the tax bill, April 15th is just like any other day. Now, a tax return should be filed regardless because this starts the clock on the IRS 3-year statute of limitations and provides official income documentation that can be used elsewhere.

Myth # 3 | The Tax Forms Tell the Whole Story

Neither your accountant nor the IRS know what you did last year. The 1099s, W-2s and other tax forms do not provide the whole picture and should be trusted no more than a teenager left home alone for the weekend. They will not inform if you made IRA/Roth contributions, processed qualified charitable distributions, or accurately recorded cost basis. Details like these must be communicated by you or someone that knows your financial situation well.

Myth # 4 | Filing an Extension Is Bad

The only requirement is that you have fully paid your tax bill by April 15. If you need more time to iron out the details of your refund, such as waiting for a corrected 1099 or a delayed K1, it’s better to file for an extension rather than an amended return. Form 4868 permits individuals an extra six months (October 15 deadline), which improves the accuracy of your submission. This may be one reason why some accountants claim extensions reduce the chance for audit.

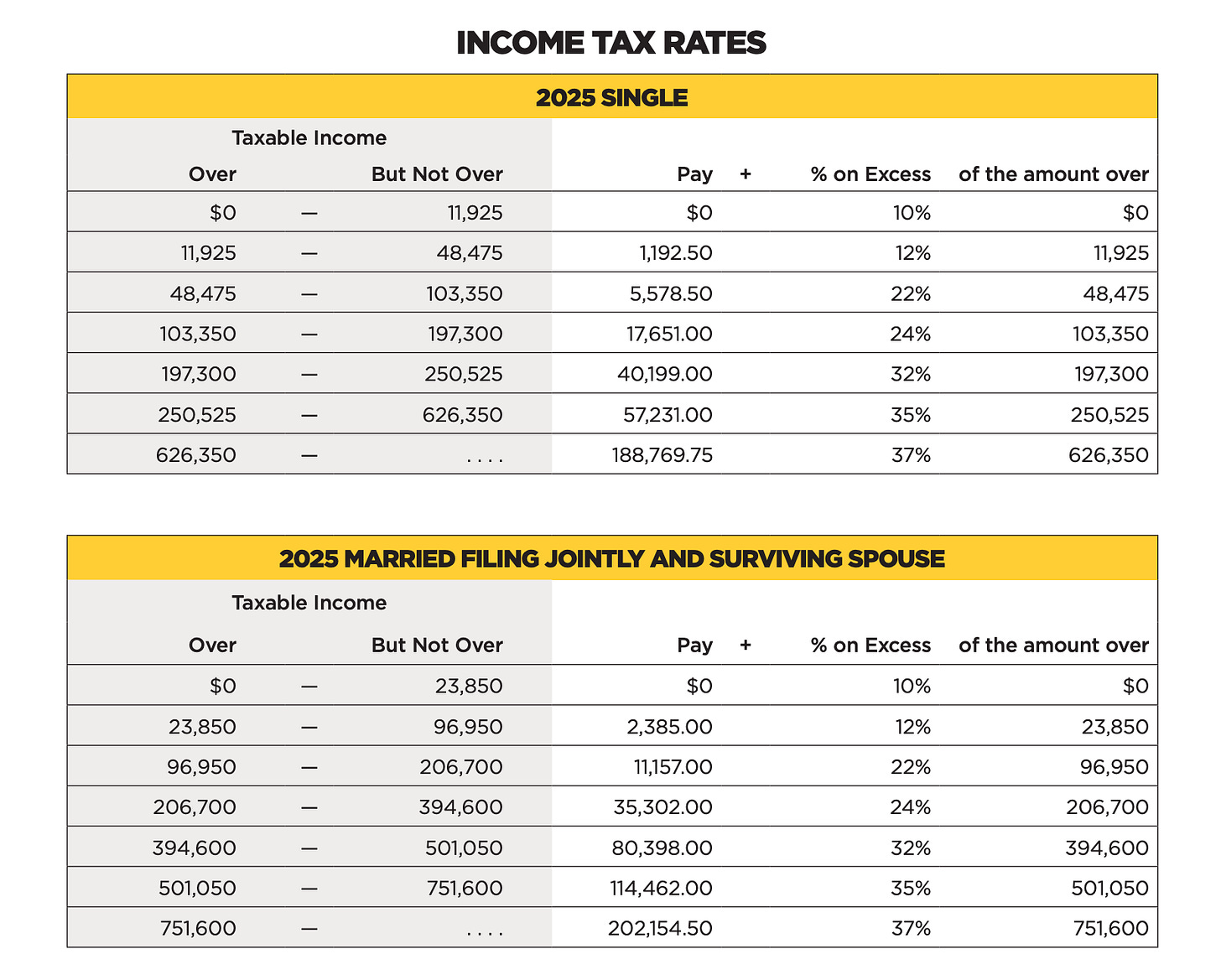

Myth # 5 | Being in a Higher Bracket Means All Income Is Taxed Higher

Brackets are progressive, which means the only the income that breaks into the next bracket is applied to the higher rate. This does not mean all your income is now taxed at the higher rate. You should never say “no” to an increase in pay because it nearly always means you will take home more.

Myth # 6 | Bonus Are Taxed More

You get a large bonus and spend the money in your head. Then the net direct deposit lands like a personal offense, crushing your aspirations. What gives? The bonus paycheck is withheld at the same effective tax rate as if your compensation was that size every pay period. Congratulations, you’re a 1%er for a pay period. If the bonus is enough to creep into the higher brackets, your effective rate could be substantially higher than usual.

Myth # 7 | Charitable Giving Always Lowers Taxes

Many taxpayers claim the standard deduction, which is $15,750 per individual for the 2025 tax year. Taking the standard deduction means you are electing not to itemize, and charitable donations are itemized deductions. There is a minor change to this rule starting in 2026 that permits taxpayers a $1,000 above-the-line deduction for cash donations to qualifying 501(c)(3) organizations. A welcome change.

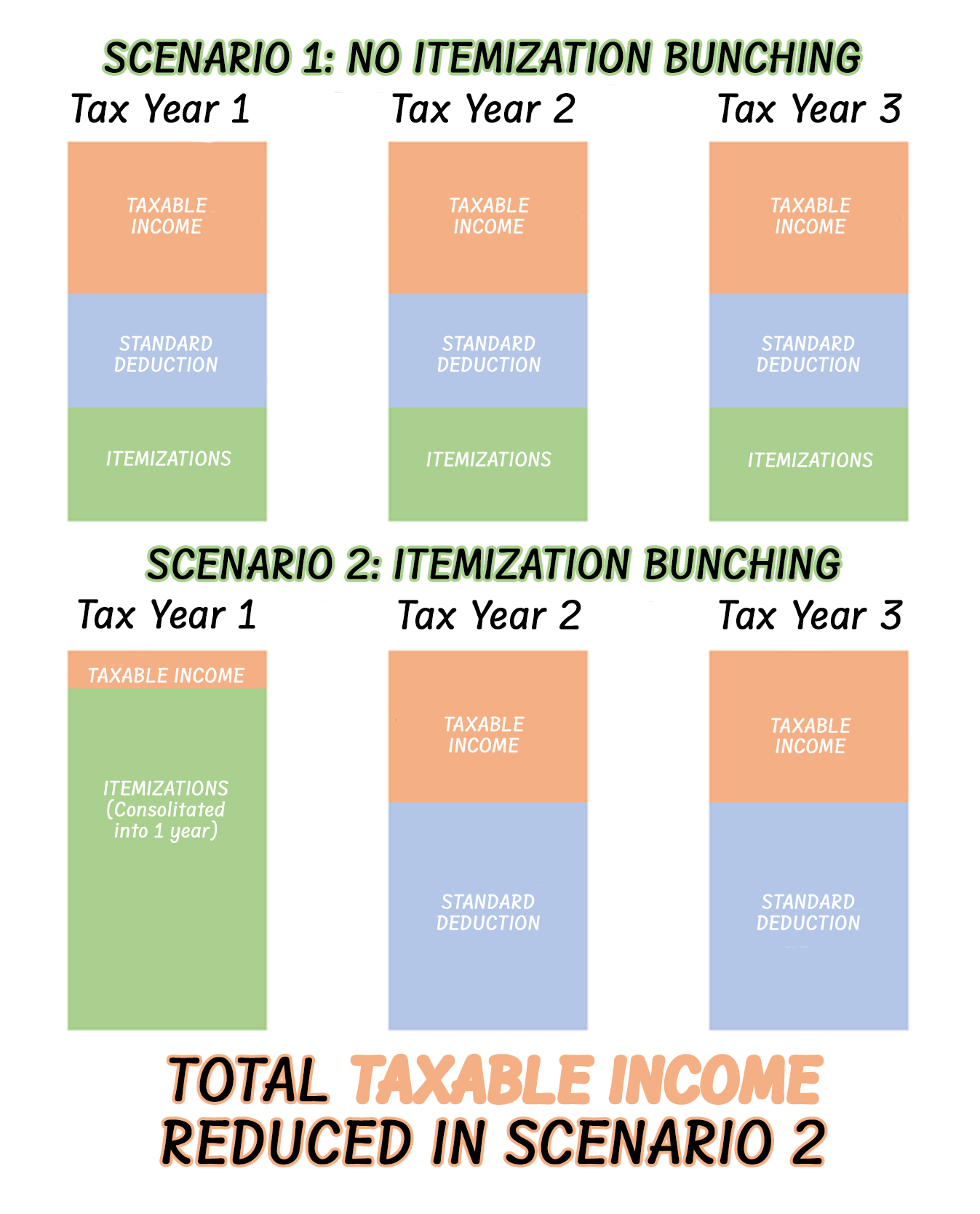

Myth # 8 | Itemization is Not Worth It

The easy button way to go is to ignore all strategy, toss your receipts and claim the standard deduction. In reality, you could be throwing away thousands doing this. Put that new 6% APR mortgage interest expense to use! Itemization bunching can be used in alternating years to potentially boost deductible expenses beyond the standard deduction. Strategies like pre-paying next year’s property tax and multi-year donations to Donar Advised Funds can be combined with great effect. Also, the State and Local Income Tax (SALT) deduction is temporary lifted to $40,000 until 2028.

Myth # 9 | No Tax on Social Security

This one really grinds my gears because it is a myth propagated by high-level politicians too embarrassed to admit to a failed promise. Social Security is not only still taxable, but recipients were also rewarded with a more complex tax return with the addition of a temporary enhanced senior deduction that includes income phase-outs.

Oh, and your Social Security deferrals are taxed twice. Once as you pay income tax on your FICA payments, and a second time when you claim your benefit. Social Security is the world’s most tax-inefficient retirement plan and the OBBBA did little to correct this.

Myth # 10 | Real Estate Automatically Offsets W-2 Income

Technically, it can offset W-2 income but there are significant caveats many taxpayers completely ignore. For one, you must be qualified as a real estate professional. Second, there are detailed distinctions between long-term and short-term rentals that must be carefully considered and integrated into a strategy. Lastly, know that this is a kick-the-can type of move. Real estate is subject to capital gains and recapture taxes once sold. Unless you plan on dying with the properties, the Piper will eventually have be paid.

As you approach your tax filing date, keep in mind there are limited things you can do to adjust for 2025 tax strategy sins. It’s better to focus on the things you can do in 2026 to streamline your lifetime tax liability.

If formalizing tax strategy feels like it might induce a migraine, connecting with a planner like me could be worth it. Unafraid to look, I have spent years learning how the sausage is made and leverage specialized software to integrate tax plans for clients.

Scheduling a brief strategy call before the end of summer to run a mid-year projection would be a great step toward a headache-free April the following year.

Investment advice offered through National Wealth Management Group, LLC.

The information presented is for educational and informational purposes only and is not intended as tax, legal, investment, or specific advice.

Tax laws are complex and subject to change; always consult your qualified tax advisor, CPA, or financial planner for advice tailored to your individual situation. Past performance is not indicative of future results.