5 Hot Takes by Charlie Munger

Some parting words from beloved billionaire Charlie Munger

Most of us have heard of Warren Buffett, the Oracle of Omaha, and his company Berkshire Hathaway. Surprisingly, many are not aware of his equally talented and inspiring business partner, Charlie Munger, who recently passed on November 23rd, 2024.

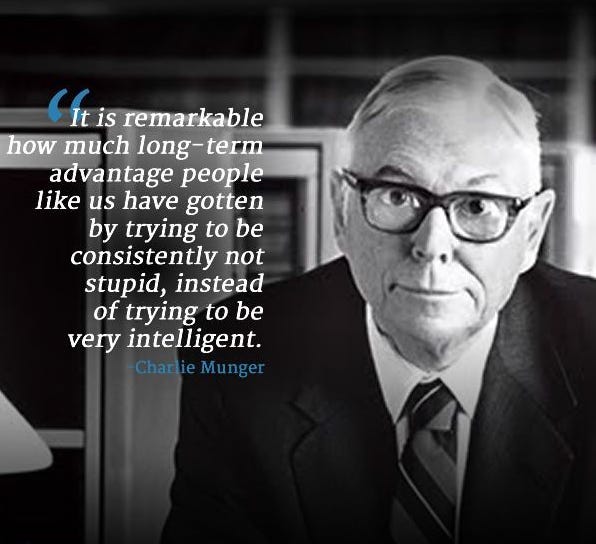

Charlie is a legend in the financial services industry, and he is often quoted by people like me. After reading some of his takes below, you can see why. His knowledge is an intoxicating blend of fine-aged wisdom and entertainment.

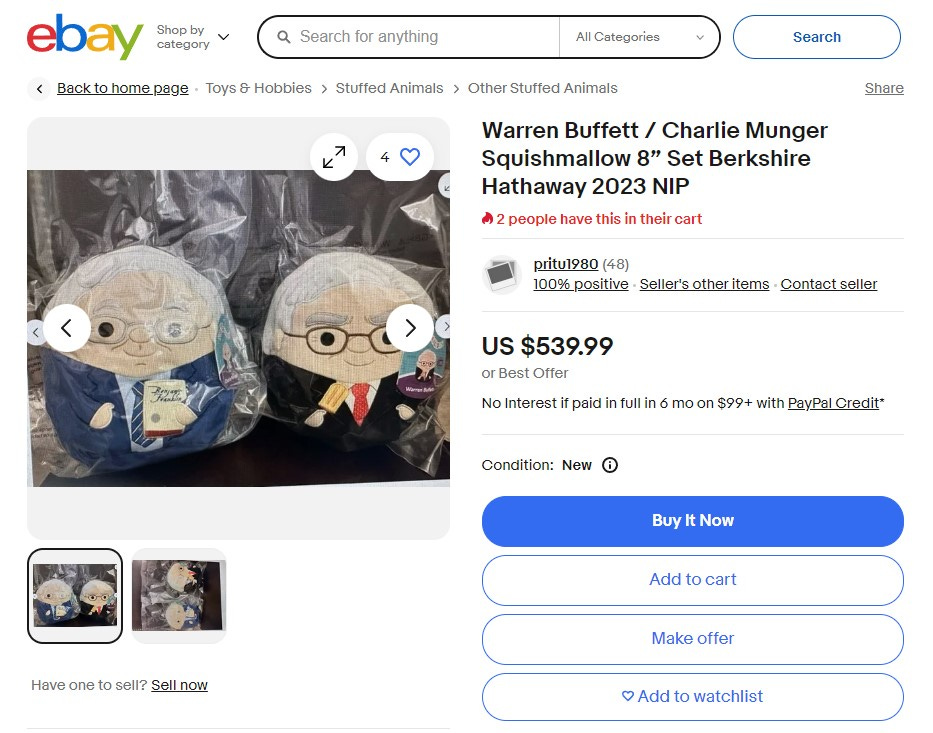

It was no secret that he did not have a love for wealth managers, though he is ironically worshipped by them. So much so that they’ve bid up the market for Squishmallows in his likeness so high they violate Charlie’s principals on sensible money management. This is hilariously appropriate.

Charlie was a rare breed. A man of principal not in word but of action. He was from a time when talk was so cheap no one ever dreamed of paying real money for it. At the time of his death, he was worth $2.6 billion, all of it earned through shrewd application of productive discipline absent what he referred to as “sleazy” business.

Nobody is perfect, this is true, but some among us are more deserving of admiration than others. Here are some of his thoughts expressed during one of his last interviews, which you can find on the Invest Like the Best podcast, episode 355. It was recorded shortly before his death in 2023.

Hot Take 1: Common Sense is Uncommon

“People say ‘old Joe has common sense’. They don’t mean he has common sense; they mean he has uncommon sense.” Charlie stresses that you must be competent and know the edge of your competency. It makes you a safer thinker. It’s common to witness people demonstrating their ignorance by overextending action beyond their skill or knowledge. It takes discipline to know your limits and stay within them. This is why good sense is so uncommon.

Hot Take 2: Get bad activities and people out of your life. “Just exclude them”

Charlie claims that he witnessed about 5% of the people he grew up with developed an addiction to alcohol. Half of them drank themselves to death and the other half became abstainers. He considered none of them to be “stupid people”. Avoid chemical addictions to avoid wasting life and talent.

More positively, he credits much of the success he experienced in his life to the exceptional people he was surrounded by. He considered it an “unfair” advantage. Being on the board of directors, he describes Costco’s corporate culture as “marching from triumph to triumph”. It is difficult to march distances with ranks not pulling their weight.

Hot Take 3: “The ordinary stockbroker is a menace to society.”

Harsh, but I am inclined to agree with him. Charlie considered most wealth managers to be marketing fronts more concerned with their profits than their investors’, saying “they only require a plausible narrative and a big fee.” He goes on to say that most managers have almost zero chance of outmanaging an index. If true, you can see how this unveils a host of issues, massive conflicts of interest among them. Keep in mind, Charlie did not rely on index investments. More on this next. He is merely making a point, in his own words, that “all investing is d**n difficult”.

Hot Take 4: [Owns just 4 Investments] “Nobody teaches that’s adequate diversification and they’re dead wrong.”

When Charlie died, he had exactly four investments. He owned Berkshire Hathaway stock, Costco stock, a Chinese investment fund, and apartment buildings. To him, this was perfectly adequate diversification. He equated his selection to finding a goldmine in your backyard. There are only so many you will find, and you’ll be lucky if there are four in a lifetime. Why wouldn’t you invest all your money in the gold mines you know about? Before you go and follow in his footsteps, he also states that finding these “goldmines” and properly investing them takes considerable skill and patience. Hence his opinion of wealth managers. Most are not capable of this, let alone the average investor.

Hot Take 5: “Suck it in and cope.”

This is his advice for dealing with life’s challenges. From culture and political frustrations to economic woes. You may think to yourself, “easy enough for a billionaire to say”. Keep in mind, Charlie did not start out as a billionaire and worked from the ground up. He lost an eye and nearly went blind. He lost his son Teddy, at age 9, to leukemia. This was most certainly a factor that led to the deterioration of his first marriage. I could think of no difficulty worse than the loss of a child. Nothing. We all have challenges, even billionaires.

There were so many nuggets of content I would like to share but I’ll instead suggest you to listen to the podcast. It’s one of the better episodes I’ve listened to this year and is worth your time. I have no affiliation with the podcast or its publishers. It was just a random listen recommended to me by a colleague.

While I do not agree with all his takes, you cannot deny the success of his principled philosophy. I find his commentary on investment selection and diversification compelling, and I plan to publish more content expanding on this topic in the future.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

To determine which strategies or investments may be suitable for you, consult the appropriate qualified professional prior to making a decision. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

All investing involves risk including loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.