5 predictions for 2026

Once again, we peer into a crystal ball.

As I draft the third edition of the annual KaratStick “5 Predictions for” newsletter, I am forced to face the reality that I possess no prophetic talents. Nonetheless, my 2025 predictions came in at 4 out of 5 correct. The prior year, 3 out of 5. Not bad for a person working on default settings.

The trick to accuracy is forecasting the obvious with just the right amount of vagueness, like ‘rain in the Amazon sometime next week’. Surprisingly, some are still surprised, which makes this all the more interesting.

Here’s how 2025 tallied up:

✅ Gov’t spending does NOT decrease

✅ AI human counter-revolution begins

✅ Crypto assets suffer a bear market

❌ The Fed raises rates

✅ US Equities correct before moving higher

Taking the time to look at the world as it is while attempting to remove as much conscious bias as possible is useful. It helps us manage expectations and avoid group-think traps that can cost us money.

Admittedly, I fell into one such trap last year by dismissing international equities as less attractive than domestic. I had my reasons; they were just the wrong reasons.

But hey, one wrong call shouldn’t ruin all the fun! We still have a winning track record and I’m hoping to extend that into 2026 with some more bold yet imprecise predictions. Please know, these should in no way serve to influence trade or investment decisions.

They are merely a collection of potential outcomes that would not surprise me if they come to pass.

1. Supreme Court Torpedoes Tariff Policy

The Trump Administration's creative invocation of the International Emergency Economic Powers Act (IEEPA) to impose broad reciprocal tariffs is looking shaky. Justices Sotomayor, Kagan, and Jackson firmly oppose the administration's position, while Chief Justice Roberts, Justices Gorsuch, and Barrett voiced doubts about interpreting IEEPA's authority to "regulate" imports as encompassing tariffs in their November oral arguments.

Only Justices Thomas, Alito, and Kavanaugh appear supportive. Historically, no president has used IEEPA for tariffs. Upholding this would establish a legal precedent for delegating Congress's tariff powers further strengthening the Executive office. However, the opposite results in potential refunds of up to $90 billion in collected duties, forcing the administration to pursue narrower, congressionally limited alternatives.

2. AI Trade Fractures into Broader Rally

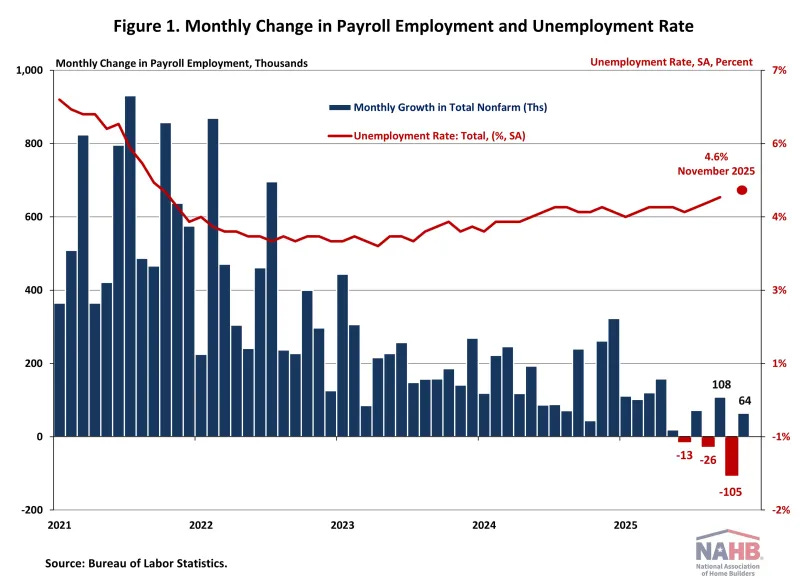

Going into 2026, the jobs data is signaling weakness which isn’t great news for investors. Perhaps employers are outsourcing to AI, perhaps they are waiting for strategic direction related to tariff policy. Probably both. Meanwhile, AI hyperscalers are going to eventually reach a ‘put up or shut up’ moment when the music of circular financing stops.

Weakening employment data could easily catalyze investor skepticism. Capital burn cannot continue indefinitely as meaningful payoffs are the expectation, which leads us to consider who all this AI tech development aims to serve.

Ultimately, that’s us either directly or indirectly through the businesses we patronize. If you buy the argument that AI is a landmark innovation, it stands to reason most businesses will benefit from it long-term. The jobs market will go through an adjustment period, but innovation typically translates to economic growth.

3. China Rebound (Continues)

After a punishing stretch of underperformance, 2025 delivered a solid rebound, with the MSCI China and Hang Seng indices posting gains north of 30%. Beijing's pivot to a "moderately loose" stance for the first time in over a decade, combined with proactive fiscal measures targeting domestic demand, sets the stage for earnings growth in 2026 as well.

Still-attractive valuations relative U.S. peers leave room for multiple expansion if corporate profits in tech, EVs, and manufacturing continue accelerating. Furthermore, wrenches thrown into the Trump Administration’s tariff policy could improve exports, although China has become increasingly less reliant on them. External risks linger, but the policy is there for another positive leg up.

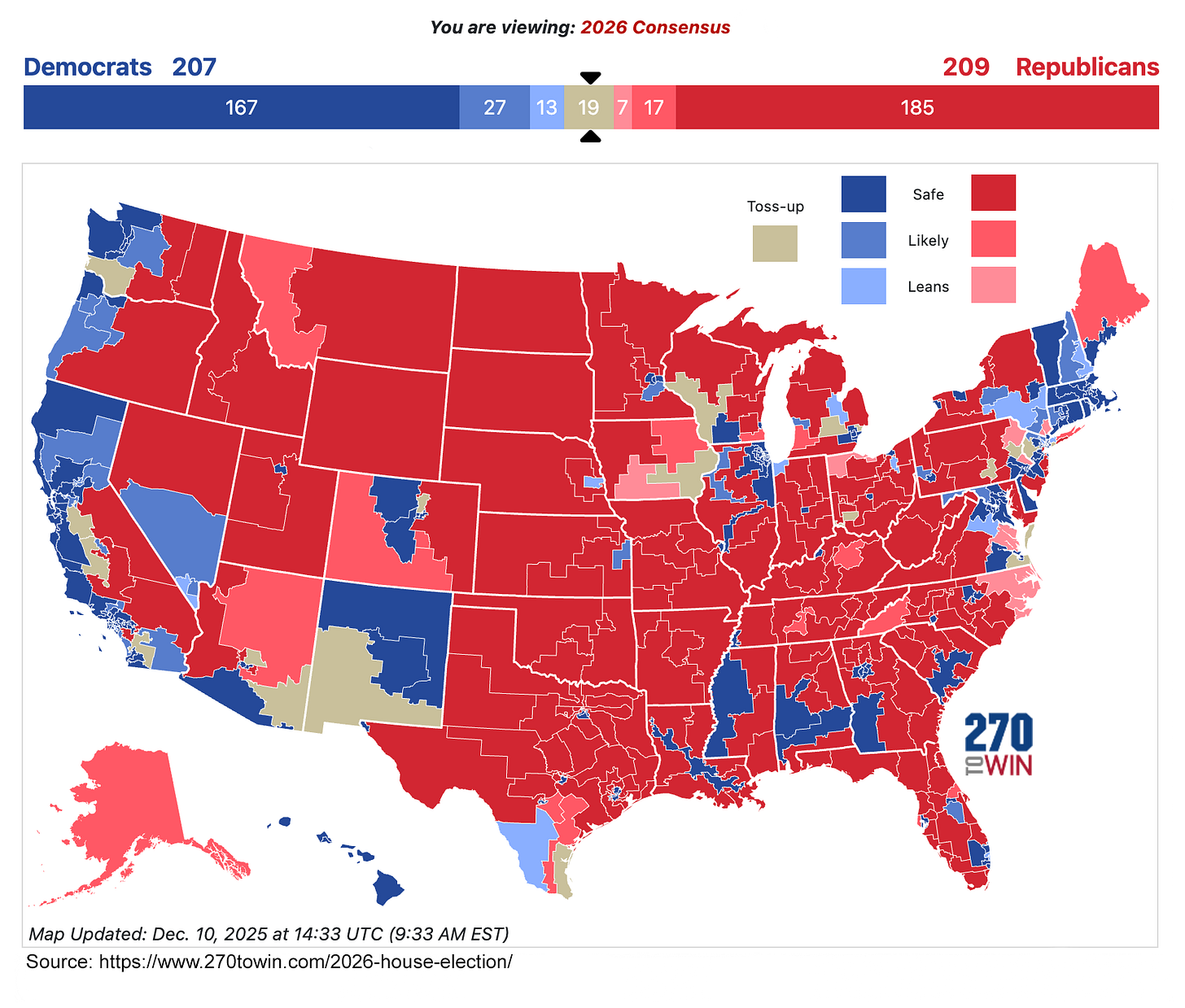

4. House Swings Blue

My track record on election predictions is, shall we say, spotty. Thankfully, one of the tenets of proper asset allocation is to ignore politics. It’s an emotional minefield that’s best respected and walked around. Wondering through only triggers stress responses with twitch reactions that have a high potential for harm.

Nonetheless, just for funsies, let’s look at the state of affairs. Well over half of Americans are not pleased with the cost-of-living situation or their job prospects. They want the impossible: better jobs and wages, decreasing costs for goods and services, and asset prices that move higher for them but nobody else.

No politician alive can deliver on this which is why whiplash elections are the norm rather than the exception these days. Unless Republicans can come up with an actual solution to the impossible problem or convince enough people that they’ll get it right next time, it’s difficult to see a different outcome.

5. Not QE (QE) with a Steepening Yield Curve

The U.S. Treasury faces ongoing refinancing challenges, with significant maturing debt rolling over annually. Elevated levels of around $9–10T have rolled over in recent years, largely short-term, mostly originating from the aggressive 2020 – 2021 COVID19 response.

FY2026 deficit projections are ~$1.9T, requiring net new borrowing of similar magnitude. Gross issuance, including rollovers, has exceeded $10–15T annually in recent years and we can expect much of the same in 2026. As Fed Chair Powell steps aside in May, possibly to make way for one of “the Kevins”, the Fed's shift to Reserve Management Purchases (RMP), the not ‘QE’ QE, provides indirect liquidity support through short-term Treasury buys to maintain ample reserves.

Continuing trends favor heavier T-Bill issuance (52 weeks or less), keeping the Fed’s focus on short-term rates/money markets, while long-term rates primarily reflect inflation and growth expectations. A boring prediction that excites no one, least of which Dave Ramsey.

EP 47 | The Money Alchemist Podcast - 2026 Predictions

It’s captivating how our culture revels in near-term predictions. We are utterly obsessed with our approximate futures while discarding any plans with maturities five years or beyond. I suspect this is rooted in our amygdala programming, biasing our attention to the present.

Truthfully, it matters little to me if any of the above predictions prove accurate. My asset allocation will remain tied to my goals and my appetite for risk, as will my savings rate and my career path. I will recommend the same for you. Think long term regardless of your age.

The best prediction market you can engage in is in your own head, consisting of event contracts representative of your available decisions. You can easily predict your success down to every micro-decision. Will you cloth yourself today? Hopefully. Will you learn something useful? Less likely, but still up to you.

Concern yourself less with the things out of your control. When possible, relegate them to fun pontifications that have no bearing on your emotional wellbeing. Bad things, and good things, out of your control will certainly happen, but their potential should not possess you.

Let’s see were 2026 takes us. I maintain my optimism because this is something I control.

The views, opinions, predictions, and commentary expressed in this newsletter are those of the author solely and are provided for general informational and entertainment purposes only. They do not constitute investment, financial, tax, legal, or other professional advice, nor are they a recommendation, offer, or solicitation to buy, sell, or hold any securities, assets, or investments.

Past performance or prior prediction accuracy is not indicative of future results.

All investments involve risk, including the potential loss of principal, and

market conditions can change rapidly.

Readers should conduct their own independent research and consult with qualified professional advisors before making any investment or financial decisions. The author and KaratStick or National Wealth Management Group, LLC assume no responsibility or liability for any actions taken based on the content of this newsletter or for any errors, omissions, or inaccuracies herein.

Advisory services offered by National Wealth Management Group, LLC.