A Tail of Two Asias

Comparing the world’s two largest emerging markets.

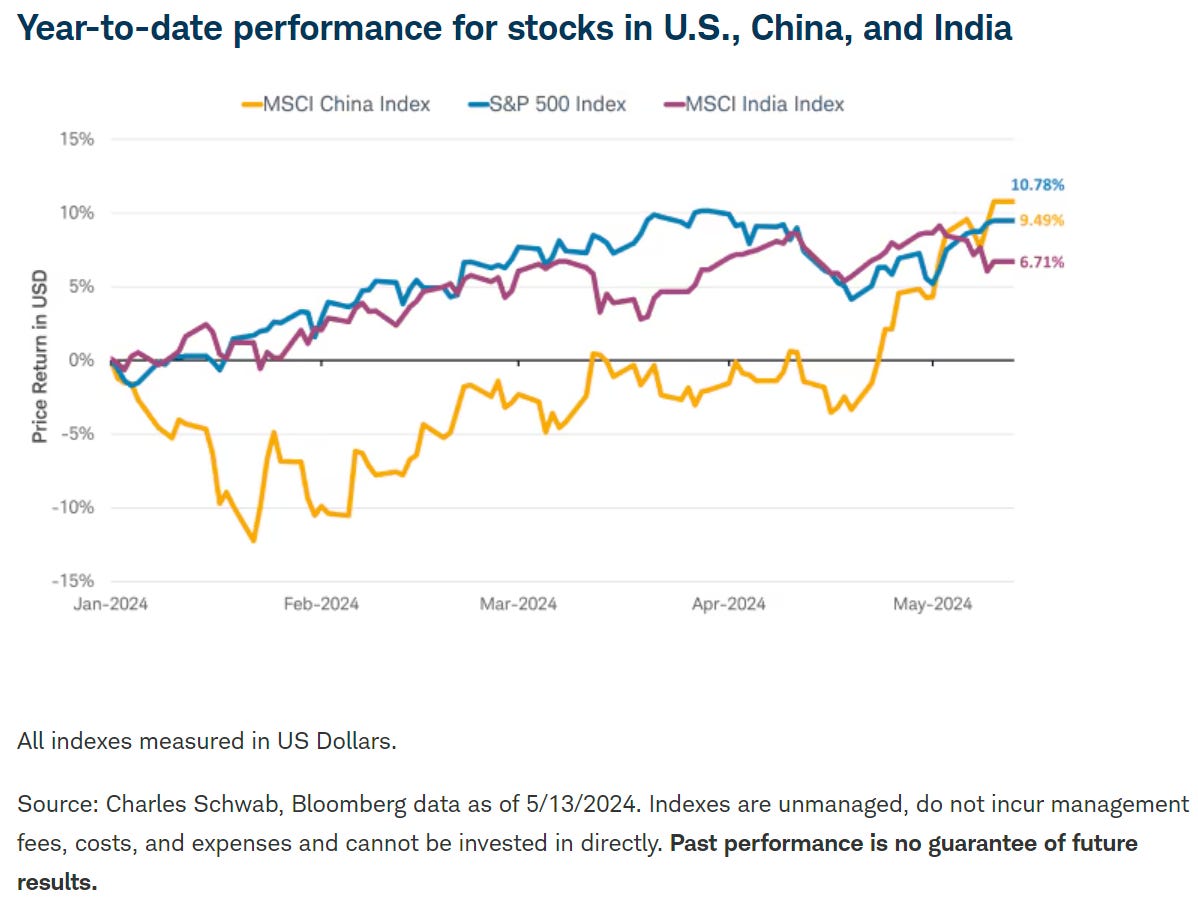

To everyone but Xi Jinping’s surprise the MSCI China Index just surpassed the S&P 500 and the MSCI India Index in year-to-date performance. The Chinese stock market took off at the end of April faster than the weeds in my mulch bed.

How does this make sense? We’ve been informed all year that the country is experiencing an economic backslide. They have demographic issues with a declining population, and a distressed property market. As of Q1 of this year, it was all over for Chinaland.

Let’s also not forget the draconian CCP with its affinity for abrupt domestic policy changes and dubious dealings with foreign trade partners. It’s no secret that US trade relations have deteriorated in recent years.

Case in point: In 2019, General Motors generated more than 40% of its sales from China alone. Just a few years later, sales fell off a cliff to less than 10% of total sales. Even Jeep, one of the bestselling brands in the US, was forced to file bankruptcy in 2022.

For a deeper dive on the US/China automobile trade war, CNBC produced a great 16 min story on it here. Well worth the watch.

In response, domestic policy makers have adopted tougher trade policies with China including the recent implementation of tariffs on various Chinese manufactured goods, and the forced divestiture of ByteDance, the parent company of TikTok.

Contrast this with China’s largest neighbor, India. Now the world's fastest-growing major economy, India remains on track to overtake Japan and Germany to become the world's third largest economy by 2027, having now recorded three consecutive quarters of growth over 8%. This is quickly closing the gap in the MSCI Emerging Market Index differential between the two countries.

Being in the good graces of the US isn’t the only wind at India’s back. Though bureaucratically complex, its widely popular Prime Minister, Narendra Modi, has been able to affect pro-growth initiatives ranging from infrastructure improvements to tax reform and trade policy. It’s young and growing population, expanding global trade relations, and sustainable use of public debt make India the new poster child for emerging market investing.

So why is the India MSCI Index underperforming in 2024 and why is China taking the top spot? Valuations. The India growth story isn’t new. It’s been in the making for the past several years and investors have taken notice. This has attracted capital from around the world, pushing valuations up in the process.

Sometimes, too much optimism or pessimism gets priced into markets resulting in value dislocations. While the stock market in India takes a breather, Chinese markets are going through the discount of a decade.

It seems likely that growth trends will continue to favor India over the longer terms, but only a fool would conclude that China’s emergence into the developed world is yesterday’s news. Plenty of opportunity exists in the country and investors can now find it at reasonable prices, albeit for a reason.

China’s rise as a global economic superpower has been truly astonishing. Billions of people have been brought up out of poverty as modern infrastructure and industry grew up to create a world class human ecosystem. Excluding its notorious human rights issues, it’s difficult to argue against China being the economic success story of the past few decades.

This level of success doesn’t just evaporate overnight, and I suspect we will continue to see China’s role in the global economy grow. India is just playing catch-up. However it plays out, that leaves us with over 2.8 billion people living in increasingly modern and productive countries. Hardly something to be pessimistic about.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

There is no assurance that the techniques and strategies discussed are suitable for all investors or will yield positive outcomes. The purchase of certain securities may be required to effect some of the strategies. Investing involves risks including possible loss of principal.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.