Are We There Yet?

The long road to what’s next.

The exuberance of July 4th makes for one the busiest travel weeks of the year. AAA estimates that 72.2 million Americans will brave both orange barrel obstacles and solipsistic drivers to find their ideal place to celebrate and possibly play with explosives.

It’s a marvelous time of year, cultivating deep personal associations with the leisure of summer, community and what it means to be an American. Cook outs, swimming pools, fireworks, late evenings with friends with unsupervised children wearing ice cream-stained cloths define these days and permeate our memories.

Independence Day is more than a day, it’s a destination. No matter where you are, things feel just a bit different, and in a good way. The patriotism is contagious with optimism and good vibes all around. Even the communists have difficulty frowning.

But, like any other day, it comes and goes and we’re off to the next. On the way home, kids will press the same tired query, “are we there yet?”. The perfect question for a circuit-fried parent, over-clocked to process the logistical miracle that is a family vacation.

It’s the same question we have been asking ourselves since the last ‘recession’ in 2020, which we all seemed to quickly forget. That history is easy to understand making it less interesting. We want to know when we are arriving to the Big Event.

When is the oil shock coming and how bad will it be?

When is Federal debt going to matter?

When is the stock market going to bust?

When is the dollar toast?

Can we stop AI from taking all the jobs?

IS THERE GOLD IN FORT KNOX?

Is it going to be a soft landing or a hard landing?

Never mind the fact that economies don’t ‘land’ any more than you can land on the surface of Jupiter. Always in flux, this plane has two states 1) in flight or, 2) catastrophe. There is no landing. That implies no movement and, therefore, a riskless state.

The economy is always experiencing turbulence, as should be expected. Presently, housing affordability is stressing budgets, which could be the primer for a correction in what were hot markets. There have been notable reductions in white collar corporate head counts, likely attributable to AI process adoption.

Stock prices for large, publicly traded US companies have been resilient in 2025, flirting with new all-time highs. This is despite unclear trade policy, weaker employment data, a weakening dollar and increased military action in the Middle East.

It’s almost as if the bad news doesn’t matter. One consequence of genie-wishing over $4 Trillion from 2020 – 2022 is a massive, seemingly insatiable demand for financial assets. The Big Beautiful Bill, from all accounts, seems to do more to exacerbate asset price inflation.

As one X user puts it:

“Stock market correction: bullish

Stock market crash: also bullish

Hope that helps”

Forecast in the expected 50 bps Federal Reserve rate cut for July and it’s difficult to see what could catalyze a sustained bear market in the coming months. The bidding to buy quality assets resembles the crowded highways this week. Congestion can at times betray logic.

Despite the traffic, these routes are popular for a reason: they lead to the most desirable destinations. Likewise. many of the trades into high quality assets, such as US equities, appear crowded. They’re popular for a reason.

The Big Event may come but it will also go. Truth is that these economic doomsday scenarios may never play out, or they will be in ways that were not predicted by the experts. The idea of vacation is usually different than the reality.

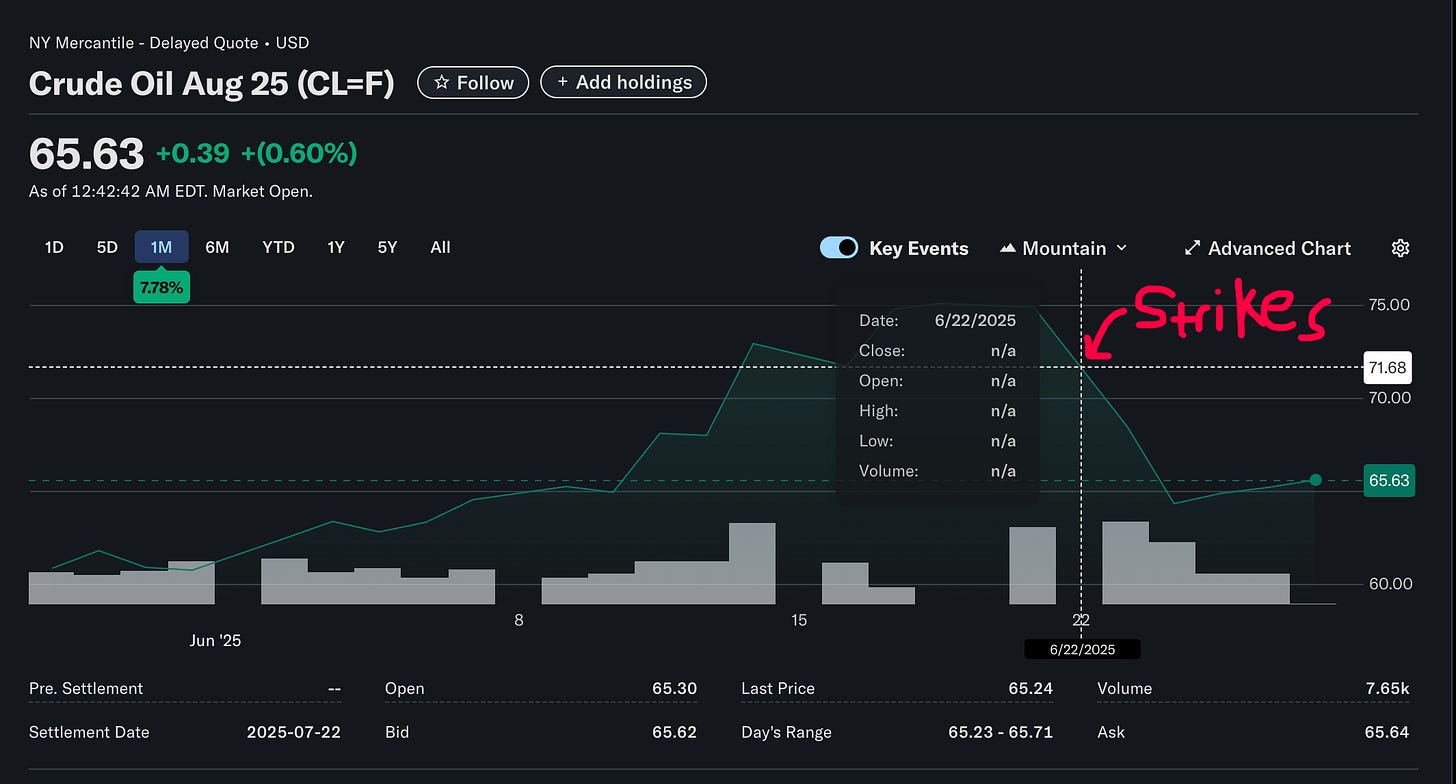

For recent evidence of this, just look at crude price action following the recent U.S. air strikes on Iran. Not a small event, to say the least, but the market reaction to this was, well, not expected.

As I recently told my kids in the car, we never truly ‘get there’. It’s an unsatisfying answer but its also the most interesting. Happy Independence Day and may you reach your destinations safely!

Investment advice offered through National Wealth Management Group, LLC.

All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The information presented is for educational and informational purposes only and is not intended as a recommendation or specific advice.