Bonds Are on the Move

Managing bonds in a rising rate environment.

Our financial markets are extraordinarily complex, to open with the obvious statement of the day. Extracting truth from simple concepts we take for granted can become impossible, like the loose thread hanging off the end of our shorts we neglectfully tug on. For example, how much money actually exists? Seems like a simple question, but you might as well ask how many people on earth are sneezing at any given time. Impossible to know with precision.

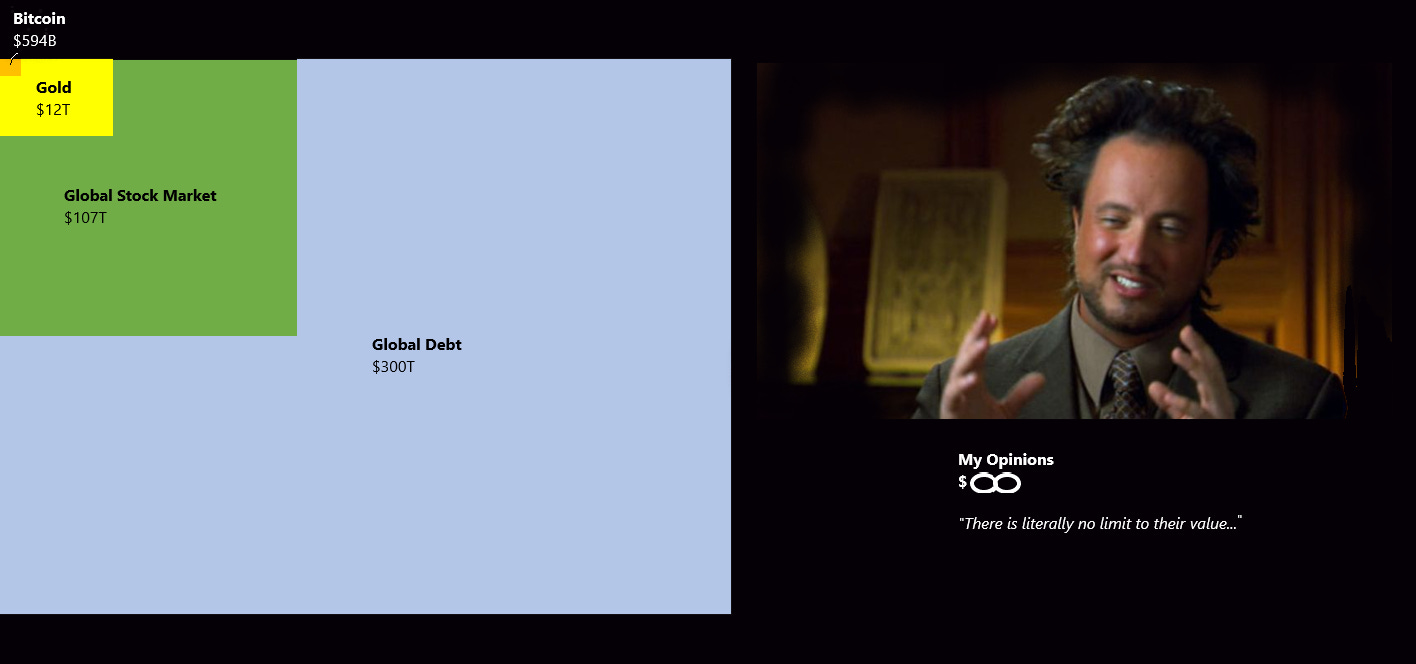

But we do know that our fiat money is backed by debt. Using data collected from BIS (Bank for International Settlements), total outstanding debt issued by governments as of the end of 2022 was $133tn. Compare this to the estimated size of the global stock market of $107tn, according to sifma.org. Keep in mind that this does not include private debt, which is estimated to put total global debt closer to the $300tn mark per the World Bank.

Of course, this is an educated guess because nobody truly knows. Let’s say you open an account with a local credit union, and they make you an offer to take out a loan to buy a car and you take it. This transaction isn’t necessarily reported to a centralized database.

Furthermore, who counts this as an asset? Now both you and the credit union show this transaction on your ledgers. The credit union could resell your loan as an investment asset, which they often do, and you have cash to spend. A process known as double-entry accounting. Money has been created without the need of a printing press.

Multiply this scenario millions, perhaps billions of times and you can see how complicated money markets are. This complexity underlies much of the differing opinions within fixed income markets today. Rates are on the rise but we don’t know where they will stop or exactly which rates will be effected.

The Fed and other central banks, such as the ECB and BoJ, can quickly manipulate short term rates simply by changing their overnight lending rates, a relatively simple process. This is mostly what the Fed has done since last March. Longer term rates, such as the 10-year Treasury, are set by dynamic market forces such as supply and demand. These securities are time sensitive so human economic forecasts and expectations also play an important role.

So what does it mean that bond rates have been quietly rising the past couple weeks? In my option it means two things: 1) The US Treasury has issued over $1tn in new debt since the debt ceiling was lifting in June, increasing the supply of Treasury bonds in the market which requires higher yields to find new buyers. 2) Fixed income investors are starting to believe the Fed when they suggest “higher for longer”, especially in light of the strong jobs numbers in June.

When longer-term yields rise this means either there are less buyers, there are more bonds available to buy, or both. A higher yield is only necessary to attract a buyer from the next best option. Intermediate investors would be wise to steer clear of the long-term yields to avoid unnecessary interstate risk but also because the 2-year notes are yielding over 5% whereas the 10-year is at 4%. For those looking for a more stable rate over time with the potential for a hedge should equity markets falter, long-term Treasuries haven’t looked this attractive in 16 years.

While the short-term direction of the stock market and the economy is unknowable, the canary in the coal mine has been acting a little funny. Investors are finally getting paid a positive real return to take some chips off the table and that may not be such a bad idea.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.