You walk into a retailer and make awkward eye contact with an elderly worker that just doesn’t seem to belong. Too polite to ask, you wonder “does this person want to be here or do they have to be here?”.

Many times, they are just choosing to be productive. There are only so many reruns of Everybody Loves Raymond one can handle. But sometimes these retirees hit every branch on the way down the bad-luck-tree and need the discount on cat food.

They are in the unenviable predicament of being dependent on others and government programs to sustain a meager lifestyle. They have superannuated. Most of us would rather receive a sensual back rub from Freddy Krueger himself than live that nightmare.

There are obvious ways this can happen, such as just not saving for retirement. It doesn’t take a mathematician to run the numbers on that equation. Not saving equals broke. Then there are the other scenarios that seem unjustifiable, and therefore truly terrifying.

It’s as if Tyche, the Federal Reserve Board of Governors, and Mother Nature gang up on you to rain all over your retirement parade. And just so you get the message that you’re good and screwed, they don’t stop until the economy tanks so there’s no hope of going back to the job you just retired from.

In financial parlance, you are a victim of sequence of return risk. We all know that returns matter. The higher the better, correct? Well, not necessarily. See, when you depend on your assets to derive an income, consistency is king.

An average return of 12% per year doesn’t mean you get 12% per year, although it is one of infinite possibilities. Typically, we get a variable series of returns/losses over a specified period that averages out to 12% per year. What’s more, not all these series of returns will deliver consistent retirement income results.

To illustrate my point, consider this simple sequence with a 12% average return on a $1M portfolio:

Now, let’s assume you need to withdrawal $60,000 per year, adjusted for a 3% inflation rate to sustain your retirement:

Now, consider the opposite sequence with the same withdrawal rate, this time the positive return is in year 1:

So, not only does the variability in returns matter, but when they occur in the timeline of your retirement matters too! And by “matter”, it means the difference between you going broke and staying solvent. That’s no small thing.

While it is possible to retire on just pension and Social Security income alone, it’s not practical. You need to store assets for lump sum withdrawal needs and supplemental income. The older you get, the more you’ll need of both.

Most Americans assessing their retirement income prospects will eventually find the monster they always knew lurked in the closet. Inflation. Fighting this leviathan without a sizable nest egg is like showing up on D-Day in your birthday suit.

You need to build wealth and make sure it lasts lest you be assigned to Hilda, the not so gentle nurse at the rest home. Once it is gone, it’s gone, and so are most of your options. It’s a scary and very real possibility, which is why you shouldn’t wing it.

Good news is that there are a variety of methods to mitigate sequence of return risk. As with most things finance, there’s no perfect solution and you should consult with a financial professional to pinpoint the right one for you.

Here are a few basic concepts to get you started down the right path:

Diversify – focus on complimenting asset classes with low to negative correlations. The aim is consistency over volatility.

Don’t chase returns or big ‘investment opportunities’ – be content with the most conservative portfolio that accomplishes your goals for your core retirement assets (it’s ok to speculate with funds you can afford to lose).

Manage for downturns – you will likely experience three or more economic downturns in a 30-year retirement. The average recovery is around three years.

Be flexible – if you find yourself bruised by a few bad-luck-tree branches, it’s time to change your position before hitting the ground.

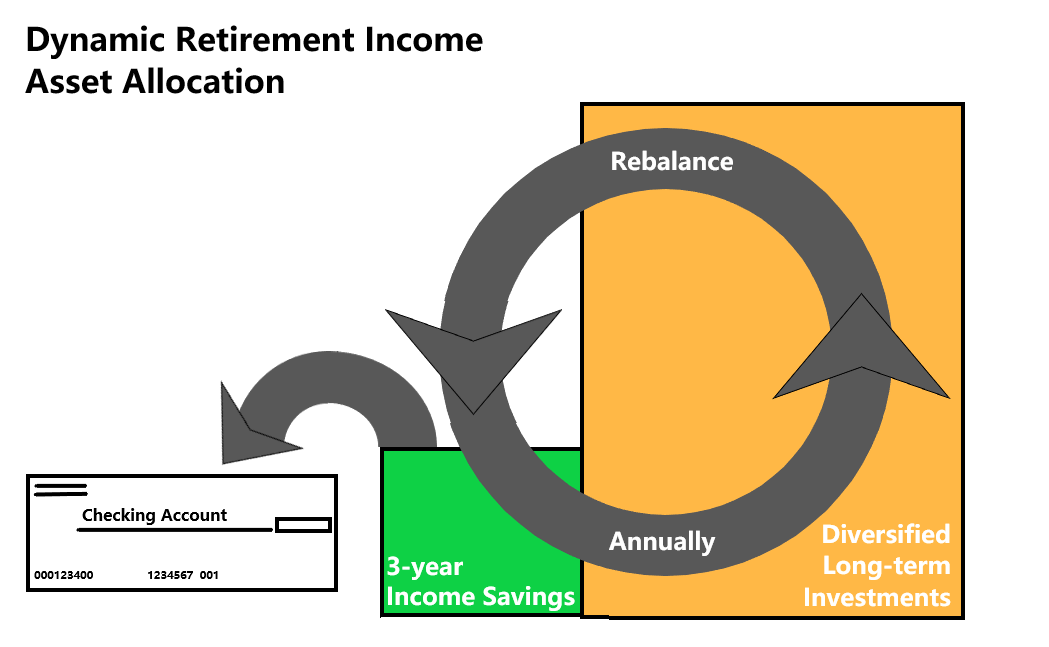

One of my favorite methods for solving the bad retirement timing problems is to use a dynamic asset allocation, rebalanced annually on valuation and performance drift. In a nutshell, it means keeping at least three years of distribution needs in what I call “dry powder”. This is a stable, highly liquid investment that can be used to sustain distributions.

Every year, positively performing assets within your allocation are sold to replenish the “dry powder” store, which buys you another three years of income. Some years, there are no positively performing assets which is why we want at least three years’ income stored.

If history rhymes, this should be enough for a recovery to appear. To be even more conservative, you could put four or even five years’ worth of distribution needs into the “dry powder” store. Eventually you will run into an efficiency frontier, however, as you dip further and further into your long-term investments which help to hedge out inflation risk.

There are no monopolies when it comes to good ideas for retirement income planning. I’ve seen many workable strategies, each with unique pros and cons. I’ve also seen many unworkable strategies. Retirees beware.

Retirement Income Planning is an over-advertised, confusing space fraught with consumer misdirection. I truly sympathize with retirees who don’t know who to trust or what to do. They get the one shot and missing it would be catastrophic. This is why it’s important to work with a fiduciary to plan out your retirement.

This newsletter is written by such a planner.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.