Budget Buster Tax Bomb Incoming

Why the sunsetting Tax Cut & Jobs Act of 2017 is meaningful to you.

Here’s some good news, the US Federal deficit spending issue may get some much-needed funding as 2026 rolls around. The bad news? I think you already know where the funding is going to come from.

The 2017 Tax Cut & Jobs Act (TCJA) was a contested bill signed into law that permanently set US corporate taxes to a 21% limit while only temporarily reducing personal income taxes under the budget reconciliation rule. While it may not feel like it, Federal taxes are below historical norms. Like warm blankets on a cold morning, its easy to get used to them and God help whoever tries to take them away.

While the changes to the corporate tax rules decreased the top corporate tax rate from 35% to 21%, the TCJA also closed loopholes that have resulted in a net increase in corporate tax revenue to the Treasury. Unfortunately, the same cannot be said regarding the personal tax cuts, which will have added an estimated $1.12 trillion to the deficit over the 2018-2027 period according to the Joint Committee on Taxation.

The lower rates will revert to the pre-TCJA levels after 2025. Most Americans look at their tax bills maybe once per year, if that. So, it is doubtful the majority will be forward thinking enough to adjust their budgets for a tax increase in just two short years.

The last tax increase on Americans was passed into law on March 23rd, 2010 as part of The Affordable Care Act. The shared responsibility payment was couched as a penalty for not purchasing a compliant healthcare plan, only later defined by the Supreme Court as a tax. It was narrow in scope, only applying to taxpayers that did not carry an ACA compliant healthcare plan, and it capped out at $2,085 per family in 2018. Furthermore, it was short-lived being assessed from 2014 to 2018.

The last meaningful tax increase in the US occurred in 1993 with the Omnibus Budget Reconciliation Act (OBRA). This increased the top marginal rates from 31% to 39.6%. Again, affecting only a narrow subset of taxpayers.

The sunsetting of the TCJA will impact every taxpayer and it will not be insignificant. Unexpected windfalls like tax cuts are as easy to harness productively as cats on a dogsled. Sense of control is illusory. The money comes in easy and is spent even easier.

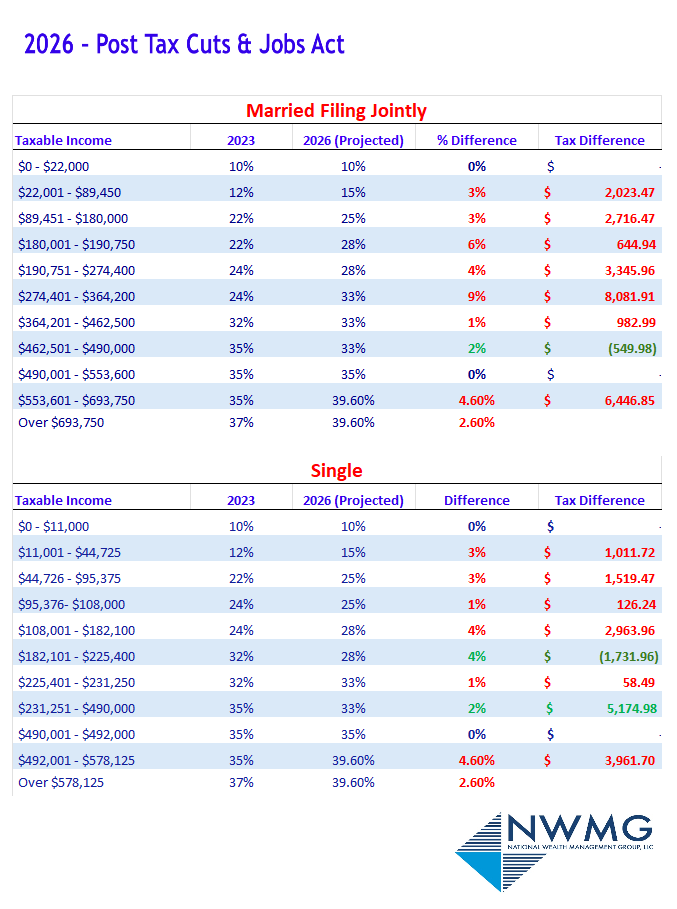

The reverse scenario is punishing for the unprepared. Most Americans will not be, I fear, even after nine years of heads up. The notice may have been posted when the law was passed, but this will do little to soften the blow. Look at the numbers below for your tax diagnosis then head to your nearest Chinese buffet for a fortune cookie. You’ll need those lucky numbers.

The tax difference is cumulative, which means if you are married filing jointly with a taxable income of $190,750, then your annual Federal tax bill will increase by $5,384.88. Have kids? The child tax credit is also reverting to $1,000 from the current $2,000 and losing its refundability status. Looks like you food pantry isn’t the only thing shrinking.

Per the IRS, there were 144.3 million personal returns filed in 2018 in which taxpayers paid taxes. The average taxable income per return was $71,746. Given incomes have increased since 2018 at a rate of 4% per year, we can assume that the average taxpayer will earn approximately $94,412 in 2026. Let’s assume the return count increases to 145 million, an unreasonably conservative estimate.

This gives us a very rough total additional tax liability north of $330 billion. I know we like to throw the “trillion” number around a lot these days making this seem insignificant, but not all spending is equal. This $330 billion plus is money sucked right out of main street, hitting right where it counts.

Dollar for dollar, a commiserate reduction in consumer activity doesn’t necessarily lead to a recession given how large the economy is. In 2023, the US economy grew by 2.5% to $25.4 trillion. $330 billion would only be 1.3% of total GDP. However, it could catalyze a behavioral ripple with contagious consequences.

How likely are you to upgrade your smartphone or willing to commit to a new auto loan knowing you have less money every month than last year? I wager not very.

Time will tell whether this will come to pass. It’s ultimately up to policymakers who may be too busy dodging political attacks to do anything of substance in the coming months. The prudent plan is to expect the worst and hope for the best.

While many financial analysts and economists debate on the prospect of recession in 2024, I look with much more concern toward the US fiscal stressors of 2026 and beyond.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Individual tax and legal matters should be discussed with your tax or legal professional.