Can You Count on Social Security?

An x-ray of America’s retirement backbone.

“Oh, I’m not going to get Social Security”, is something I’ve heard on more than one occasion, and it’s usually followed by melancholy sigh with a directionless glance off into the distance. I even used to hear this from people before I entered the work force, so I imagine the concern predates my birth. It is true that Social Security is woefully underfunded in its current state, and people are living longer thus overstaying their government assumed welcome. The Social Security Administration claims that its $2.7 Trillion Old-Age and Survivors Insurance (OASI) Trust Fund will be exhausted as soon as 2033! Of course, this is a projection subject to change depending on population longevity, payroll tax revenue and interest rates. As such, policymakers and economists are floating radical ideas such as “baby bonds”, extending the benefit age to 70 and uncapping the Social Security tax (currently only assessed on the first $160,200 in individual annual income).

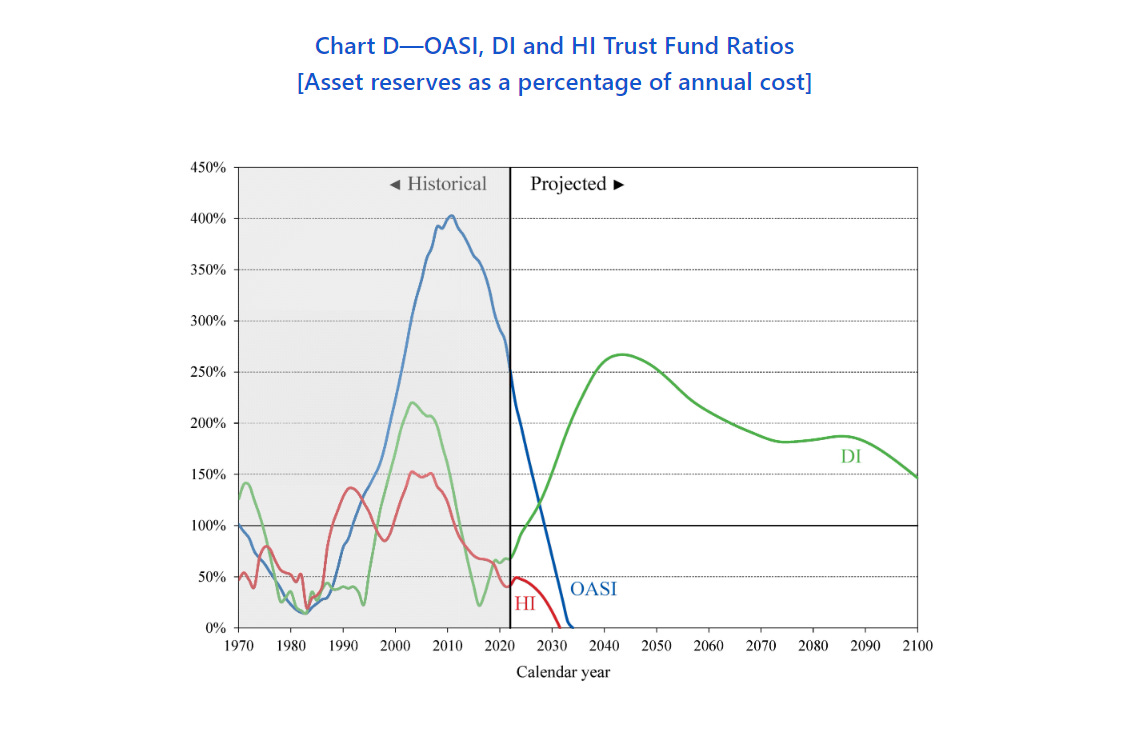

As long as I’ve been in the business of providing professional financial advice, Social Security has been in crisis mode. Yet people continue to retire every year and the operation runs situation normal, even as deficits pile up. In fact, the Social Security OASI program has been operating at a deficit since 2010. Up until then, the program took in more revenue than it paid out, which is how it built its trust fund reserves managed by the US Treasury. In 2022, a total of $993 B was collected by taxation to offset a whopping $1.094 Trillion in benefit payments. Some of this deficit was offset by trust fund interest earnings, but not enough. The gap in revenue vs benefit payments is expected to grow because 1) people are expected to live longer, 2) a higher volume of applications is expected as Baby Boomers begin to claim benefits, and 3) the size of the workforce sustaining the program is insufficient to cover the increase in claims. In its 2023 Annual Report the Social Security trust fund trustees conclude, “The 2023 Trustees Reports indicate a need for substantial changes to address Social Security’s and Medicare’s financial challenges. The Trustees recommend that lawmakers address the projected trust fund shortfalls in a timely way in order to phase in necessary changes gradually and give workers and beneficiaries time to adjust their expectations and behavior.” Not exactly a ringing endorsement of Social Security’s long-term viability.

Source: https://www.ssa.gov/oact/TRSUM/

So what’s next? Are citizens slated to receive benefits after 2033 just out of luck? In my opinion, no. It’s likely we’ll see a reform before things get too ugly but it’s Congress’s style to wait until the last minute. Even if this does not occur, we have historical precedent for deploying massive financial bailout parachutes outside of legislative action. It would be political suicide for policymakers to choose a sudden cut in benefits versus sprinkling a little bit more magic fairy dust money on the problem. The question isn’t whether you will see your promised benefit, but how diluted your promised benefit will be by the disastrous inflationary monetary policies implemented to fulfill it. You will get your promised benefit alright, but bananas will cost $100 each. I’m being a bit hyperbolic here but that is on purpose to get the point across. Social Security’s future will likely be far less exciting. The folks holding the purse strings will find just the right balance between paying you what you think is your fair due and inflating the currency just enough to not be accused of any negligence.

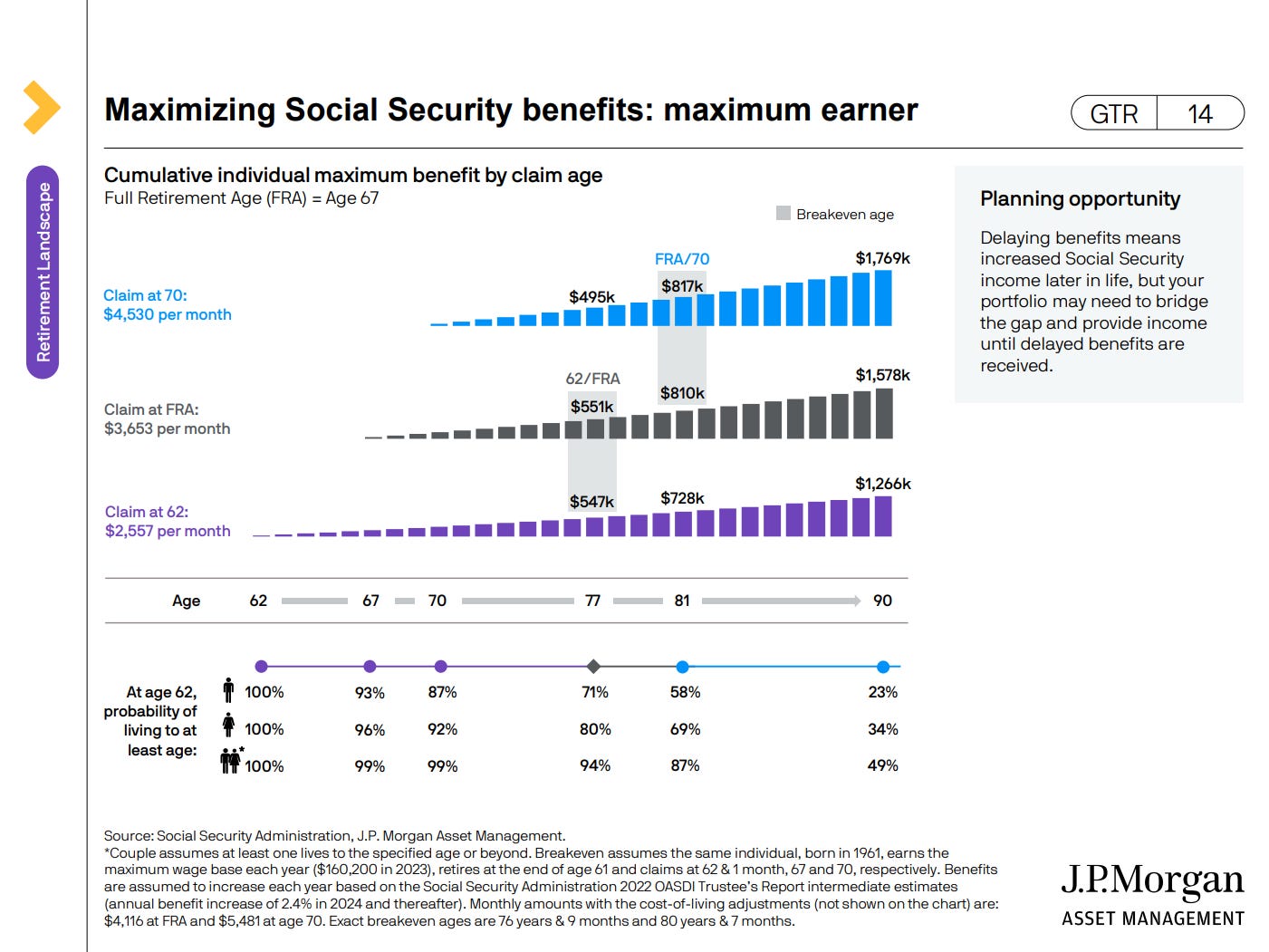

Social Security will likely continue to play a pivotal role in American retirement for decades to come, even after its projected insolvency. Many of our elderly fellow citizens would not be able to make ends meet without it. Nonetheless, it’s not a good idea to rely on this entitlement alone. It generally only provides for one third of living expenses and that is in today’s dollars. Imagine how inflation could reduce this share of retirement costs even more. For those of you looking to file now or in the near future, check out the chart below to help in the decision-making process. It’s a decision you can only make once so you want to make sure to get it right. Find a good financial planner if you’re uncertain to help in the process.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.