Doubting the DOGE

Cutting $2T in spending

$1,000,000,000,000. That’s a big number. At $34/hour, if you worked 40 hours per week without time off, it would take 14,140,271 years to earn this amount. Overtime isn’t permitted. Your employer is already overcommitted.

On your hypothetical first day, there would have been no polar ice caps and whales were just beginning to adapt to life in the ocean. Your commute, assuming you outran the terror birds and saber tooth tigers, would have been gridlock free.

With this context, it boggles the mind that Federal annual spending currently clocks in at $6.75 T per year. According to the US Bureau of Labor Statistics, the average hourly wage in 2024 is $34. If there are 168 million people working in the United States and we evenly distribute the spending across this population, we get $40,178.57 per working citizen.

That’s comes out to 1,182 of your labor hours, or 29 full-time weeks, consumed by your Federal government each year. Multiplied by 168 million. Per year!

In the sage words of Forest Gump

It’s easy to see how spending could get to an unsustainable level when you consider the incentives of policy makers. Recipe for political success: cut taxes and spend money. It’s what the voters want and the paymasters demand. Anything less is like clapping at a funeral.

But we all know, even the financially illiterate among us, that all this debt piling up cannot lead to paradise. The universe demands sacrifice, which means one of the things must give. The voters spoke and that thing is the spending.

The incoming Trump administration has commissioned the Department of Government Efficiency (DOGE) to advise on cost cutting measures. ‘Department’ is something of a misnomer because it will not be an official department of the Federal government, which would require legislation to approve.

Rather, DOGE is an advisory board tasked with auditing Federal spending and directing Congress and the President where to swing the cleaver. It’s still unclear what will require congressional approval and what can be done by executive order, so a showdown is imminent.

The stated goal of cutting $2T in spending, 30% of the current budget, is enough to make Andrew Jackson blush in his grave. It’s also enough to earn the scorn of a long list of powerful players dependent on the easy money. Maybe too powerful, and that’s the point.

Will we actually see any meaningful spending cuts? This is the gamble. If the incoming administration and aligned Congress are successful extending and expanding on the 2017 tax cuts (TCJA), making good on campaign promises, then cuts are necessary. Lest we pile on to the already problematic debt load, exacerbating inflation.

If left up to Congress, I wouldn’t bet the farm on the DOGE. There are just too many donors and constituents to answer to, blunting the cleaver. It seems more probable that most of the spending cuts will be ordered through the executive branch, limiting the stickiness of the initiative.

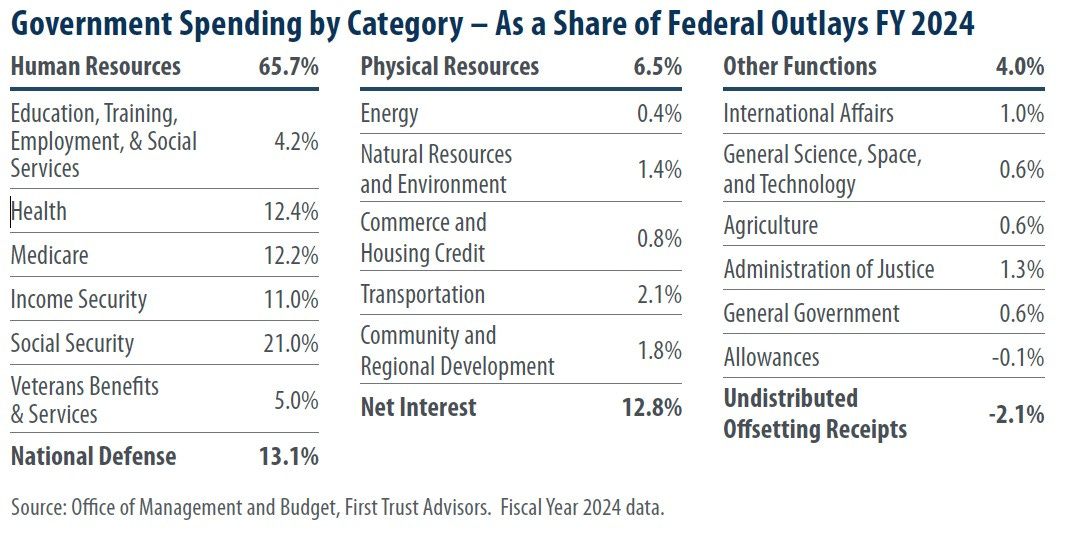

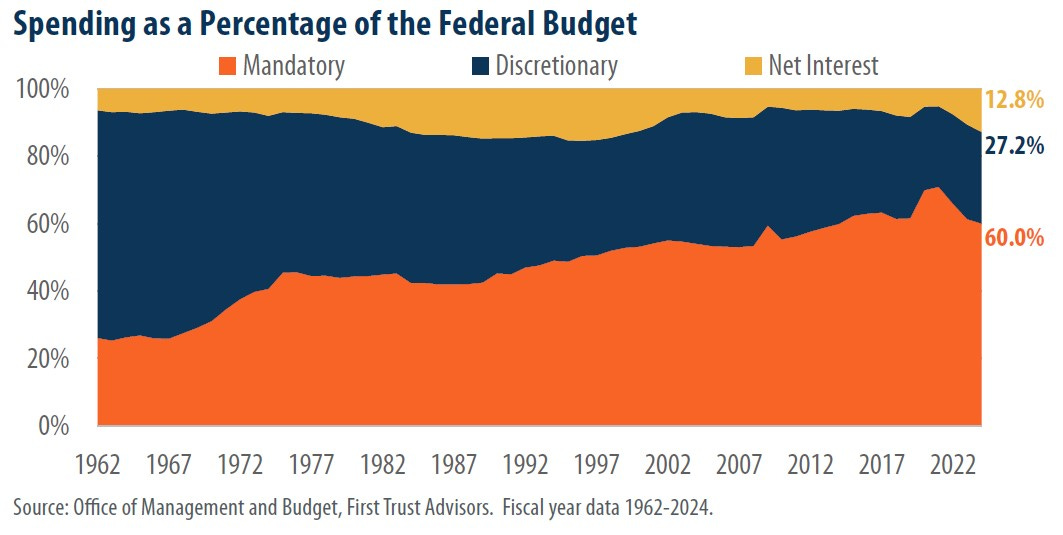

The challenge of weaving Federal finances into viable spending patterns grows each year as mandatory spending programs like Social Security consume ever larger portions of the Federal budget.

‘Sire, the subjects will revolt if you admit the Treasury is empty!’

It’s not just Federal finances hanging in the balance, 23.4% of US GDP is comprised of government spending. What happens if we cut that by 30%? A potential 7% drop in GDP using 4th grade math, and we all know accurate economic forecasts require the gifts of a prophet.

Hopeful eyes look to regulation cuts for the offsetting productivity gains necessary to salvage re-election campaigns. Reduced Treasury insurance could alleviate upward pressure on long-term rates and inflation, contributing to the offset.

This may be just enough to pull it off, buying the American dollar more time on the throne. But as I said, it’s a gamble. Good thing Elon is on a winning streak trading DOGE coin.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.