Estate Planning Gone Wrong

Everyone has an estate plan, and some are a punch in the face.

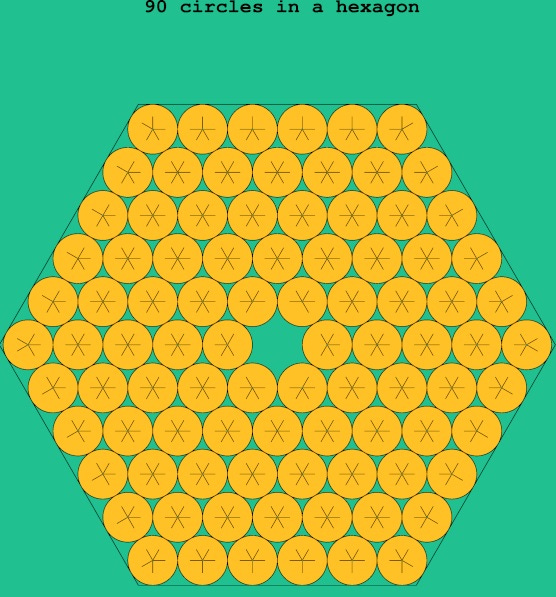

One of the unfortunate facts of this life is that it is temporary. It is a mist that appears for a while and then vanishes. To illustrate just how limited our time is, think of how quickly the past twelve months have passed by. Now consider the image below with 90 circles in a hexagon and imagine each circle represents a year of your life. The average life expectancy for people born in the US today is 78.8 years according to usafacts.org. In this context, it doesn’t look like we have many circles, many of which are already spent if you have the interest to read this newsletter.

This is not a fun topic to come to grips with but make no mistake, you will come to grips with it. The sooner the better. Your life is precious and each moment you experience culminates into your meaning, whether these moments are filled with time with family, work, leisure, or nothing at all. Each serves some purpose in defining who you are and why you are. Some of these moments you are productive and receive consideration for this productivity in the form of money. And a fraction of these productive moments you bank for the future. This nest egg of yours, the collection of rare and precious moments of productivity, is unceremoniously dubbed your “estate” by those in the business of settling your affairs when you’re gone.

Do not treat your estate with thoughtless abandon. To do this would be a complete disregard of your own life’s meaning, like trashing a magnum opus because carefully transferring it to a better location seems like too much work. There are many reasons why people avoid getting their affairs in order; because considering your death is macabre, because you do not want to make difficult discissions regarding who gets what, or because you would just rather do something else, anything else. What you may not realize is that you already have an estate plan even if you haven’t drafted one. It’s also the worst kind of estate plan, the government drafted kind. If you die without a Last Will and Testament, the most basic of all estate planning documents, your affairs will be settled by the intestacy laws of the state you resided in which pre-determines who gets what according to existing law.

What you may not realize is that you already have an estate plan even if you haven’t drafted one.

This, reader, is a good recipe for engendering family toxicity. The kind that can result in appearances before criminal courts, not just the probate kind. I could write a small book about the wild things I’ve seen family and friends do to one another over an inheritance, some small and some large. While this would be entertaining, I will just summarize my erudition for the intended education. As Notorious B.I.G. so eloquently puts it in his 1997 hit, “Mo Money Mo Problems”. Unless you would like to seed resentment and bring out the worst in your family, potentially destroying it in the process, you need to have an estate plan and clearly communicate this with those who are its beneficiaries. Nothing suggests I’m in for trouble more than a child that’s asking me about the size of their beneficiary claim while Mom is still connected to the EKG. Here’s the key, you should plan your estate while you are of sound mind if possible. Given you are reading karatstick.com, you are of sound mind right now.

Unless you’re like the person that created the meme above, the first thing you should do is draft a Last Will and Testament, which is essentially a letter of instruction to the probate judge for how you would like your affairs handled. Now, not all your estate would be subject to probate if you do things correctly. One of the easiest things you can do is assign beneficiaries directly to your accounts, which would bypass the will and allow the asset to flow directly from your estate to the beneficiary without probate involvement. This is sometimes referred to as “Transfer on Death”, or TOD. You can even do this with real assets such as real estate and automobiles. If you desire some control of your assets from the grave, you may want to consider something more complex such as a trust. Trusts can also serve other important functions such as minimizing estate taxes or assigning care to a special needs beneficiary. Meeting with a financial advisor is a good starting point for discussing your needs because they will be able to help you conceptualize your plan prior to sitting in front of an hourly rate attorney, which can be costly. Furthermore, an advisor is often helpful to your survivors because he or she will be familiar with your estate and your desired intentions.

I offer the following bits of parting practical advice from someone who has settled many estates:

1. In most cases, assign every beneficiary to all accounts versus leaving account A to beneficiary 1 and account B to beneficiary 2, so forth and so on. Otherwise, you may end up passing unintended tax burdens to some beneficiaries and it will most likely result in unequal distribution.

2. Involve your beneficiaries in your estate plan prior to your death, at least to some degree. The most positive experiences I have are those that involve the beneficiaries the most and the earliest.

3. Consider inter vivos gifting of capital you are unlikely to spend in your lifetime. The best way to find out if someone is deserving of a large sum is to see what they do with a small sum.

4. Do not assume your children will get along when you’re gone, especially if a good bit of money is involved. Make sure your intentions are clear, which can also help clear the air on unresolved disputes.

Eliminating the financial tangles that your loved ones must unravel after you’re gone can help them focus on what truly matters. Your life with all its meaning will be examined by those you leave behind, hopefully in positive contemplation. If you fail to assign clarity to your precious years of stored productivity, this will dominate the minds of those you love the most when they should be thinking constructively.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.