Hike, Hike, Goose

The Fed pauses rate hikes, now what?

Eight times per year the FOMC (Federal Open Market Committee) meets to discuss the state of the U.S. economy and cast votes on monetary policy which directs Open Market Operations such as setting the Federal Funds rate target and quantitative easing/tightening. The FOMC is not the Fed, but rather a branch of the Fed that consists of twelve members, eight of which cast votes on policy. A majority vote is required to move forward with a policy change such as raising rates. Currently, Jerome Powell is the FOMC figure head as chair of the Board of Governors. Established under the Federal Reserve Act of 1913, the Fed is one of the most powerful institutions in the world. While there are limits to its power, suffice it to say that our personal finances are massively affected by the decisions made by the FOMC in its private meetings.

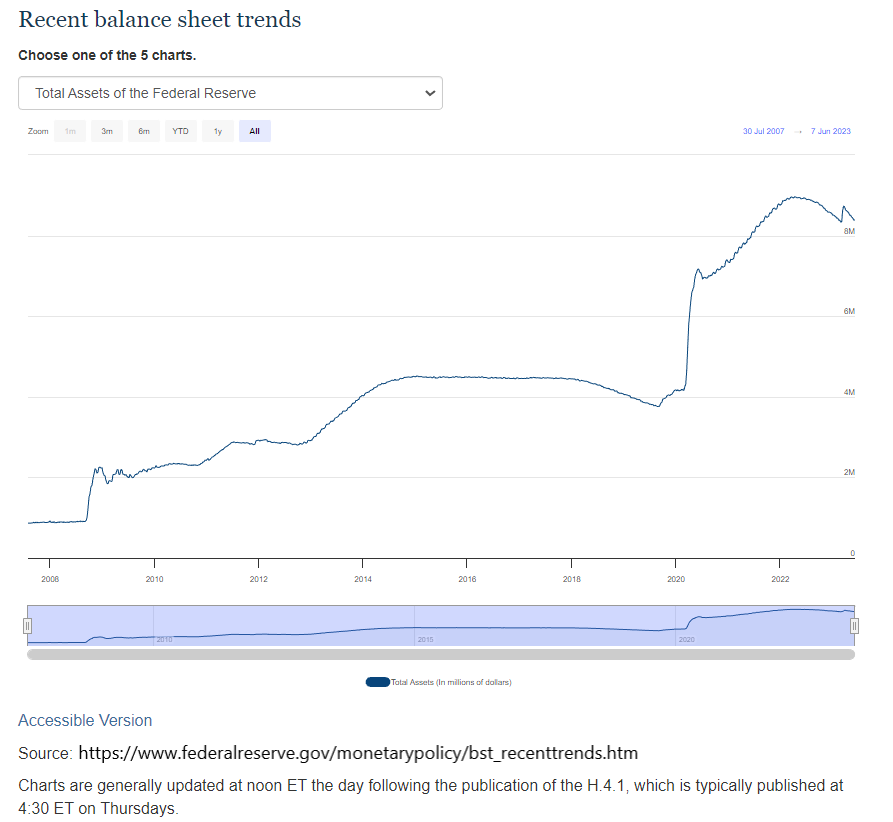

Such a meeting took place this week from June 14th through 15th with the result being a vote to keep the Federal Funds target rate between 5 - 5.25%. Additionally, the board voted to continue reducing its balance sheet which consists primarily of Treasuries, agency debt and mortgage-backed securities, a process that began last May. The takeaway being the Fed wants short-term rates to remain level with a modest increase to long-term rates. The Fed’s control of interest rates resembles that annoying coin pusher game you play at the arcade, with the inserted coins representing the Fed’s OMO inputs, the coins on the top tray the regulated banks, and the coins on the bottom tray representing the rest of the economy. They generally only control a few base inputs such as the overnight lending bank rate, known as the discount rate, and conduct open market operations that influence the supply of certain fixed income securities. Change rates too much and you may get a cascade of unintended economic changes. Change too little and you may get no change in direction, which is bad if the economic trajectory is poor, which has been the recent case with uncomfortably high inflation. It’s a frustrating process that perplexes the best and brightest among us and I do not envy the decision makers here. Its impossible to predict with precision the consequences of every decision.

The recent meeting marks the end of 10 consecutive rate hikes that began in March, 2022 which took the Federal Funds rate from 0 to 0.25% to 5 to 5.25%, with the end goal of taming inflation. Most pundits agree that a pause here makes sense given the pullback in economic activity and inflation. The Fed’s 2% inflation target has not yet been achieved, though, so the FOMC is still signaling additional rate hikes are ahead. Rate hikes will continue until morale improves, after all. I believe that the more important shift is not necessarily the rate itself, upward or downward, but the difference between rates and inflation, otherwise known as the “real” rate. For more than a decade, the average savings rate was far below the general rate of inflation. The Keynesian’s would argue that this is good because it encourages spending and spending is all that matters! Little thought was given to the importance of encouraging thrift, and how saving leads to stronger economic activity over time. An American consumer with a healthy amount in savings leads to a more resilient economy. They can withstand longer bouts of unemployment, more easily engage in entrepreneurship, and avoid capital destructive debt. An interest rate environment that offers positive real returns on liquid savings is a long-term positive because it encourages thrift. While many seem to be frothing at the mouth awaiting interest rate cuts, I stand hopeful that the Fed will maintain its current course and never return to the 0 bound policies that marked the last decade.

Short-term rate hikes may be pausing for the time being, but rest assured this doesn’t change the fact that taking on additional debt to spend on “goodies” is just a bad idea. Even if it’s for the Keynesian ideal of the greater good, which is a fallacy to begin with. While anecdotal, I have witnessed a growing interest in saving, which may explain some of the data suggesting retail sales are falling while employment and incomes have not. This is a good thing, not bad. We may see some downward pressure on the stocks and the economy in the near term, but I believe this is setting the stage for a more resilient economy thereafter. For the time being, make hay while the sun is shining. Like the sunbeam piercing the heavens illuminating Excalibur to King Author, the universe is sending thrifty consumers a clear signal to pad that liquid savings account earning a positive real return.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.