I Depreciate That

Depreciation: A top tool for reducing tax liability.

They say there are only two certain things in life, death and taxes. The statement fails to account for a variety of realities, one of which is the inevitability that government policy will entropy into an incomprehensible cipher. This too is certain.

As Americans, we like to entertain the notion that this is the land of the free with equal opportunity and consistent application of law. It sure sounds nice, but as George Orwell once wrote,

“some animals are more equal than others.”

The line dividing who gets to be more equal and who pays retail price is epistemically defined. The informed get the best treatment under the law, regardless how convoluted the rules are. And the policy that affects us all with economically painful consequence is the Internal Revenue Code (IRC).

With full compilation weighing in at more than 70,000 pages, you are not going to understand its full implications using TurboTax. Even hiring an accountant to calculate your bill and file your return isn’t going to elucidate your strategy. Keep in mind the volume of clients the average CPA firm takes on to remain profitable.

At $750 a return, it takes 330 clients just to earn a gross profit of $250,000, not nearly enough for a complete staff. Many bill below $750 per return, making it a brutal business model. It’s not reasonable to expect such a tax professional to painstakingly profile a household’s personal and professional financials to create plans that interweave complex tax strategies.

In other words, you get what you pay for.

So, who should pay for such tax planning advice and how much does it cost? Generally, households with annual incomes above $300,000 need to investigate the benefits of a professional tax planner.

Additionally, self-employed individuals with gross revenues exceeding $100,000 and all real estate investors/professionals should benefit. And by “benefit”, I mean save more money than they would pay in professional fees. Sometimes substantially more.

Planning fees range but you can expect at least $6,000 per year for a serious professional. While this may seem high relative to a discount filing service, keep in mind the value in exchange and the time required to build a thoughtful analysis and application. You’re not shopping for indentured servants here.

Case in point: depreciation. This is one of the most powerful, yet tricky, tools available to individuals looking to reduce their taxable income. It applies to most tangible assets used in a trade of business. Think rental property or equipment, even vehicles you buy to support business operations.

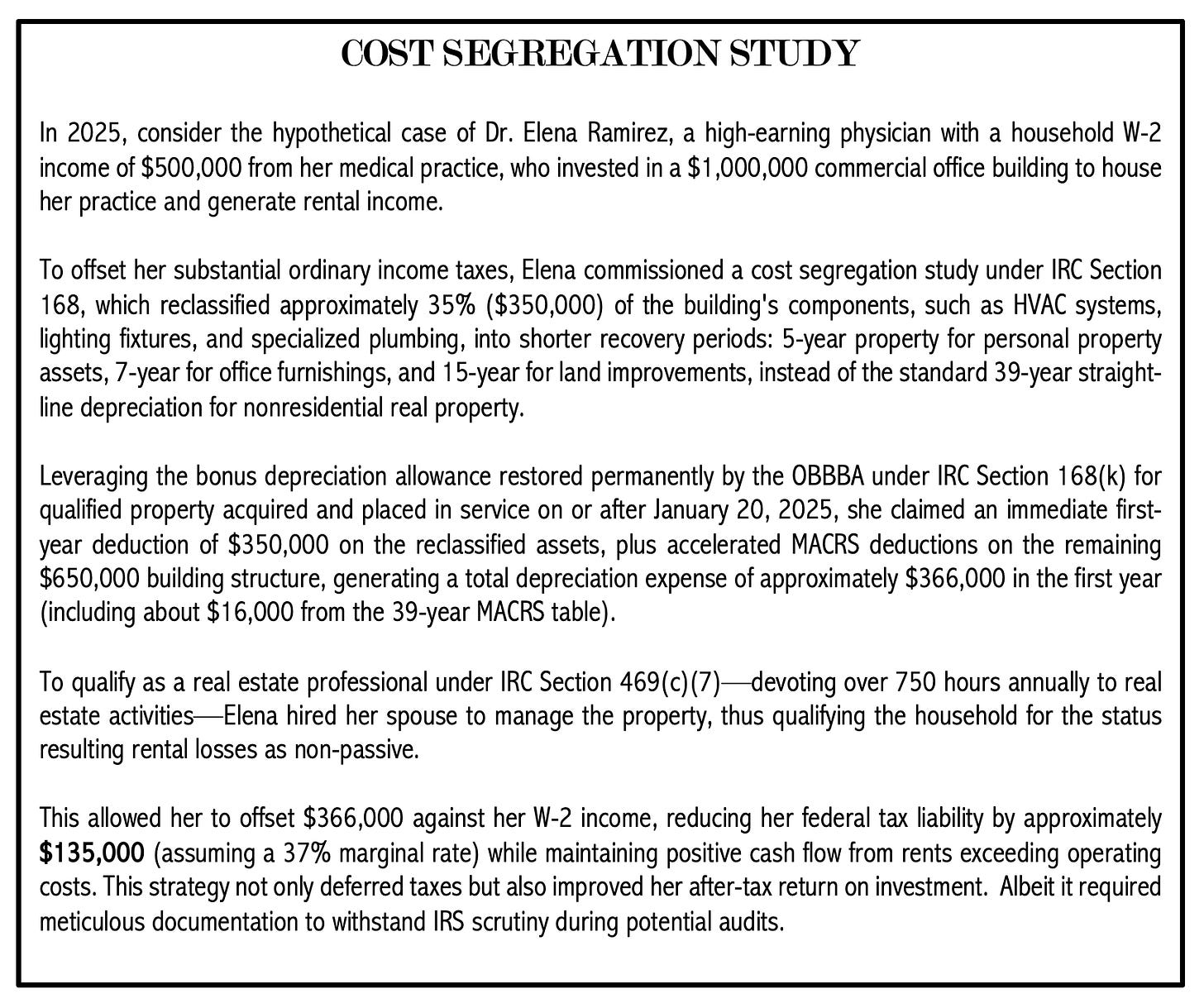

Depreciation is a non-cash expense that can be used to directly offset earned income, even W-2 or self-employment income. The passage of the One Big Beautiful Bill brought back bonus depreciation which permits front-loaded depreciation to be taken in one year. This creates unique planning opportunities once unavailable.

Real estate investors can combine bonus depreciation with cost segregation studies to deliver huge up-front deductions on their taxable income for any given year. The cost segregation study is used to define short-term components of real property eligible for the bonus depreciation. Ideal for when a property is being sold at a large gain or for when income is unusually high.

Even without a spike in taxable income, it is still better to defer taxes into the future given the time value of money. Real estate depreciation is rather unique as it is the one asset that tends to appreciate while the IRS assumes it does not. Idiots. This can result in depreciation recapture taxes if you’re not careful.

Depreciation isn’t just a tool for real estate investors, but useful for any business owner, current or aspiring. Let’s say you’re planning a retirement but do not want to slow down. You may be in your peak earning years with enough financially security to start that wood working shop you’ve always wanted to.

Now is the time to establish your articles of incorporation and invest in property and equipment. Such an investment could leverage Sections 168 and 179 of the IRC to tactically offset active income as the business gets ramped up in preparation for the transition.

It should be noted, however, that the IRS does expect the business to turn a profit at least three out of five years to prevent any disallowance. Not a suitable strategy for hobbyists.

Nor is the use of depreciation suitable for the DIY investor. Sure, you can avoid professional fees and try to do this all on your own. Just know that professionals also hire other professionals. Some things, like performing your own surgery, should not be treated like a single player activity.

As you look over your 1040, painfully eyeballing that line 37, you are likely to wonder what can be done. EZ filing isn’t without its costs. Depreciation may be one answer. Perhaps it’s something else. Perhaps death is the only answer to taxes. You’ll never know unless you are informed.

It’s in moments like these you should think to yourself, “I should give that Karat Stick guy a call”. While we cannot raise the dead, we can analyze taxes.

Investment advice offered through National Wealth Management Group, LLC.

The information presented is for educational and informational purposes only and is not intended as a recommendation or specific advice. Consult with your professional tax advisor for tax guidance specific to your situation.