In a Land Far Far Away

Is international investing worthwhile?

Once upon a time investing in overseas markets was an exotic endeavor full of intrigue and promise. The modern state of the international side of your portfolio resembles the child that simply couldn’t launch. You wonder, “should I just cut my losses and present the eviction notice”?

Advisors, conditioned by academic groupthink, lean into Modern Portfolio Theory to extol the virtues of diversification. They claim it would be irresponsible to neglect overseas markets.

Shame on you for thinking what you’re thinking! Historical performance is not indicative of future results! After the obligatory fleecing of their preferred financial educators, investors simply learn to ignore the giant boat anchor hanging off their portfolio statements.

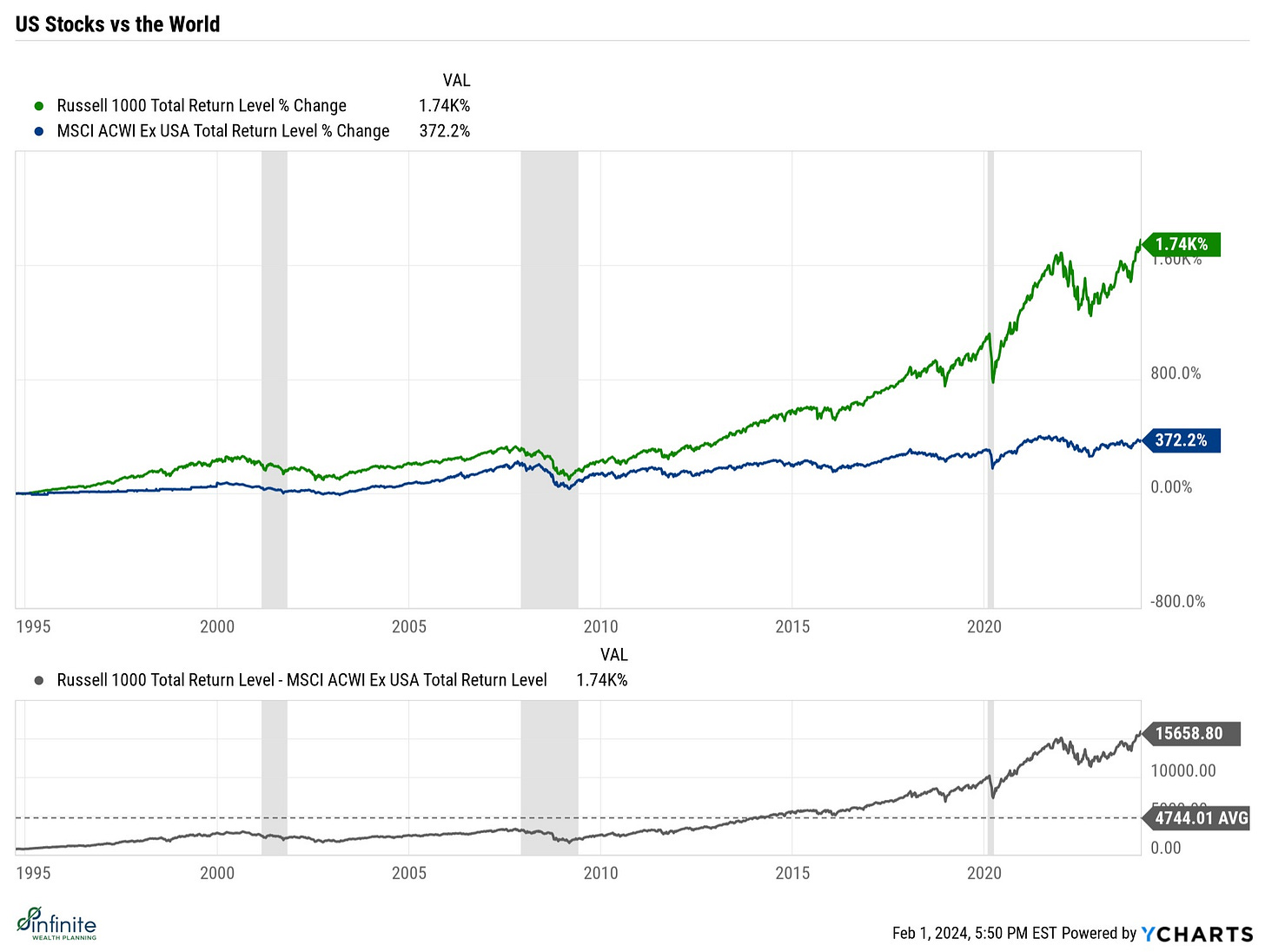

International investing is generally considered higher risk, so it only stands to reason that exposure would add alpha over time. But the promise of outsized returns from overseas markets has been as realistic as fairy tales of gold at the end of rainbows. In fact, we have seen the complete opposite for the past two decades.

“Well, Ben, the point is to be diversified, you know, to reduce volatility”, proponents retort. Well, those seeking reduced volatility through diversification may also be surprised to learn that broad international exposure has led to increased volatility during most years, not less.

So why do we do it? Even investing celebrities like Dave Ramsey suggest as much as 25% portfolio exposure to international equities is prudent. This just doesn’t seem sensible when you consider the track record.

I agree, it isn’t sensible based on track record. Sometimes your instincts inform you of truth that you intuitively understand but cannot articulate with precision. It makes no sense to reward underperforming markets with a quarter of your nest egg simply because “diversification says so”. Nowhere in the rulebook of diversification, which does not exist, does it state we must invest in as many things as possible no matter the quality.

The point of diversification is to reduce idiosyncratic risk. This is generally a good thing unless you’re the type that likes to swing for a home run at every pitch, even the high flies. But the fundamental rule of investing still applies: avoid the losers.

It is true that past performance isn’t necessarily indicative of future results. No one should be driving solely looking through the review mirror. Everyone, yes everyone, tricks themselves into selecting investments based on past performance even after this disclosure mantra has been imprinted into our minds like Neo’s Kungfu. But, if the road has been straight for the past ten miles, what are the odds it’s straight for the next two or three?

The answer is, like Schrodinger’s cat, either 0% or 100%. No one knows. Fundamental analysis still must be applied which means looking through the windshield. What I see in international markets is a mixed bag. Some foreign economies, like India and Japan, have demonstrated robust growth in recent history, with markets either outperforming US markets or at parity on a 5-year trailing basis.

Others struggle to keep pace with domestic markets. China’s Hang Seng index, among others, has been flat for over a decade. Nonetheless, we are painting with broad strokes here. While some international indexes, and their underlying economies, have offered investors little but regret the past few years, there are still gems in the rough. There’s always a case to be made for scrutinized international stock selection.

Despite the escalating political and cultural tensions in the US, there’s no place like home. We remain bullish on the US economy now and over the long run. It demands the lion share of your nest egg. Not because it’s performed well in the past, but because the reasons it performed well in the past still apply today.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

There is no assurance that the techniques and strategies discussed are suitable for all investors or will yield positive outcomes. The purchase of certain securities may be required to effect some of the strategies. Investing involves risks including possible loss of principal.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.