Lions, Prognosticators & Bears, Oh My!

How shopping lines and pessimism can grow at the same time.

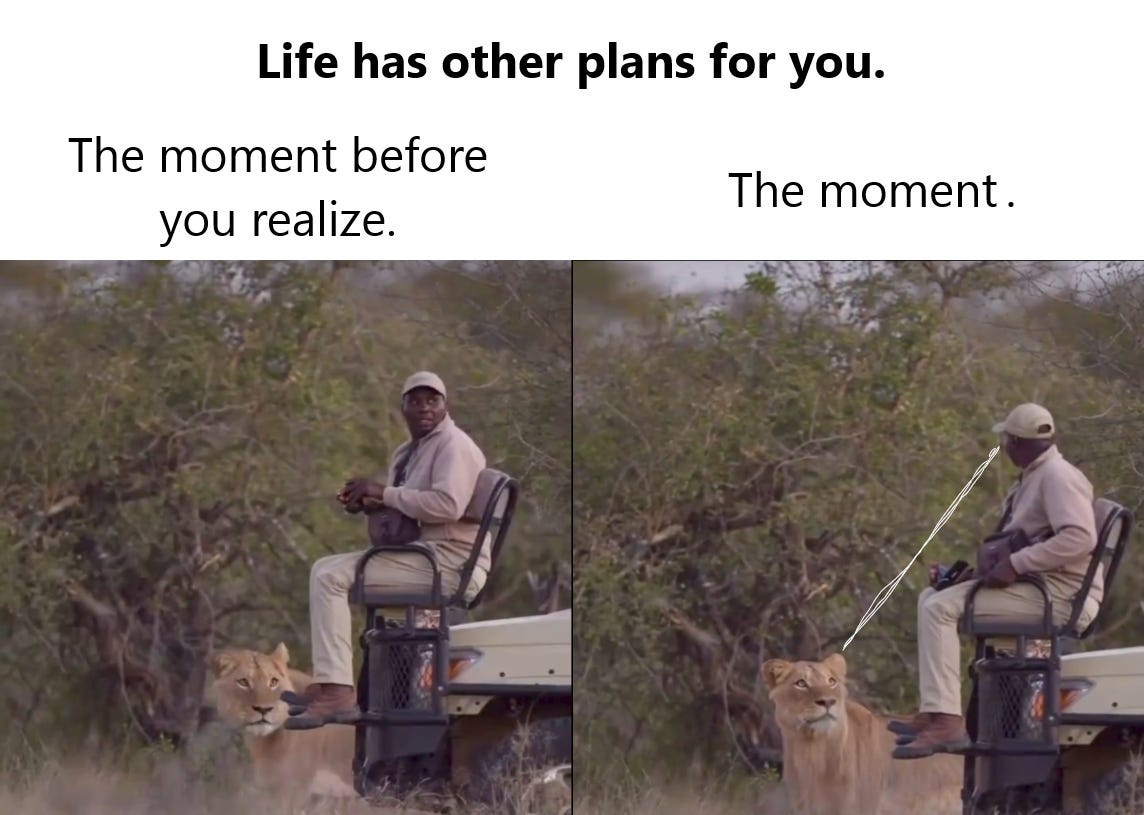

As far as ancient history is concerned, life has favored humans with an affinity for caution. Missing a few berries hanging off a branch was, and remains, no big deal. Missing the lion with its hungry pride behind her would be a far greater offense that could mean in the end of your gene pool.

The propensity to approach uncertainty with caution continues to find useful application in our modern lives but it can also serve contrary to our own interests if we’re overzealous. Particularly when it comes to expanding our own opportunities, which requires us to flirt with uncertainty. Flirtatious eye contact with potential chaos is, well, uncomfortable.

At some point in your life, you likely touched something that was dangerously hot. You didn’t need your mom to tell you what to do next, you just did it. The instinct to pull away from pain is engrained in us at the most primal level. Pain is one of the first things we learn to avoid.

We feel it, acutely so, when our portfolio loses value. In fact, studies have shown that pain associated with financial loss is felt two times greater than the pleasure associated with financial gain.

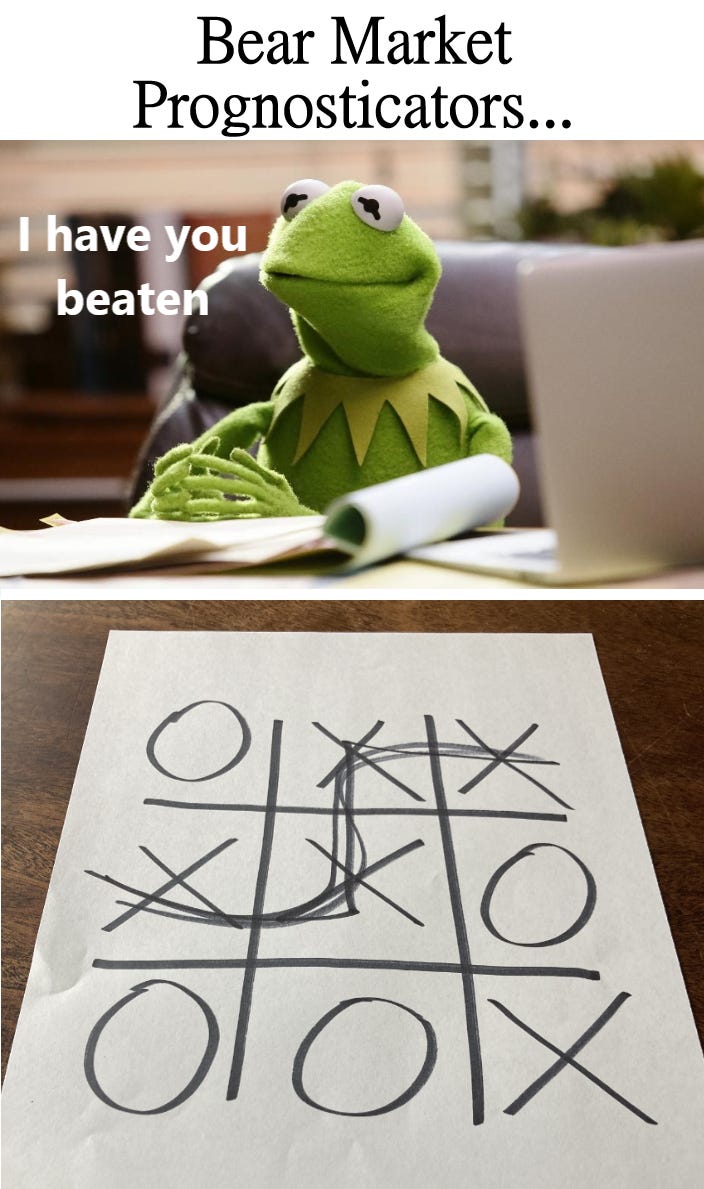

You can begin to see how the loss aversion instinct can distort our forecasts. More importantly, do you see how this bias can, at best, discolor the analysis of an otherwise intelligent financial ‘expert’. At worst, it can be used by doom and gloom opportunists to make money on your attention or through outright grift.

Think of this logic: a precious metals dealer reasons that you buy gold because the dollar’s collapse is imminent. If this were true, why is the dealer in such a hurry to sell its inventory for your dollars?

As the saying in media goes, “if it bleeds, it leads.” It’s the same reason horror movies are a popular genre and we all slow down to survey the aftermath of an automobile accident. It’s not because tragedy induces excitement. It’s a primal instinct to read life’s warning labels. We deeply empathize with the pain experienced by others but also wish to learn from observation so we can avoid the pain ourselves.

The point here is that we should always be aware that this bias exists and that it can work against us if we let it rule every decision. Investing, like exercise, is one of few activities that require us to, as the Marines say, embrace the suck.

Let’s add some IRL (In Real Life) context by analyzing some of the more popular negative leaning talking points floating around right now.

Consumer debt is at an all-time high.

True, yes. But so is consumer net-worth, which is assets minus debt (liabilities). Surprise, surprise, the pundits fail to mention that asset growth has been notably greater than growth in outstanding debt. Net worth for households and nonprofit organizations hit record highs in 2023, rising 8% from 2022 to $156.2 trillion.

People can’t afford housing.

Purchasing a home is the most expensive it has been since the 1980s, but this also means that prices relative to incomes is not unprecedented. Truth is, the vast majority of home owners are benefiting from the appreciation in home values. Owners’ equity is at levels we have not seen since the 1960s. I predict it will only improve from here as borrowers are reluctant to give up below inflation rates and stay put.

Potential new home buyers are facing higher barriers to entry, which is unfortunate, but what’s good for the goose isn’t necessarily good for the gander. Patience is the remedy for this woe, not price collapse.

Inflation is forcing people deeper and deeper into debt.

Since I’ve been a student of finance, 60 – 70% of the population have been living paycheck to paycheck. A huge chunk of this population, being young, have not reached their prime earnings years but face the same prices as everyone else at the grocery store. This is life. Inflation hits these folks hardest and they are not shy to voice their frustrations, giving the impression that everyone is in the same boat.

Again, the statistics are being bent to serve a pessimistic narrative. In this case, the message is as inaccurate as an Imperial Storm Trooper. Household leverage, represented by household liabilities as a share of household assets, declined to 11.6% in 2023, down from 12.1% in the previous year. The trajectory remains the same so far in 2024.

Always consider negative information within a more complete context. You don’t need to glue rose colored glasses on the bridge of your nose to see an opportunistic future, just a healthy degree of pragmatism separated from primal instinct.

When you are finding yourself having a tough time with this, ask yourself “am I waiting in line when I go shopping or out to a restaurant?” I know the current answer to this question. Costco on Saturday late morning is standing room only.

How can this be true but at the same time hold the belief that the economy has one foot in the grave and the other on a banana peel? You’ll know the answer if you follow the logic. If not, as Dr. Sues says…

You can get all hung up

in a prickle-ly perch.

And your gang will fly on.

You’ll be left in a Lurch.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.