Long-Term I Don't Care

How Americans pay for long-term care

This has been one of those weeks. Life has come at me in volumes that make it impossible to savor. I’ve been jumping from task to task with a ferocity that matches a Marine eating chow in basic training. Now Friday, the 22nd at 6:00 PM, I’m just now distraction free enough to push out my musings into the virtual world. Forgive me in advance for the poor writing quality. The memes took priority.

The confluence of events that kept me so occupied this week is unusual and life will return to a more subtle cadence. Even so, for most of us, we are regularly plagued by distraction. So focused on present tasks that we neglect the more important matters in our periphery.

Recently, I decided to make it a point to go visit my grandfather in the nursing home every week. He likes coffee with one spoon of sugar. He likes it unreasonably hot, lawsuit worthy hot. He also wants it with a chocolate cake donut. I know this because he is a New Englander that shares his opinions with verbal force, not shy to offend those with midwestern sensibilities.

My grandfather is a good man with a track record to prove it, so he has earned the right to be particular. I’ve been to my fair share of retirement homes but only as a visitor with the briefest of intentions. My instinct is to put them as far away from my mind as possible.

Introspectively, I find the whole idea of nursing homes to be an uncomfortable reminder that life ends, and that most of what we do throughout the day doesn’t matter in the end. That’s sobering.

Facing this inconvenient reality once per week is a small price given the value received. Just to be clear, by “value” I am not referring to anything monetary, which is an impossibility in this situation. I’m referring to reciprocal love.

So, on we go, distracting ourselves. Not only from the reality that we one day will be faced with end-of-life decisions, but that there are real financial burdens associated with them.

I’m not necessarily just referring to your end-of-life affairs either. Chances are, you will be intimately involved with close family or friend decisions if not your own.

Mapping out the ideal strategy for end-of-life care requires advanced planning. This is not the kind of advanced planning with a highly credentialed financial planner backed by complex calculations. I mean “advanced” in context of time.

Specifically, you should start this process no later than age 60 and it should be a component of your retirement income plan. There are three ways to pay for long-term care:

1. Self-Pay

2. Long-term Care (LTC) Insurance

3. Medicaid

All three mentioned above can be combined with other benefits such as Medicare, which can pay for the first 90 days of hospitalization plus the 90 lifetime reserve days, and the Veterans Aid & Attendance Pension Benefit. These would only be supplemental to the above, however, and would not be sufficient to cover the full cost of care.

The first decision you should make will be whether to eliminate option 2 from the menu of choices. Option 1, flowing into option 3 as funds are depleted is the default choice. Better to make this choice intentionally if it can be helped.

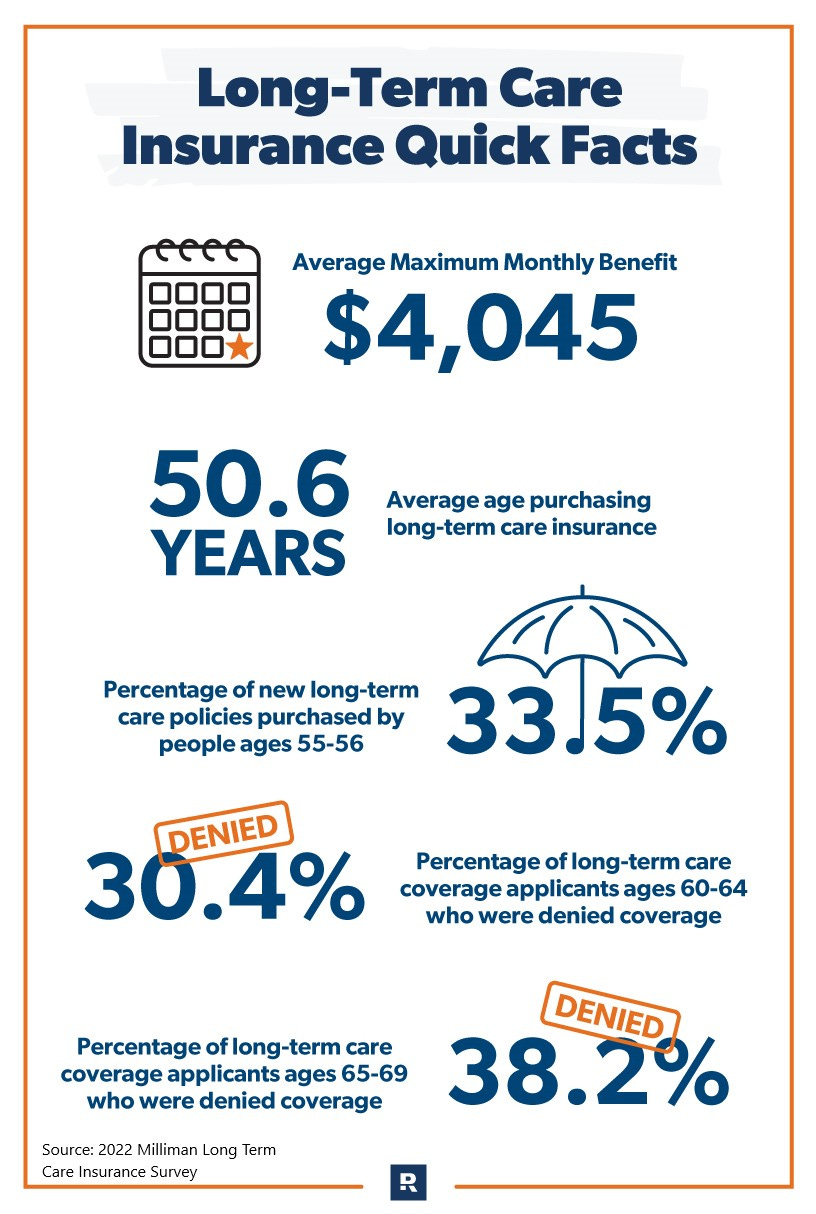

Like life insurance, LTC insurance is more affordable at younger ages. Furthermore, because we all know insurance companies are not altruistic, it affords the insurer more years to average in their actuarially forecasted costs.

Lastly, the older you become, the more opportunity there is for health events to arise that make you uninsurable.

While it is not impossible to secure insurance at older ages, it is generally prohibitively expensive. Best to start this process between 50 and 60 years old.

Let’s say you reject the insurance offers, or they simply are not an option due to age or health status, are there any options for preserving your assets? Yes, but you may not like them.

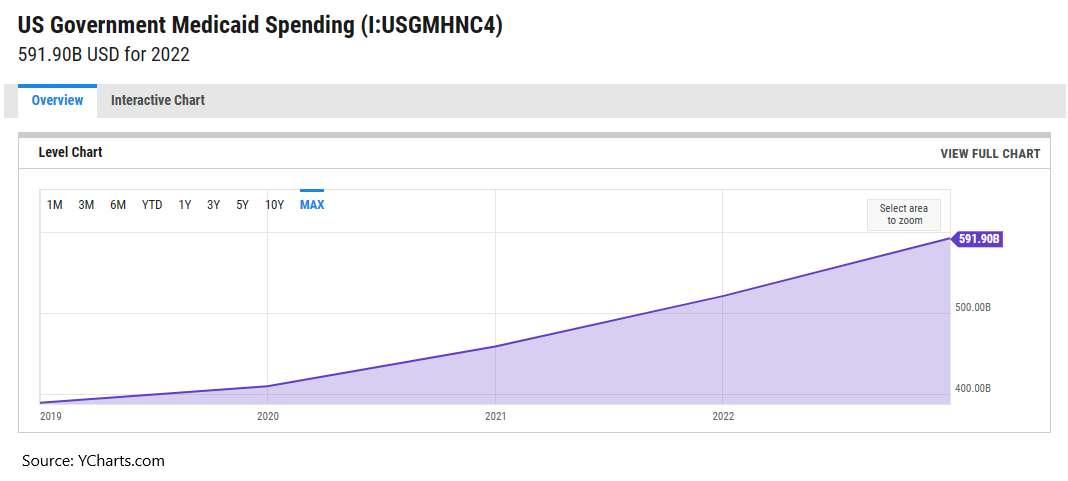

First, know that if it’s not you paying the tab, the bulk of the heavy lifting will be provided by Medicaid. Each state is responsible for doling out Medicaid benefits and the rules vary.

Most states permit a married couple to retain their primary residence, a vehicle, retirement savings belonging to a spouse, and a small portion of “countable” assets. However, if the LTC resident is not married, generally all assets must be spent down before any Medicaid benefits are approved.

So, the name of the game is to impoverish yourself as quickly as possible. This means being familiar with the Medicaid rules in your state to know which assets are counted and which are not.

Those that are counted should be either spent or gifted away, ideally five years before any Medicaid benefits would be needed. Keep in mind, however, that many facilities may require private payment for a specified period to be admitted.

Some states permit gifts to be made to irrevocable trusts, however the surefire way is to spend the money or gift to individuals directly. If you’re fortunate, you have a trusted family you can coordinate efforts with just in case you do not make it past the lookback period.

To say this is difficult to coordinate is an understatement. Navigating this conversation around the vast minefield of familial tensions while making weighty healthcare decisions is too tall a task for many. As such, estates are exhausted and would be heirs are stuck consoling themselves with a false sense of civic duty.

You are not going to solve the US deficit spending issue by abdicating this planning need.

It also needs to be stressed that preserving estate values becomes less important as wealth increases. Warren Buffet is not going to give away his estate simply to qualify for Medicaid. At some subjective point, the focus should be on tax minimization rather than preserving an estate from healthcare expenses. That is a topic for another time, I’m already too long here.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.