Macro Malaise

The data are not good.

Once again, the FOMC convened to discuss the fate of financial markets worldwide. Once again, they surprise no one, deciding to keep interest rate policy as is. So, if you’re looking to perfectly time a real estate purchase on the cusp of an interest rate cut, you’ll need to wait just a liiiiitle bit longer.

Post meeting, markets are forecasting significant odds of a change in interest rate policy in the September meeting (17th – 19th). This forecast is extrapolated from fed funds futures using the CME FedWatch Tool. How does this tool work, you might ask? Nobody cares. It makes for good headlines and that’s all that matters.

The expectation that the Fed will cut rates is realistically grounded. Recent economic data releases from the BLS, ISM and the Fed itself have been, let’s say, underwhelming. The x-post below sums it up pretty well.

The yield on the 10-year Treasury, considered to be the de facto risk-free world reserve asset has dipped below 4% for the first time since January. This indicates a shift in investor sentiment from bullish to bearish since a drop in yield denotes higher demand for Treasuries.

Some of the domestic reasons investors are seeking shelter in the risk-free trade include a softer labor market, a significant slowdown in manufacturing (PMI) and political uncertainty.

High inflation, public enemy number one for the past two years, has decelerated quickly. So much so that some are now worried about its dark reflection: deflation. I am not convinced that deflation is around the corner but there is a case to be made for darker days in 2026. Just avoid looking into the mirror with the lights off and refrain from saying “bloody Mary”.

The most concerning of all the economic data released is the slowdown in the ISM® Purchasing Managers Index. It is based on a monthly survey of purchasing managers across various industries, who are asked about key business metrics such as production levels, new orders, employment, supplier delivery times, and inventories.

A reading above 50 means expansion, a reading below 50 means contraction. It is considered a leading indicator, and therefore clues us in on future economic growth. The recent U.S. PMI reading from June was a paltry 48.5. This could explain the weakness in job growth.

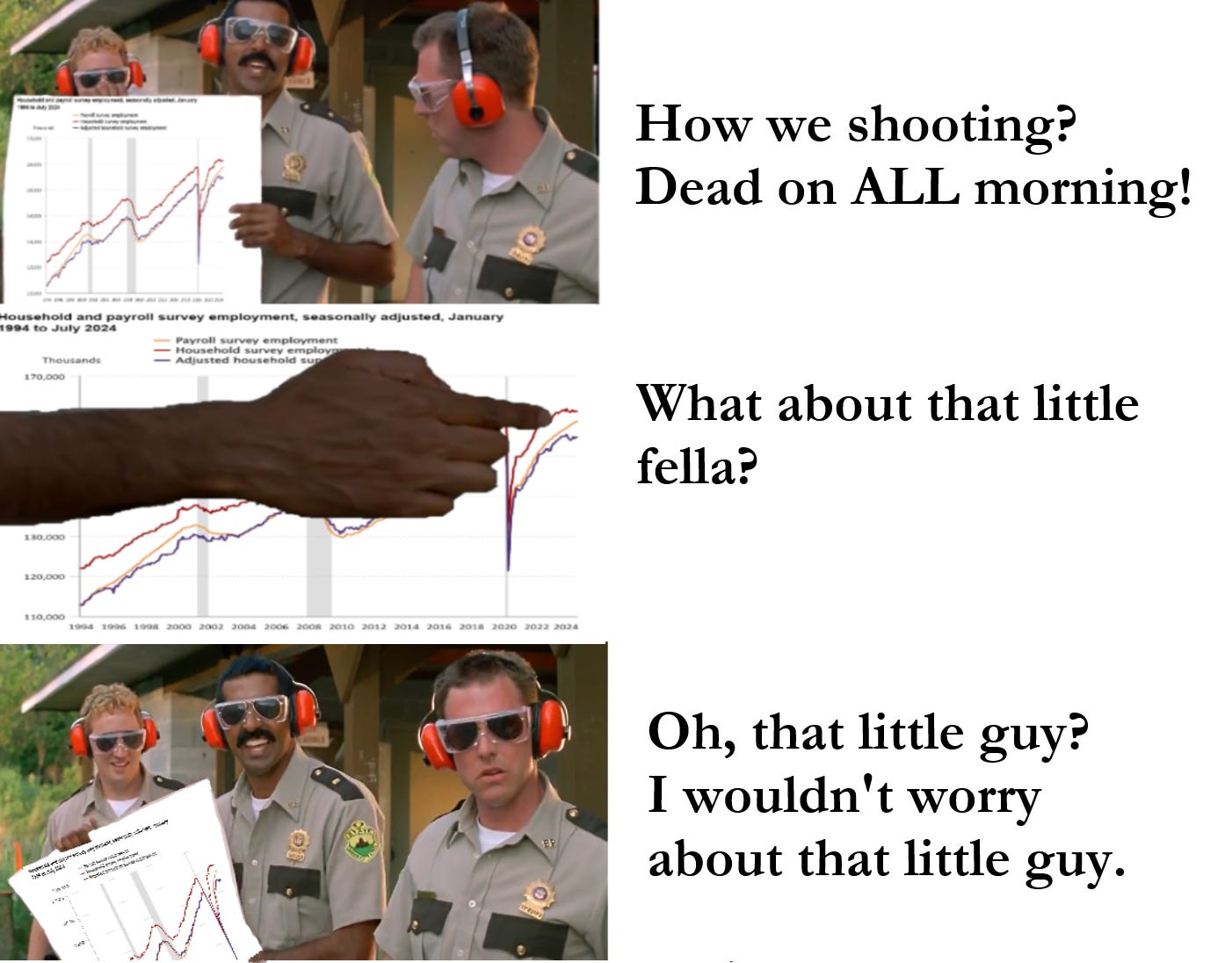

Interestingly, there’s a notable divergence between the Household survey (red/blue) and the Establishment survey (yellow). Household data is collected from workers while establishment data is collected from employers. The divergence is a new phenomenon and no one knows quite what to make of it.

The going theory is Americans must be working multiple jobs in increasing numbers. It could also be that employers are posting positions and simply not filling them. Either way, there doesn’t seem to be a positive way to interpret the reading.

Not all is gloomy. Corporate earnings have been solid in the U.S. which has led to a meaningfully positive stock market. Furthermore, the historically rapid interest hikes have been comfortably absorbed by economy, arming the Fed with more than 500 bpts to work with if cuts become necessary.

Nonetheless, the prudent thing to do is to prepare for some market deterioration. For retirees and those needing to pull from their investment accounts within the next three years, make sure that dry powder keg is full. For investors with a longer-term horizon, that means assessing your portfolio risk, padding your cash reserve a bit, and being prepared to invest at depressed prices.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

There is no assurance that the techniques and strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.