Meet The New Fed Chair

Same as the old chair.

So, you think you’re a central bank expert? Name all the central bankers. Make sure to revisit the list in May to add Kevin Warsh as he relieves Jerome Powell as Fed Chair. He’s back in the game after a fourteen-year interim career that could only be described as sinecure-laden interlude.

It pays to go to the right schools. The sequential combo of Princeton to Harvard Law is like a railgun for success. In Kevin’s case, it was pointed directly at Wall Street, launching his career trajectory to land him in the front lines of America’s Great Financial Crisis (GFC).

His enlistment company: Morgan Stanley, where he worked his way up to VP status back when “Vice President” meant something in the banking world. He ends his 7-year stint in investment banking as executive director in mergers and acquisitions in 2002 to serve under President Bush’s administration. A few years of shaking the right hands as Special Assistant for Economic Policy and Executive Secretary of the National Economic Council and he is anointed.

At age 35, Kevin becomes the youngest appointee ever to the Federal Reserve Board of Governors. Apparently, the guy is something of a political savant. Ben Bernanke, Fed Chair presiding over the Financial Crisis, frequently mentions his ‘political savvy’ in his memoir, The Courage to Act: A Memoir of a Crisis and Its Aftermath.

“Don Kohn, my vice chairman, with his long experience at the Fed, and Kevin Warsh, with his many Wall Street and political contacts and his knowledge of practical finance, were my most frequent companions on the endless conference calls through which we shaped our crisis-fighting strategy.”

During the GFC, Kevin did what all good Ivy League boys do: save his former employer and their friends from self-inflicted financial ruin with massive quantities of publicly sourced easy money. He did this while maintaining a stiff finger in the air pointed at the Fed, vigorously wagging in full view of the Wall Street occupiers. Just in case anyone got the wrong impression.

To be fair, Kevin Warsh has been consistent in his stance on monetary policy, skewing to favor more hawkish positions (i.e. favoring higher rates).

2006–2011 (Fed tenure): Inflation hawk; backed crisis interventions but wary of prolonged QE, citing risks of inflation, capital misallocation, and balance sheet expansion.

2011–2024: Consistently hawkish; criticized extended low rates, QE, and forward guidance for distorting markets; pushed for rules-based policy, faster normalization, and smaller balance sheet.

2025–2026: More dovish shift; advocated quicker rate cuts, flexible policy emphasizing growth (e.g., via supply-side/AI gains) without inflation, while retaining calls for balance sheet discipline and “regime change.”

That is, until last year when President Trump began seriously sniffing around for a new Fed Chair. Looking for someone more...compliant. Strange. Is he exercising his political savvy or his practical finance here? Someone should call Bernanke to ask.

There’s been lots of fuss about the Fed Chair announcement. Gold reacted violently with COMEX Futures falling from $5,318.40 on January 29 to a bottom close of $4,622.50 on February 2nd. That’s a drop of more than -13% for those of you still doing the math in your heads. Let’s not even talk about Bitcoin. Life is better when we ignore the ugly things.

The commotion also bled into the NASDAQ and SPY; however, both indexes began their current pullbacks on the 28th and 27th of January, respectively. This implies that the January 30th announcement of Kevin Warsh as Fed Chair appointee isn’t the only thing weighing on stocks. More on that in a later installment.

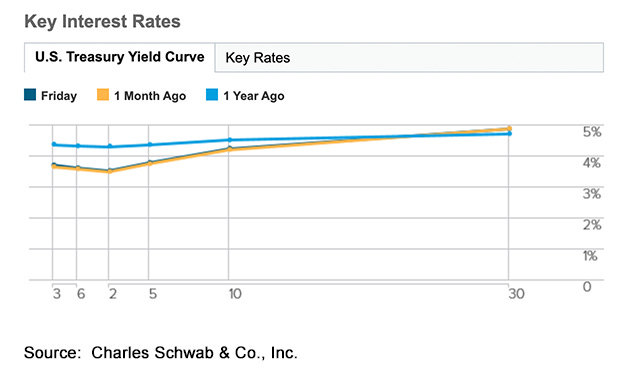

Treasury Bonds, the market that the Fed actually conducts operations in, slightly rallied with the yield on the 10-year note dropping to 4.2% from 4.23% since the date of the announcement. Snore.

Seems to me all this ‘hawk’ fear mongering is just noise. It’s precisely the kind of noise an assassin would want to mask a hit, which makes one wonder. How does gold lose approximately $5.5T in global supply valuation in just two trading days? That, my friends, is a question with a valuable answer and I’m afraid I can only offer speculation.

What I do know is that, despite Kevin’s hawkish past commentary, this announcement doesn’t change the harsh reality that easy money policy seems inevitable. We have a significant funding problem with Social Security, a rapidly growing net interest expense, calls to increase military spending and a frightening unwillingness to balance spending with revenue. Call me dubious.

The Fed Chair is powerless to change national spending and therefore is unlikely to effect change that could reverse the negative effects of ballooning deficits. They can ease or tighten financial conditions through open market operations. This, in the simplest of terms, means buying debt to reduce interest rates or selling it to increase rates.

What this means for you, keeping in mind President Trump’s preferences for an ‘independent’ Fed Chair, is that lower short-term rates are coming. This does not mean lower mortgage rates, which are mostly priced off the 10-year Treasury.

While the job ahead of the Fed Chair is as challenging as ever, Mr. Warsh has announced some interesting shifts for the key central bank.

Limit the scope of the Fed to just monetary policy and return to statutory remit

Abandon socially charged topics like climate change, inclusion agendas and demographic targeting

Return legitimacy through successful price stabilization

Operate with true independence (sure Kevin, we believe you)

A Fed operating with true independence is going to be a difficult sell to the public. The perception is that the club is small and the only thing the Fed operating independently from is you. His political debts and long-term marriage to billionaire heiress Jane Lauder will be conflicts of interest difficult to ignore.

The hope is that a return to the basics will permit markets the space it needs to accurately price risk and set prices. Intuition demands we should then forecast higher long-term rates, something that will be difficult to allow when political pressures mount. It’s a nice thought, but thoughts don’t move matter.

What this means for your portfolio is more of the same. The mantra “don’t fight the Fed” is still just as alive today as ever. Kevin Warsh will be a voice to listen to over the next four years as the policy he endorses will have the power to move entire economies.

Meet the new Fed Chair, same as the last. Until proven otherwise.

Questions or comments? Email us at planning@nwmgadvisors.com

The views and opinions expressed in this newsletter are solely those of the author and do not necessarily reflect the views of National Wealth Management Group, LLC or any affiliated entities.

Certain statements contain forward-looking speculation or hypothetical scenarios that involve significant risks and uncertainties and should not be taken as predictions or guarantees of future events or market outcomes. Market data referenced (including prices, yields, and index levels) is based on publicly available information as of early February 2026 and is subject to revision. Past or recent market movements are not indicative of future results.

This material is provided for educational and informational purposes only. It is not investment advice, a recommendation to buy or sell any security, or an offer of investment advisory services. Investing involves risk, including the possible loss of principal.

Investment advice is offered through National Wealth Management Group, LLC.