Money Alchemist Podcast EP 38 | The Most Hated Economy

A war of the classes

“It was the best of times, it was the worst of times.”

So begins the famous novel Tale of Two Cities written in 1858. Written by Charles Dickens, the motif of duality can easily be applied to our modern economy. Throughout history, the state of mankind can generally be described as fitting someplace between bad and good.

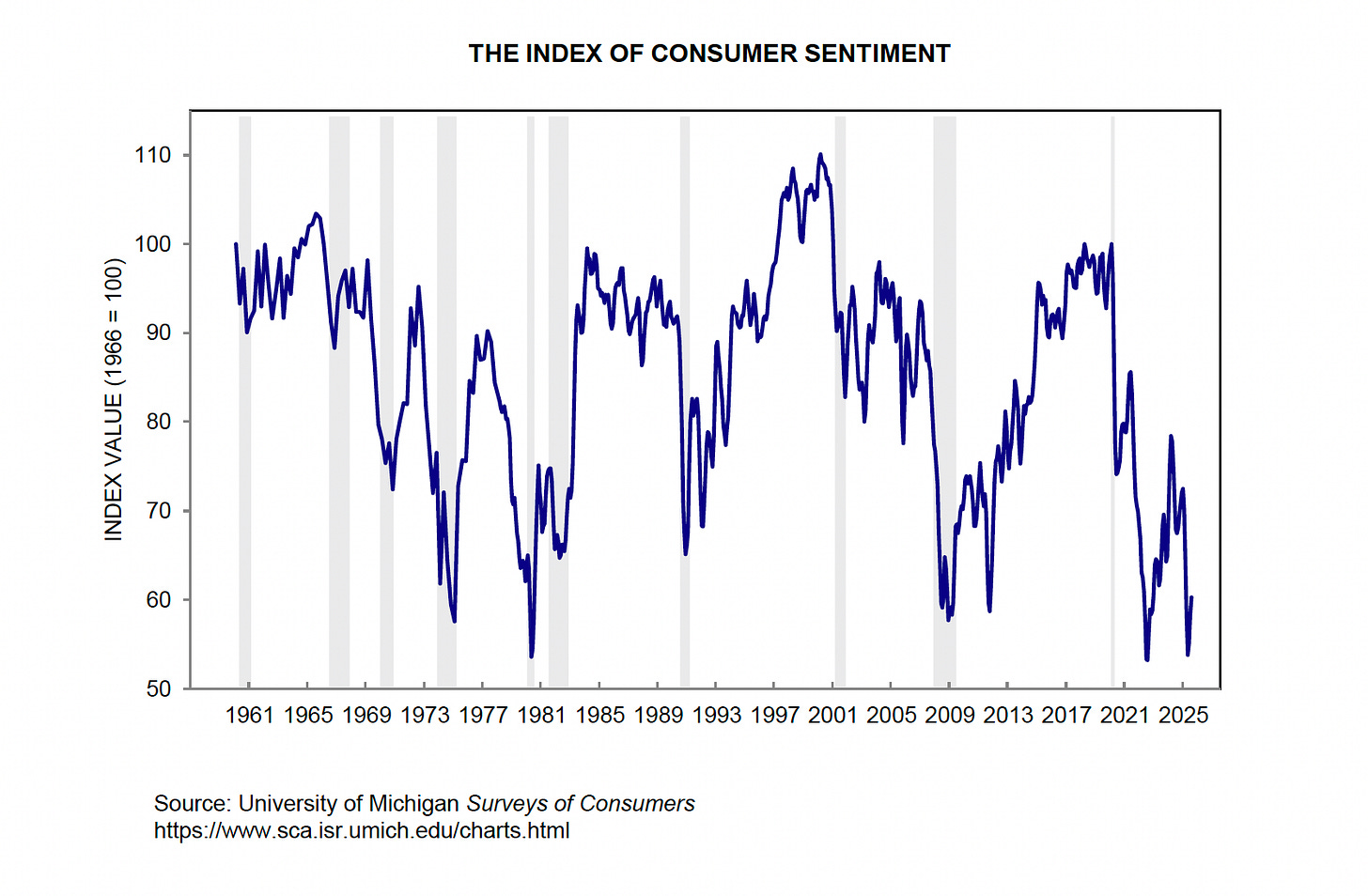

The economy is either terrible or great, depending on who you ask. It’s a subjective sentiment check more based on feelings colored by bias rather than material facts. The Michigan Consumer Sentiment survey illustrates that respondents feel worse about our present-day economic state as they did in the doldrums of the 2008-09 Great Financial Crisis.

The perplexing disparity requires us to unpack layers of independent variables feeding data points like the Consumer Sentiment Index to better understand what is going on. First, it’s important to acknowledge that winners and losers exist concurrently. There is no economic condition in which all market participants are doing well, or all are doing poorly. We function as independent cogs in the machine.

Some cogs receive more lubrication than others depending on their positioning in the mechanism. It is undeniable that inflation is the rust deteriorating the function of smaller economic ‘inputs’. Inflation exacerbates wealth disparity as asset prices accrete monetary premiums whilst prices for necessary goods and services devour greater portions of free cash flow. A one-two punch for the middle and lower classes.

A big differentiator in 2008-09 is that most felt some degree of pain, even the wealthy. For the first time in many generations, housing prices fell. Stock and fixed income markets fell substantially more than a typical recession. It was a great opportunity for those who played it safe, although many didn’t change their appetite for risk when the time was ripe.

Today, the situation is grossly asymmetric. Anyone who has achieved a financial escape velocity, a definition that is subjective but not representative of the majority, is doing quite well. Those living paycheck to paycheck, not so much.

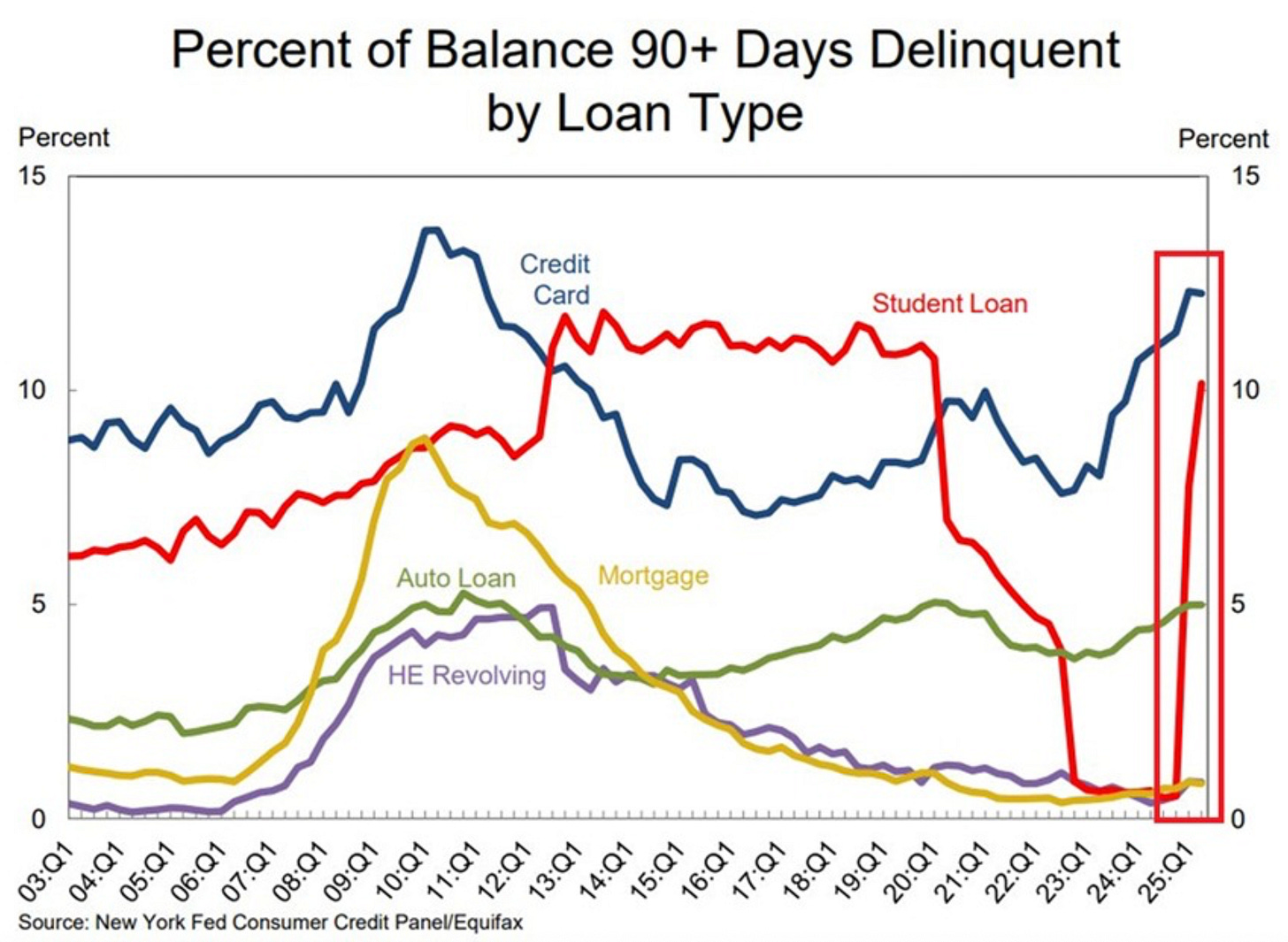

In fact, they may be doing worse than ever, relatively speaking. Delinquencies are picking up across the board, with most of the increase concentrated in higher risk loans such as credit card and auto loans. Recent revisions to the BLS establishment survey suggest that lower income earners may not be as well off as initially reported.

We tried to contact an external analyst to inform on the matter, however the department was recently sacked as part of a strategic efficiency initiative. I assure you this is an isolated incident that has nothing to do with AI (it is most certainly AI).

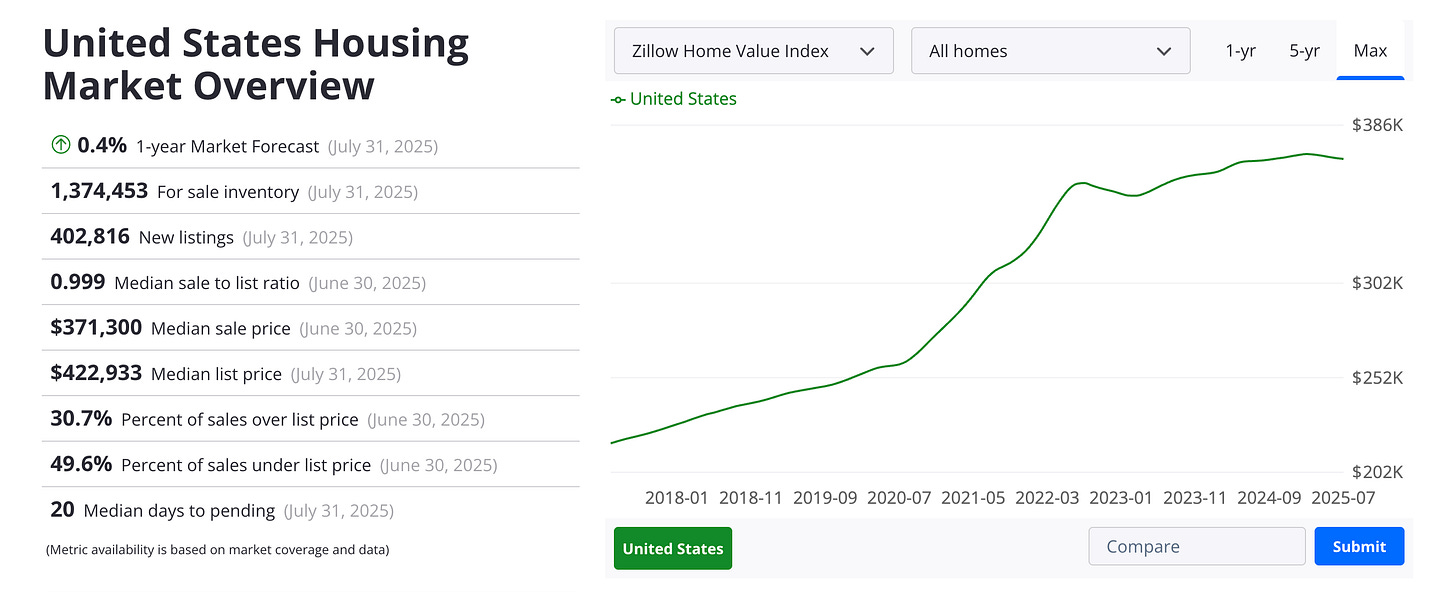

Yet there has not been any meaningful deterioration in financial markets. It has been quite the opposite with the S&P 500 kissing the 10%+ performance marker so far in 2025. Housing prices have broadly moved higher with Zillow reporting a 0.4% YoY increase. One could conclude that the economy is quite strong when looking solely at asset prices.

This then begs the question: does it matter? To financial markets, no. What matters is total spending, not the symmetry of value exchange. To a stockholder, margins matter more than the quantity of widgets the customer receives. It does matter for political and economic stability.

Resentment is building with an unknowable tolerance threshold and outcome potential. Do the wealthy usher in a new age of economic dominance, dragging a disgruntled class of serfs like detritus? Or can we expect an upheaval or even a renaissance of egalitarianism?

Ben and Brent discuss this matter further and offer their insights on what could be going on, but more importantly, what to do about it. Listen to Episode 38 of The Money Alchemist Podcast to join in on the conversation!

About your Hosts

Ben Jones, CFP®

Managing Director, National Wealth Management Group

https://www.linkedin.com/in/ben-nwmg/

Brent Gargano, CFP®

Founder & Advisor, Infinite Wealth Planning

www.infinitewealthplanning.com

linkedin.com/in/brent-gargano-cfp®-2067b573

Comments or questions? Email us at comments@moneyalchemistshow.com

Investment advice offered through National Wealth Management Group, LLC.

All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The information presented is for educational and informational purposes only and is not intended as a recommendation or specific advice.