QCD Microdosing

Using qualified charitable distributions to alleviate RMD pain.

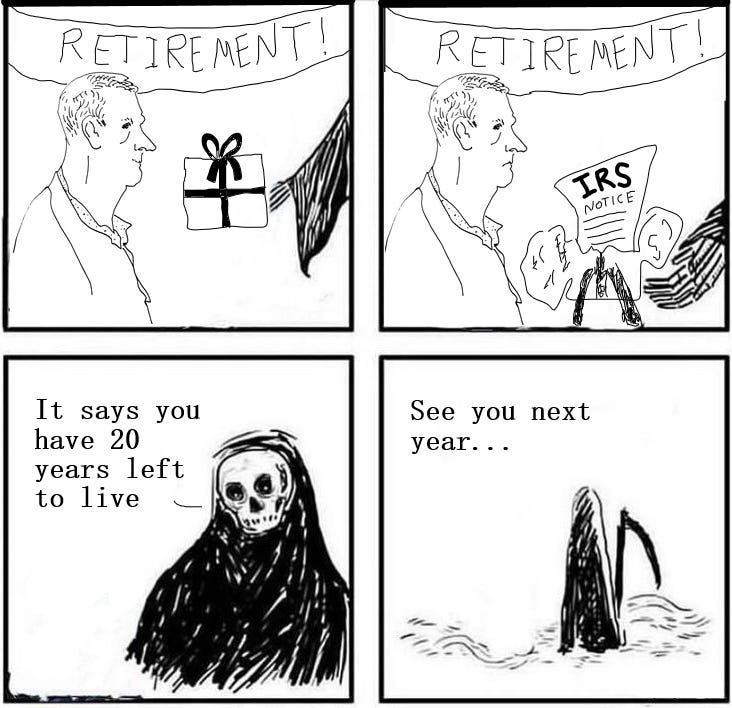

Fun fact: to avoid IRA penalties, sometime between the age of 72 to 75 you will be required to calculate how much longer you have to live. Every year. For the rest of your life.

The morbid and convoluted exercise is required by the IRS to force taxable distributions from your retirement plan. It’s your penance for taking advantage of tax deferral. How much do you owe them? Oh, they know but it’s up to you to figure it out.

Should you get the answer wrong, a 25% penalty will apply on the amount you failed to distribute from your IRA plan. There are circumstances in which the IRS will waive the penalty, such as if you cannot physically process the distribution due to medical reasons. Unfortunately, being bad at math or having a case of the forgetfuls are not among them.

Few things reek of dispassionate government policy more than the required minimum distribution (RMD) rules. But it’s the law of the land, nonetheless.

It is rare that the RMD amount aligns with a retiree’s distribution needs. If the distribution required is less than what the retiree is drawing from their pre-tax plan, then there’s not much to worry about. The RMD is satisfied. However, it becomes a proverbial thorn in the flesh if the reverse is true.

Many retirees take the RMD out of their investment accounts and deposit it into their checking or savings account. There it sits until the end of time, doing little to counteract the deteriorating effects of inflation.

Those more in tune with the concept of wealth building simply move the required amount from the IRA plan into a non-IRA account, keeping the unneeded dollars invested. At least this limits the damage to the Form 1040. Realizing unneeded income could negatively impact taxation of your Social Security and increase your Medicare premiums due to a higher Income-Related Monthly Adjustment Amount (IRMA).

This may not have to be the case for the charitably inclined. There’s a neat trick you can pull once you reach age 70 ½ that can directly offset 1099R income by distributing funds from a pre-tax IRA plan directly to a 501(c)(3) organization. This is known as a Qualified Charitable Distribution (QCD).

By sending a check to the charity of your choice, the distribution will satisfy the RMD requirement. However, it will not result in a taxable distribution to you even if you take the standard deduction. While this is not technically an above-the-line deduction, it essentially acts like one.

This makes the QCD especially useful for people subject to large RMDs and tend to be generously charitable. So, if you are subject to a required distribution that you do not need to live off of, and you are donating to a 501(c)(3) organization, it’s difficult to see how a QCD would not be worth looking into.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Individual tax and legal matters should be discussed with your tax or legal professional.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.