Rates Remain, For Now

Firmly planted, the Fed maintains its target.

Big egos the size of planets orbiting and unstable star clashed in July as calls for interest rate cuts interlaced with insults had about as much effect as you’d expect. One could understand why Chairman Powell would keep rates right where they are simply as a matter of principal.

It’s almost as if the scrap eaters are not getting the whole story. Why exactly does President Trump want the Fed to cut interest rates? Publicly, the reasons given are to reduce borrowing costs for individuals and the Federal government. The problem with this narrative is that most debit is issued under longer-term contracts.

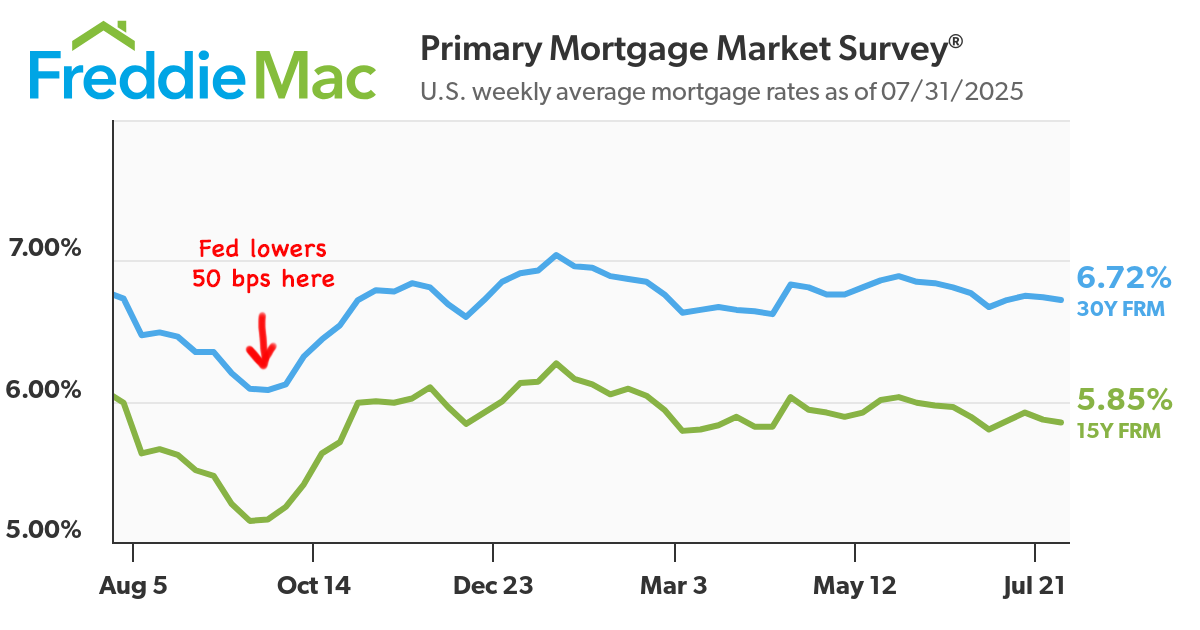

With decades of experience investing in real estate, he must know that short-term rates do not directly influence long-term rates, which are used to price mortgages. In fact, the last time the Fed cut rates by 50 bps, the rate on 30-year mortgages, which were heading south of 6%, shot up 80 bps!

So, a call for the Federal Reserve to cut rates might push rates higher on longer-term debt. To understand why this could happen requires a deeper understanding for what the Federal Funds Rate is and how it works.

The Fed, and various regulators such as the FDIC, require banks to maintain sufficient capital to meet solvency requirements. To facilitate this, the Fed uses various ‘tools’ to influence the rate banks charge one another for overnight loans used to meet capital requirement thresholds. These tools include open market operations, Reverse Repurchase Agreement Facility, and interest of reserve balances.

The key takeaway is that this is simply a rate that banks charge each other for overnight loans. It is not a fixed rate on dollars deposited or borrowed from the Fed. Lowering this rate encourages banks to expand credit as it becomes less profitable to hold the reserves. At least, that’s the theory.

In practice, lowering this rate is about as predictable as adopting a feral cat. I should know, my family just adopted two.

Banks could expand credit to increase margin; however, this would come at the cost of liquidity risk. Large banks have largely been allergic to anything but slam dunk lending opportunities. I seriously doubt we’ll see JPMorgan issuing start-up funds anytime soon, even at a zero Fed Funds rate.

On the other side of the equation are savers currently benefiting from higher short-term rates. Anyone old enough to have a bank account remembers the ZIRP years from 2009 – 2021. Negative real returns on cash were expected like an undeserved whipping from your stepfather.

What happens to this money when rates fall below the increasingly cryptic rate of inflation? I’ll clue you in from experience: nothing. Savers just earn less interest which makes them feel less wealthy and then they spend less at Costco.

The net effect is something akin to one of those bicycle bars in Nashville: a little bit of healthy meets short-term and irrational tomfoolery. Nobody knows where this thing ends up and who gets sick along the way.

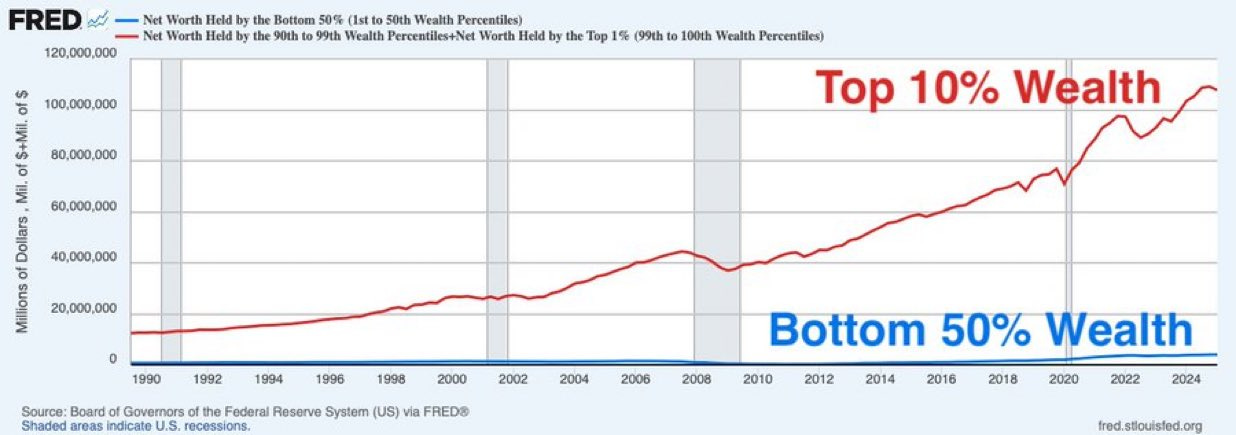

But we can see who would benefit if short-term rates where to go down, which is evident in how markets reacted to the last 50 bps rate cut. Asset holders. A reduction in the Federal Funds rate would boost demand for T-Bills (US Treasuries maturing in 12 months or less), which would in turn lower T-Bill rates permitting a temporarily higher debt load.

Additional Treasury issuance means, you guessed it, more government spending. Everyone’s favorite! Who benefits most from this? Mostly large enterprise and the owners and payees of said enterprise.

Suffice it to say, most of this spending floats to the top, exacerbating an already expansive wealth gap. The wealthy divert a large portion of excess cash flows into financial assets. Much more than the average person. There’s only so many luxury cars that can be driven in one lifetime.

Everyone likes the “number go higher” game, especially the rapacious. It’s how the unenlightened measure their self-worth. We all suffer this despair to varying degrees. At scale, the flows of capital carve durable grooves in the bedrock of our economy, channeling liquidity into any asset that is presently desirable.

It seems little thought is being given as to whether this is good, productive or even sustainable. Should his reasons be political, principled or spiteful, Jerome Powell seems unafraid to draw attention to the dangers of asset price inflation. This matters more than any unpredictable consequence of lowers the Fed Funds rate.

But, with his term up in May 2026, it’s likely we see a lower Federal Funds rate over the next 12 months. Baring a major deflationary event, it’s difficult to see how this does not widen the river of liquidity into popular assets.

Investment advice offered through National Wealth Management Group, LLC.

The information presented is for educational and informational purposes only and is not intended as a recommendation or specific advice.