Real Changes in Realtor Wages

How the recent settlement with the NAS affects real estate transactions.

As Spring and Winter jockey for position across the northern US, you’re likely to be thinking to yourself ‘why is my realtor friend so salty and why are they drinking alone at the local bar?’ It can’t just be seasonal depression disorder. Spring is peaking through from time to time, although with the ferocity of a tepid BMV clerk.

Other big stories have largely been buried by the tragic news around the Baltimore bridge, so you can be forgiven for missing an important headline. One of which is that The National Association of Realtors (NAR) reached a significant legal settlement on March 29th in a landmark lawsuit known as the Sitzer-Burnett case.

This settlement, if approved by the Missouri federal court, has the potential to substantially change how real estate transactions are processed. Specifically, around how agent compensation is considered.

The settlement, amounting to $418 million, was reached in response to a barrage of lawsuits converted to class action. The plaintiffs argue that the Multiple Listing Service (MLS) cooperative compensation model rule introduced in the 1990s artificially inflates real estate commissions.

If you have ever sold or bought a home, you are familiar with the MLS. It’s the critical system that enables real estate companies to share listing information. Without it, sellers would have a fraction of the visibility and buyers a fraction of the menu options. Because most homebuyers and sellers need professional advice, the NAR’s MLS enjoys a near monopoly with this listing service.

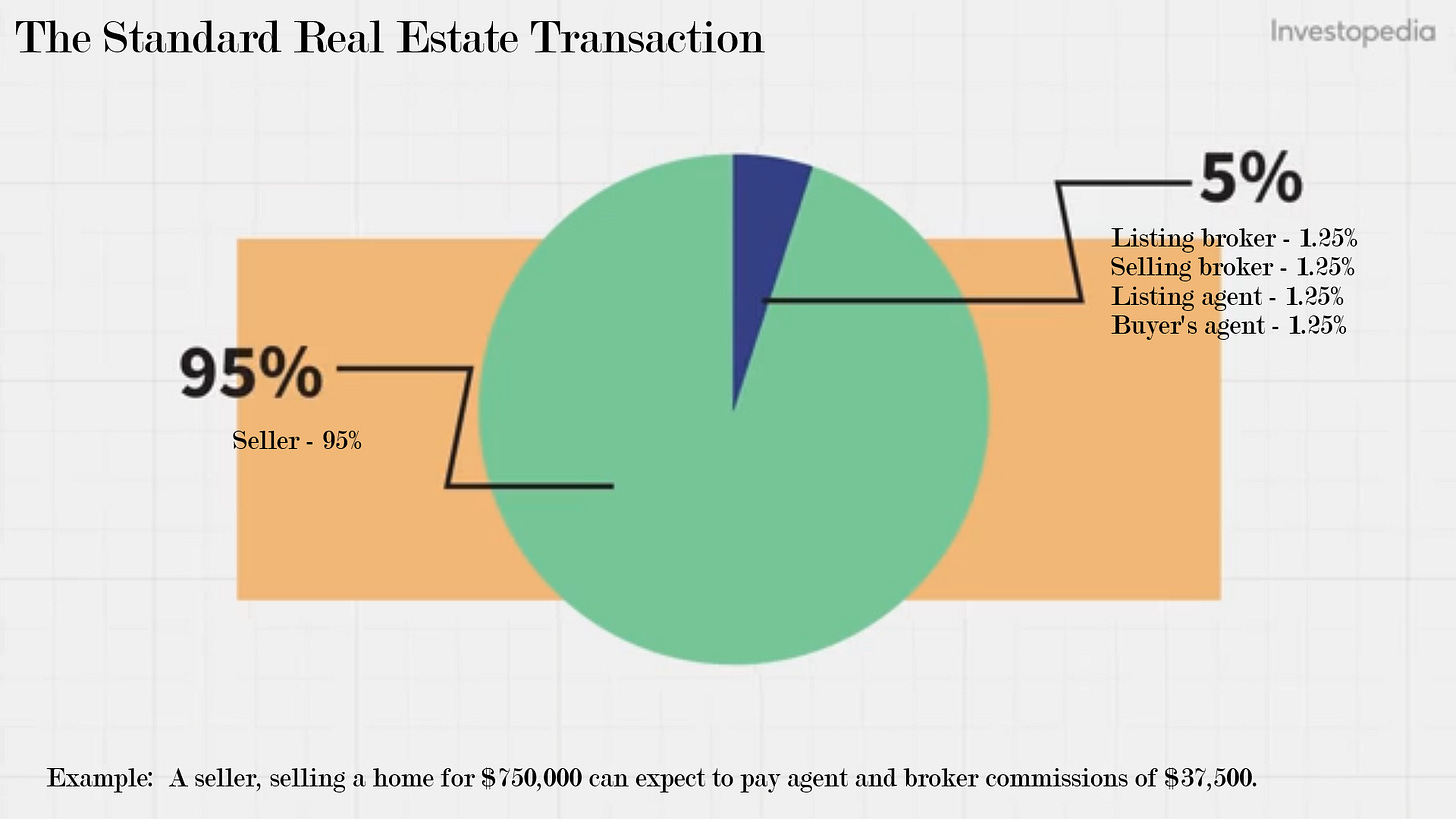

The cooperative compensation model rule associated with the MLS is why we consider a transaction commission of 5 – 6% to be customary. This has been the standard for over a generation now, so most just take the pre-determined commission as a given.

Not so for a few disagreeable sellers. It takes a special person to feel so ripped off that they rally together like-minded people to crusade against industry. I celebrate these people, even though I suspect their efforts were motivated more out of vindication than altruism.

I know one such person, who shall go unnamed. He once boasted that he specifically increased the price of his for-sale-by-owner (FSBO) home by 3% to make up for the buyer’s agent commission. He also made it crystal clear to all the prospective buyers that this was the case. Agents love this guy.

While I’m sure this helped him to psychologically grapple with his perceived notion of grift, it did little to change economic reality. Fact is, people were just willing to pay 3% more regardless. But I digress.

The MLS rule established a carve out for seller’s agent commissions. These commissions were advertised on the MLS so that sellers’ agents would feel confident that they would be paid for representing the buyer’s side of the transaction. This agreement changes that.

Sellers’ agent commissions will not only not be advertised on the MLS listing, but the new rule also removes the standard commission for the sellers’ agent. The idea is that this will lead to more negotiation around compensation, which it should.

Technically, the rule forced sellers to pay for buyer representation – something my acquaintance, nor the lawsuit plaintiffs, did not appreciate. Afterall, why should a seller be forced to invest in the buyers’ interests? Shouldn’t buyers just beware?

But this was the reality because the sellers were the only parties to the transaction that could reliably pay the commissions, which are not unsubstantial. Every seller is about to become flush with cash! They would pay the agent commissions AFTER the closing transaction – an important detail.

Sellers can still choose to pay for the buyers’ agent, something that will only come back in a buyers’ market and only as a concession. So, buyers must come up with cash to pay for their own representation. Furthermore, this cannot be lumped into the mortgage since it would violate current regulatory requirements.

The first of the dominos tips over beginning July when the new rule is expected to go into effect. Some are under the impression that this will lead to lower home prices, to which my response is “ROFL”. Yeah, I’ll also wait for my grocery store prices to decline after they install the self-checkout. It will lead to lower commissions, but the difference will go into sellers’ pockets.

Overall, this is a good thing but it’s not perfect. Consumers should never be forced to buy something they don’t value. I also feel realtors shouldn’t be forced to represent buyers that do not value their service. It’s a bad combination. However, many buyers will choose frugality of the moment over long-term wisdom. Many will buy homes they shouldn’t have.

At the end of the day, buyer beware.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.