Red, Blue or Green

Mixing politics and portfolios.

Rather listen? Tune into my new podcast The Money Alchemist. Available on most podcast apps, including Apple Podcasts! New episodes every two weeks.

When you begin to think the ruination of society is upon us, recall the words written by Charles Dickens in 1859, “It was the best of times, it was the worst of times”. In his novel, A Tale of Two Cities, Dickens teleports his readers into one of the tensest political moments in history, the French Revolution.

You think our 24/7 politically charged news cycle is entertaining? Back in 1799, the French version of “The Five” was watching five beheadings in a row. As ugly as today’s political commentators can be, at least we all get to keep our heads, for the most part.

Just two years after The Tale of Two Cities was published, America became embroiled in its own deadly civil war, which lasted for 4 years and cost the lives of over 600,000 Americans. Point being, politics have always been a nasty business. And yet, the best of times can usually be accredited to the present, even when tensions are at their peak.

Political forecasting and portfolio management work together as well as dog and a car tire in motion. Best one leaves the other alone. When one does meddle with the other, the misfortune is usually asymmetric in the most catastrophic of ways.

We should be wary of emotional responses to mechanisms beyond our control, especially when they are capable of crushing us.

This political cycle is nothing new and we should not be lured into a state of panic by influencers with glaring conflicts of interest and questionable motives. Chances are, they are more interested in your temporary attention than your long-term health.

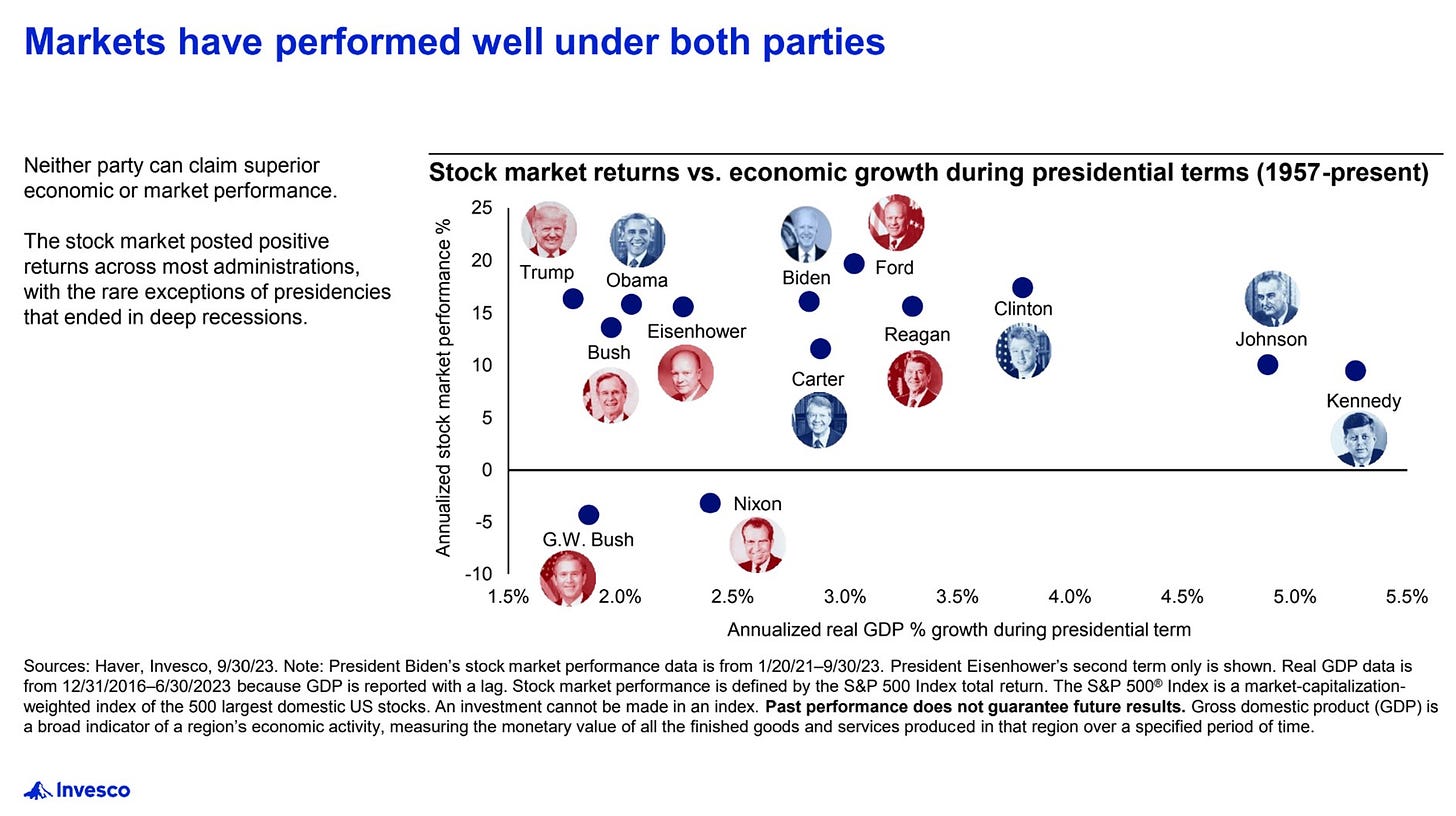

As the loaded messages inevitably pick up, it’s important to keep our minds grounded by trends that are more meaningful than the 4-year election cycle. One such trend is that the economy operates independent from party.

The best way to demonstrate this is with one simple question: will you cancel your Netflix subscription if your preferred candidate doesn’t win? Didn’t think so. In fact, you may need distraction even more than before.

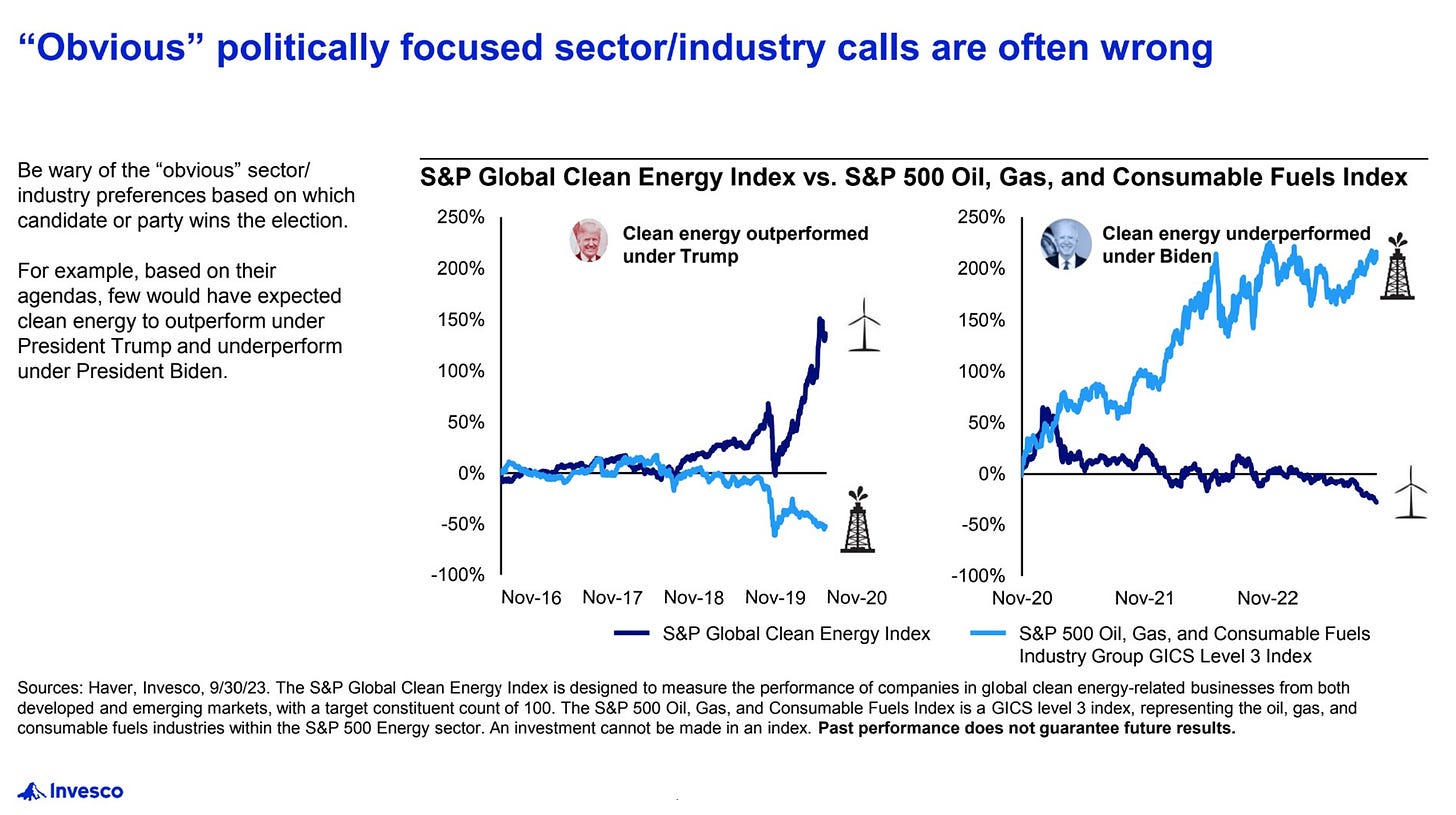

With ironic indifference, markets seem to not care who the president is. Nor can we predict the direction of markets based on who the elected officials are. Policy is not the engine of innovation, and we tend to exaggerate its influence over our economic decisions.

Yes, the influence is there. It’s just not enough for us to defy our own self-interests. Nobody is waking up with the next billion-dollar idea and saying to themselves, ‘nah, the makeup of the Senate really isn’t ideal for me right now.’

Human beings, like water downhill, flow in the direction of their incentives. This means that regardless of the election outcome, we will continue to show up to the retailers, to work, to the car dealerships, to wherever we can find perceived value. This almost always results in economic productivity.

Never forget, red and blue are also the hallmark colors of a bruise. Consider this a warning signal of natural design. Elections are an important part of our governance and culture. They do matter. They just rarely, if ever, matter as much as the interested parties want us to believe. At least from an economic perspective.

Just keep these things in mind as we approach the season of abandoned discernment. Reject the manufactured information and align your portfolios with natural human economic incentives. This election season, think green!

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.