Life requires us to juggle a never-ending stream of variables, constantly assessing and error correcting to maintain our forward path. Determining the direction of our path, in some ways, is even more complicated than navigating it. Meandering through uncharted territory is likely to stir up a fair amount of anxiety. Rather than chart a path with careful planning, many rely on fortuity to garner enough riches so that plebeian problems don’t apply to them anymore.

This is why most of us have contributed to their state sponsored stupid fund, otherwise known as the lottery. “There’s always a chance!” we say to ourselves. Here’s a short list of things more likely to happen than winning the mega millions:

1. Beating a world class chess player in a match

2. Finding a gold coin on the beach

3. Running for and being elected as a US Senator

Before you call me out on the last one, just know that the odds of winning the Mega Millions jackpot is 1 in 302,575,350. This is 300 times less likely than being struck by lightning. Saying that you’re more likely to get struck by lightning than win the lottery is like saying you’re more likely to get hit in the head by a frisbee than an airplane.

Yet, we buy the tickets and dream of the what ifs. I argue that most people buy the ticket not to win but to just imagine for the briefest of moments how the world’s problems could just roll off them like oil on Teflon. It’s a misguided manifestation of the deep desire to find fulfillment.

There is a key difference between getting rich and building wealth; one involves concentrated risk while the other is mostly concerned with preservation and deferment of capital across time. Building wealth is mission critical, lest you end up in a perpetual financial desperation loop ultimately to wind up someone else’s burden. It’s also the least exciting and therefore, the least engaging.

Striking it rich is not required for success but everyone wants the reward. The unfortunate reality is that few have the temperament for it and even fewer still the serendipity. We all thought the cypherpunks investing in Bitcoin at $0.1 were throwing money into the toilet, so we pointed and laughed.

When fate sided with them, we didn’t just try to grab the lightning bottle, we borrowed from friends and family and bought all the bottles we could find and hired people to hold them in the air. The result was the crypto crash of 2022 that wiped out more than just a few. Fortune does not favor the crowds.

This then begs the question; how do you get rich? The whole idea behind investing money is to defer immediate use of the funds in exchange for a larger sum of funds at some point in the future. Generally, the riskier the enterprise, the more the potential for return should be, and/or the sooner the payoff.

By concentrating your capital into one venture, the fate of your wealth is intertwined. Should the venture pay off handsomely, your fortune could multiply exponentially. Is it any wonder why so many billionaires today are entrepreneurs?

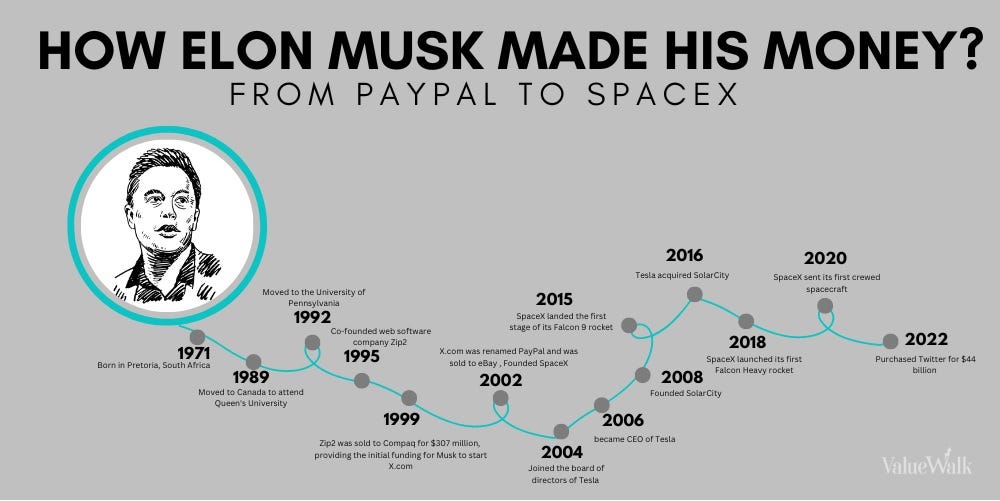

By default, an entrepreneur ties up his or her working capital, both in terms of money and labor, in one singer enterprise. Elon Musk made his first $300 million in 1999 when he sold Zip2, a company he founded with his brother on a $28,000 loan, to Compaq. His path to the richest person in the world involved multiple concentrated investments, most of which panned out.

While these stories are amazing, they often leave main street in a bewildered state as we hunt for applicable inspiration. Frustration can lead to desperation, which is only exacerbated by the social media spectacle that parades extreme examples of financial success as if it were a common experience. Newsflash, it isn’t.

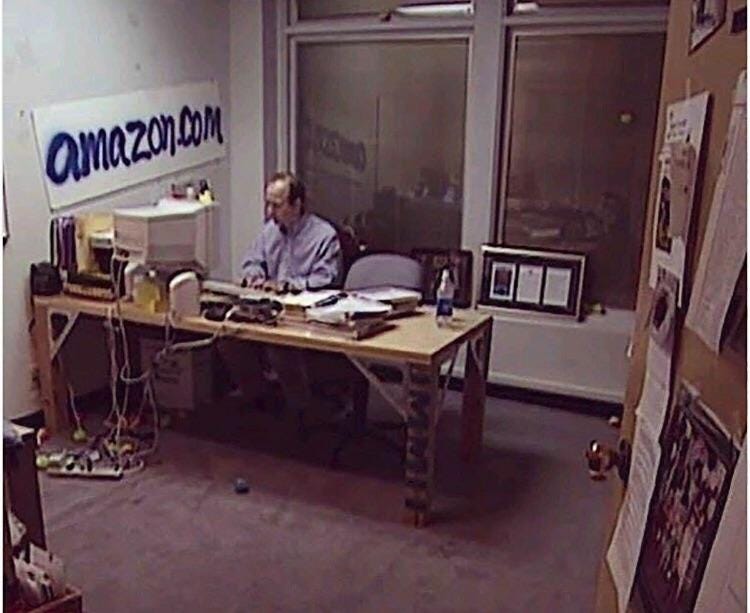

This is not to suggest getting rich is impossible and a fool’s errand. Just know when you should try. While I cannot speak for Jeff Bezos, I’m sure he had a clear vision of what Amazon could be when this picture below was taken in 1994. While luck is a necessary ingredient, conviction in a good idea and dedication to implementing it create the environment necessary for luck to appear in abundant quantities.

If you don’t have one of those billion-dollar ideas burning a hole in your head, it’s best to put your nose to the grindstone and build wealth using a reliable and repeatable process. I have a process and it is slow, boring, and often emotionally compromising. If it were easy, there would be no need for financial advisors who mostly act as monetary behavioral therapists. It’s ok to admit you could use one. I think most people do.

Don’t be lured into get rich quick schemes. If it sounds too good to be true, it probably is. If you have conviction in a good idea that could be the next billion-dollar idea, vet it out and be prepared to work harder than anyone you know. Either way, I am rooting for you!

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.