Saved By The BLS?

The Bureau of Labor Statistics on US labor demand.

The unenvious task of gathering and reporting data on the U.S. labor market is the purview of the US Bureau of Labor Statistics. They do this using several methods, all of which are dependent on field economists that call on businesses and households to collect data via a “conversational” approach. We have the Job Opening and Labor Turnover Survey (JOLTS) which supplements the Employment Situation Summary. Both are released monthly with the JOLTS survey coming in nearly a month in arrears. The Employment Situation Summary is often called the Jobs Report and consists of an establishment survey of more than 122,000 businesses, and a household survey that consists of approximately 60,000 households.

Keep in mind, these field economists are collecting this data monthly. That means over 180,000 contact points per month. Call me a skeptic, but in the era of junk email filters, caller IDs and generally low patience levels for unsolicited inquiries, I would like to see an audit of this process and its accuracy. We get glimpses of the faultiness of this process when comparing the data with that of America’s largest payroll provider, ADP, which releases its ADP National Employment Report monthly. For example, the ADP report suggests that 296,000 jobs were added in April while the BLS Jobs Report suggests 253,000 jobs were added. ADP’s data isn’t perfect either, but it does not require an army of field economists smashing phones all day to collect “conversational” information, so I tend to trust its process more.

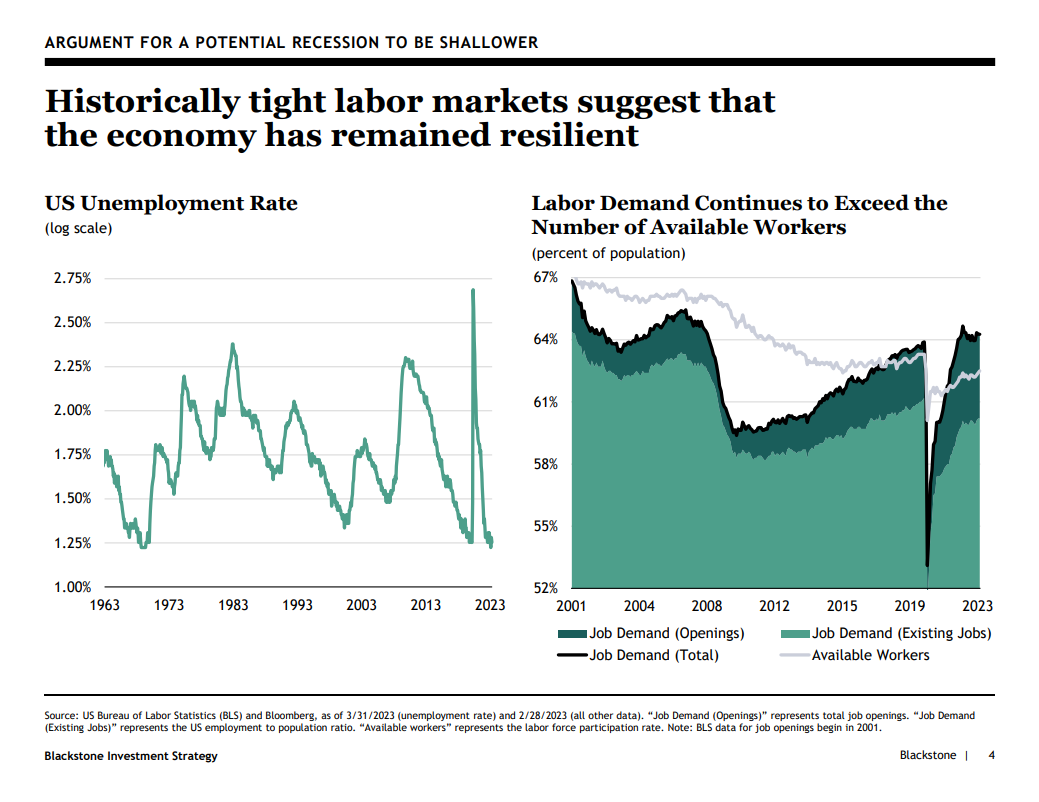

The fidelity of employment data does not need to be precise to find out which way the wind is blowing. The Fed depends on this information, in part, to determine the effectiveness of its monetary policy. Jobs growth that exceeds labor participation growth means the economy is still growing while the opposite means its time to pull back the reigns. Current data from both the BLS and ADP tell us that the economy is still in growth mode, which may come as a surprise given the amount of doom and gloom going around. But don’t let this wash away all your fears of a potential recession. There is nuance in the data that is difficult to parse. For example, how can we tell if one person is working multiple part-time jobs or if the job openings are entry level versus career level? Having a low unemployment number and a high number of job openings doesn’t necessarily equate to a booming economy. Here’s a fun thought, what if we were all in the business of creating our own YouTube channels and we simply just traded videos amongst one another? A funny, yet hardly productive economy that many children would enjoy.

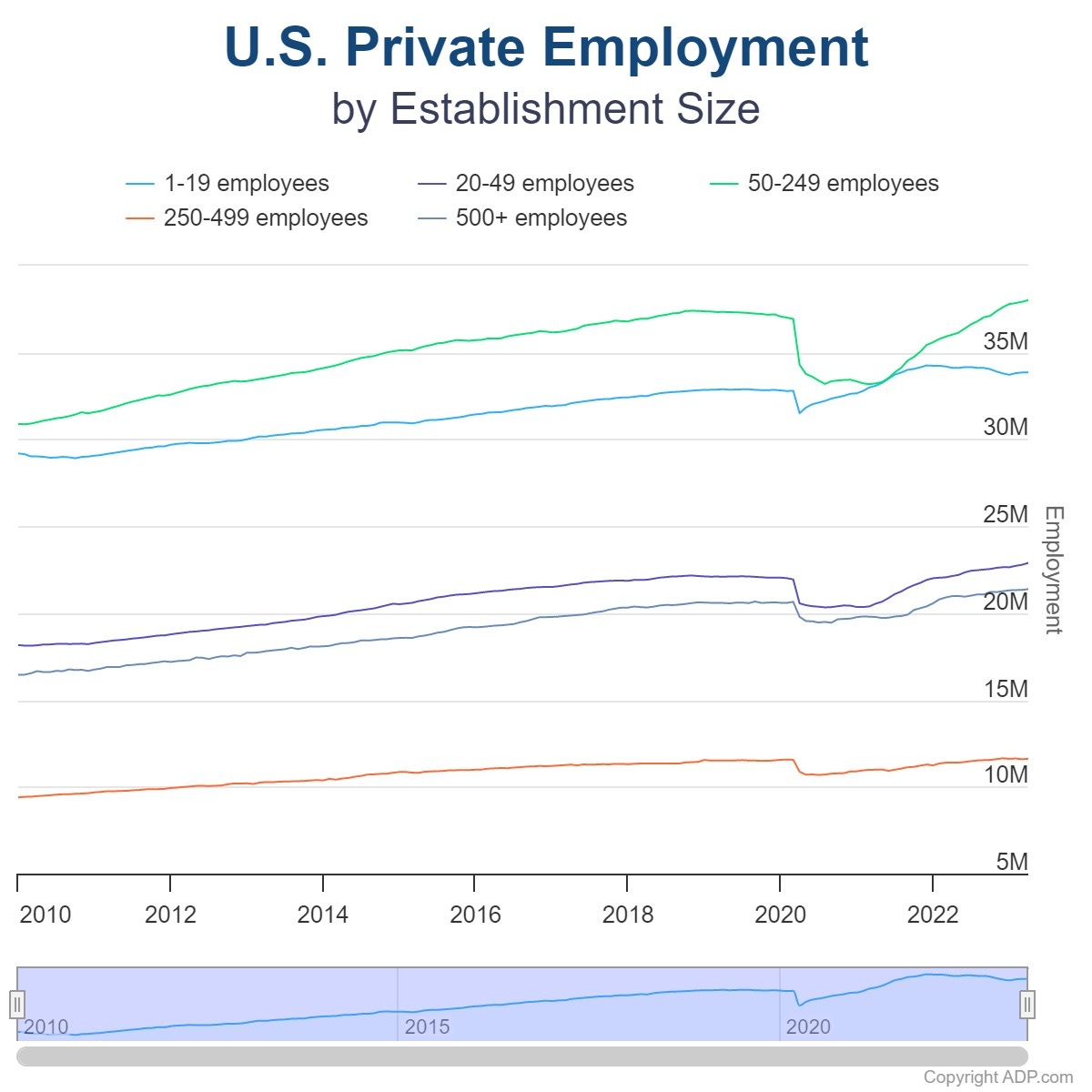

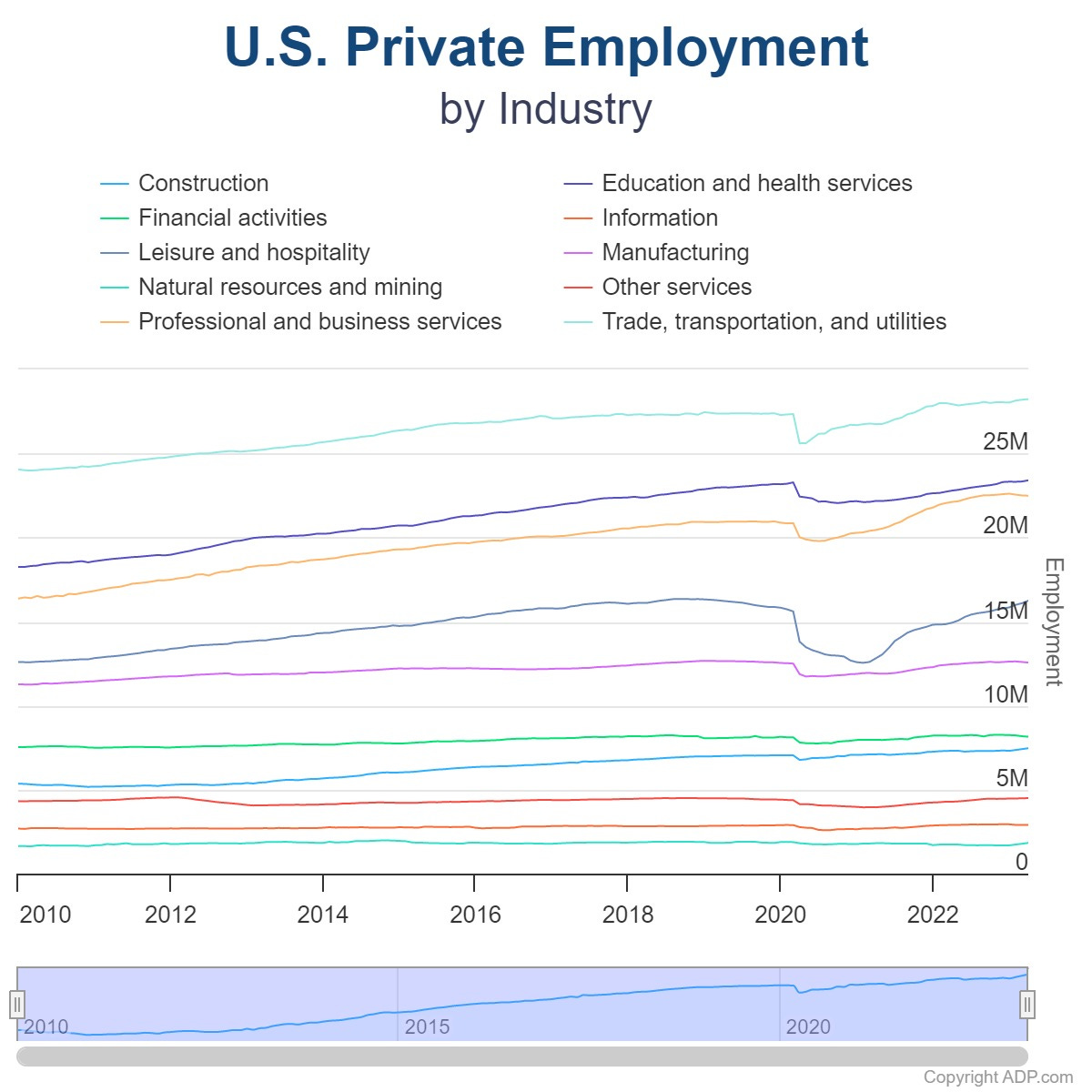

The ADP Jobs report is published online and contains some good data points to this effect. One data point that confirms a suspicion I had was that most of the jobs growth in April was from small to mid-size businesses in the leisure and hospitality space. We all see “help wanted” signs at nearly every food service location in the US at the same time learning of massive layoffs in the tech industry. Even with equity markets being down 15% from market highs, Americans are flush with cash when compared to pre-COVID levels. This means Baby Boomers can retire and the younger generation can afford to sustain themselves with gig-work and other labor-light endeavors outside of toiling for the scrutinizing patron. So, this is what’s driving today’s “strong” labor market. While it doesn’t quite fit the definition of a paper tiger, the term is directionally correct, albeit a bit too strong.

Source: ADP National Employment Report; https://adpemploymentreport.com/

Can we avoid a recession if the current conditions in the labor market persist? Well, no, for a short answer. First, employment data tends to be a lagging economic indicator which means it’s usually the last data point to weaken in the cycle. Consumers pull back spending well before the pink slips are doled out, which triggers the layoffs after a series of economic dominos fall. This begs the question then, what causes the consumer to pull back spending? Higher interest rates, tax increases, declines in household income, asset depreciation, natural disasters, and war, to name a few. Right now, higher interest rates are the only factor at play, with the prospect of war looming as a distant threat in the psyche of the American consumer. The record pace at which interest rates have gone up is enough by itself and forward-looking data points such as the Institute of Supply Management’s PMI index suggest they’re having the desired effect. It’s tough to enough to steer a canoe with two people without an error or two, let alone an economy with 100s of millions of people. A few eggs will be broken. The robust demand for labor supports our base case for a shallow and short-lived economic protraction. Once the economy adjusts to the new rate environment, hopefully we can see a rebound in conditions. That is, unless some of the aforementioned factors come into play. We are looking at the sunsetting of the Tax Cuts and Jobs Act passed in 2017 in 2026, and that is no small deal.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.