Six-Figure Poverty

What it takes to raise a modern middle-class family

Listen now! The Money Alchemist Podcast EP 26 - Six Figure Poverty

Earning a salary of $100,000 used to be a remarkable achievement. The phrase “six figure income” is still revered as something special but it merely survives as a remnant from an aging culture coming to grips with the crushing reality of a debased currency.

What used to earn you a seat at the table of American high society is now barely enough to fund general obligations to government and a comprehensive healthcare plan. The line between rich and poor has been creeping up the income bracket.

People desperate to clear the bar are contorting themselves in unnatural ways for that extra edge. Expedient gimmicks like online betting are surging in popularity with self-harm as the highest probability outcome. Most are just predatory monetary extraction schemes.

It’s uncomfortable to admit, but the hurdle is only going higher. At some point, it will be impossible to hurtle into the middle class if jumping from the ground. You can thank intractable deficit spending and money supply growth for that, yet I repeat myself.

Wealth feels achieved once financial independence is attained. It’s the equivalent of reaching escape velocity in aeronautics, a point at which a pilot can decide with ease whether to ascend or descend. It is a position of option.

The required fuel for such a feat is income. Steady and sustained is better than explosive, in most cases, but more is always useful. How much does it take to have a chance at reaching escape velocity in 2025?

For the average American household of 2 adults and 2 kids, it’s somewhere between $130,000 and $150,000 per year.

The reaction to this figure is usually one of two:

a) No way, stop complaining and buckle down like I did, or

b) Finally, someone admits it. I feel heard.

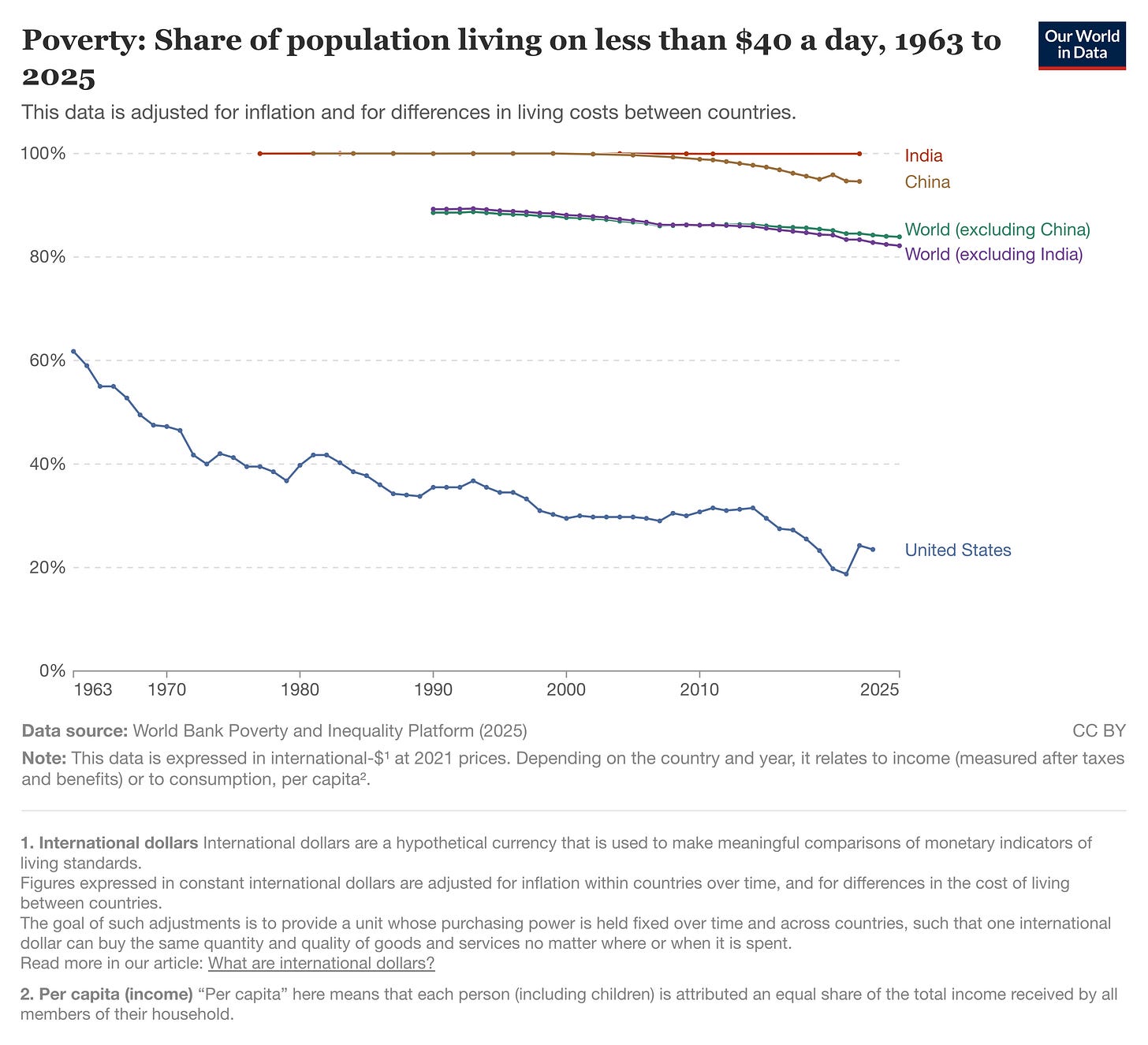

In a world where nearly every American can earn a wage higher than the global average, the common retort is to “just be thankful”. But forced perspective, often preached by those outside of the grind, feels so…unhelpful.

The message fails to consider that inflation is geographically variable. Your $100 bill stretches much further in Hanoi than it does in Manhattan. It also disregards humanity’s nature to assess and compare within local groups, otherwise known as the frog pond effect.

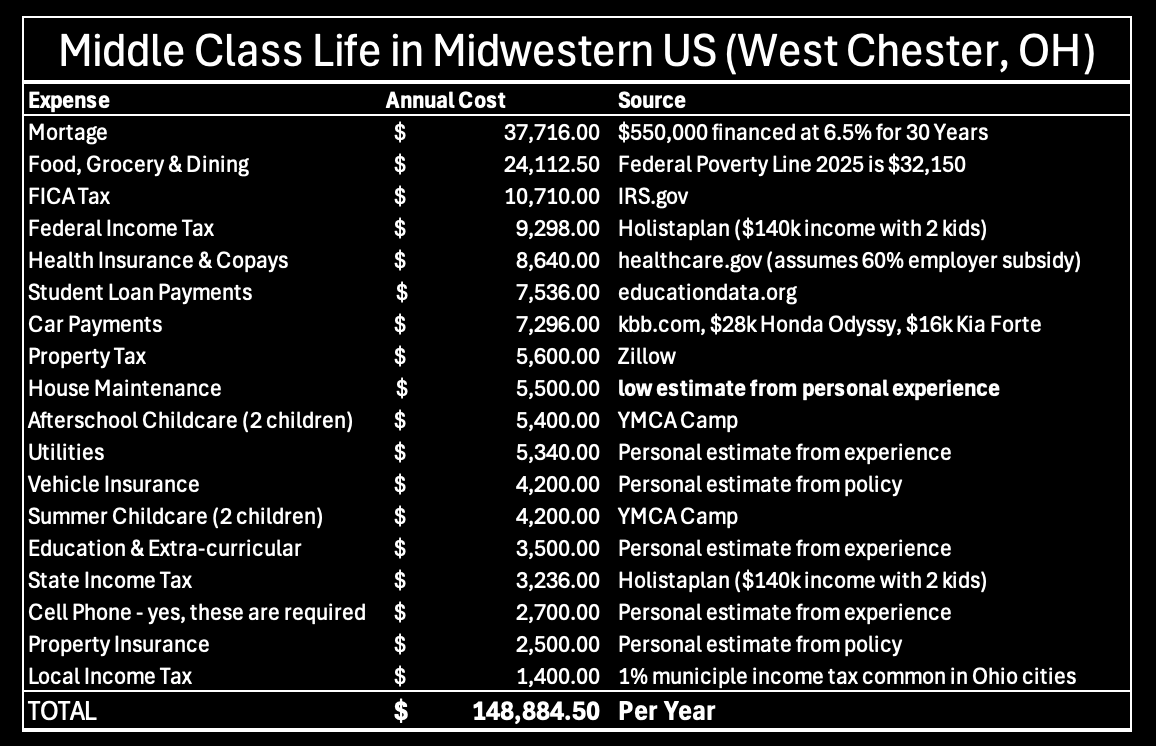

To live a middle-class life in an average Midwestern US city, it takes around $150,000 per year. To make things even more real, the tax estimates above assume household incomes of $140,000 per year which means this household is in a spending deficit.

That’s accounting speak for ‘six-figure poor’. There are numerous ways I could fire pain-seeking missiles into this rickety budget for maximum devastation. Fox 1 – pregnancy. Fox 2 – employer reduces health coverage subsidy. Fox 3 – HVAC dies mid-winter. Target neutralized.

Notice there is no room for savings, which should be another $28,000 per year. Sure looks like $250,000 per year is the new coveted six-figure income.

No wonder the birthrate is at a record low. It’s also not surprising why there’s so much generational hostility. “Ok, Boomer” is code for, “just die and put the money back where you found it.”

This not to suggest abject poverty is as bad in the US as it is globally, because this is not true. Not even close. It’s just not a helpful perspective to a working-class family struggling to juggle relevancy and solvency living in the richest nation on earth.

Reminding a person in this situation that they don’t have dirt floors is failure to read the room. Especially if the critique is leveled by someone that walks on marble. In fact, it is a great way to invite a punch to the throat and a vote for wealth redistribution.

Studies, and my own lived experience, suggest happiness is partially derived from where you stand among your peers1. As we’ve expanded our connections through social networks and infrastructure, we have broadened our cohorts and inadvertently entered competition with professional consumption athletes.

In our pursuit of happiness, an American constitutional right, we have remained steadfast in our refusal to accept less than our friends. Accepting less than our parents is unfathomable. We only move up and to the right. This is the way. Consult the charts!

As Mark Twain once wrote,

“There are three kinds of lies: lies, damned lies, and statistics.”

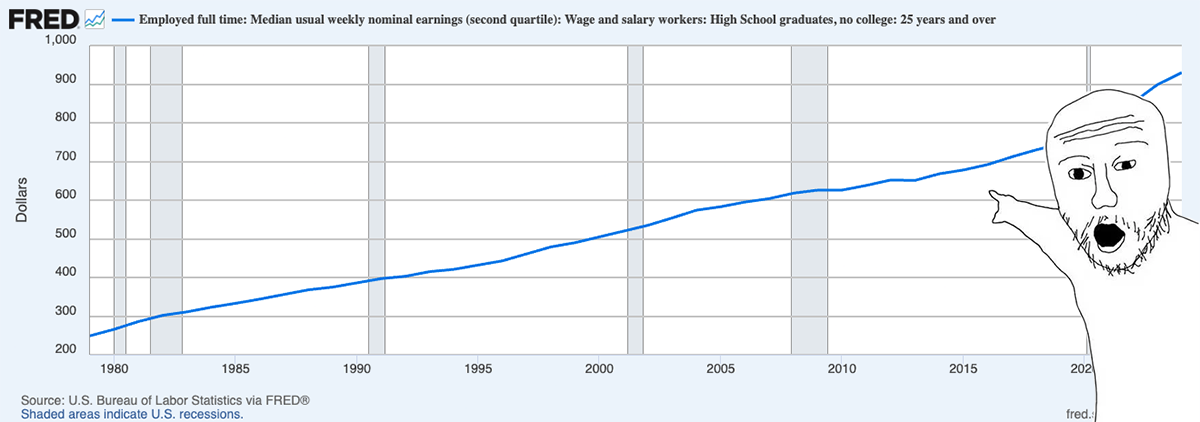

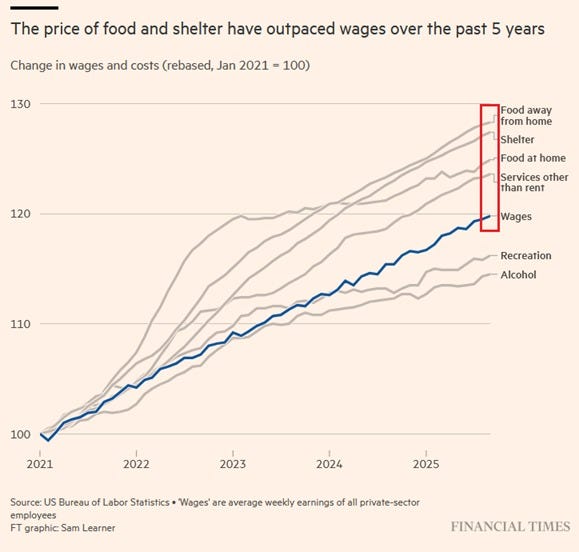

The up and to the right chart may look correct, but it sure doesn’t feel that way. Maybe, a variable or two have been ‘miscalculated’.

The high-school graduate wage has increased 2.97% per year since 1979. If true, how is it that my grandfather was able to sustain a household of six working for $10 per hour ($38/hour today, adjusted for inflation) at a steel mill, retire with comfort and die a millionaire?

Something seems to be missing in the data. That 3% inflation rate we’ve been programed to believe seems suspiciously stable with blow-out deficit spending. Figures like the CPI, GDP, the Poverty Line and unemployment are ambiguously calculated yet held up by officials as heralds of economic truth.

The statistical information seems to exist for one purpose: messaging. And the officials crunching the numbers are not immune to self-flattery. Suspect the charts because they never tell the whole story. A higher number does not necessarily translate to higher quality.

Incomes may have moved steadily higher; however, the household budget profile has changed drastically in ways unaccounted for. For example, how do the charts factor in a loss of 40-50 hours per week in household productivity because of an extra full-time job?

Has the CPI been adjusted to account for the loss of pension savings and the modern requirement to defer income into financial assets? No. Are financial assets themselves included into the inflation data? Of course not, though they are necessary.

My grandparents were able to pull their family out of poverty’s gravity well, but it is much more difficult to do it today. Here are just a few reasons off the top of my head.

A full-time house manager: tragically, the most undervalued resource in our modern culture is the homemaker. I wince using this term because it is so hated. The messaging has been effective. ‘Home Manager’ is a more precise, modern term. Schedules must be orchestrated, food must be prepared, laundry must be done, children monitored, and doctors consulted. This does not happen by itself. Unfortunately, dual incomes are a requirement for most households leaving less time available for the fundamentals.

Lower value for unskilled labor: years of globalization has shifted unskilled labor demand overseas where wages are far lower and worker rights are minimized. Inhumane, yes, but we still buy Nikes and iPhones. In response, America’s youth flooded university campuses to stay economically relevant. Not everyone was intellectually prepared so the loan rules had to be ‘adjusted’ to prevent widespread defaults. The strategy worked for some, and they are now in the top 30%.

Credentialing & education burden: it was possible at one time to pay for a quality education with the income from a summer job. Today, if the job earns you enough to pay for a degree, why are you even getting a degree since you already have the job? Education has never been more accessible but credentialing, critical to most employers, has never been more costly.

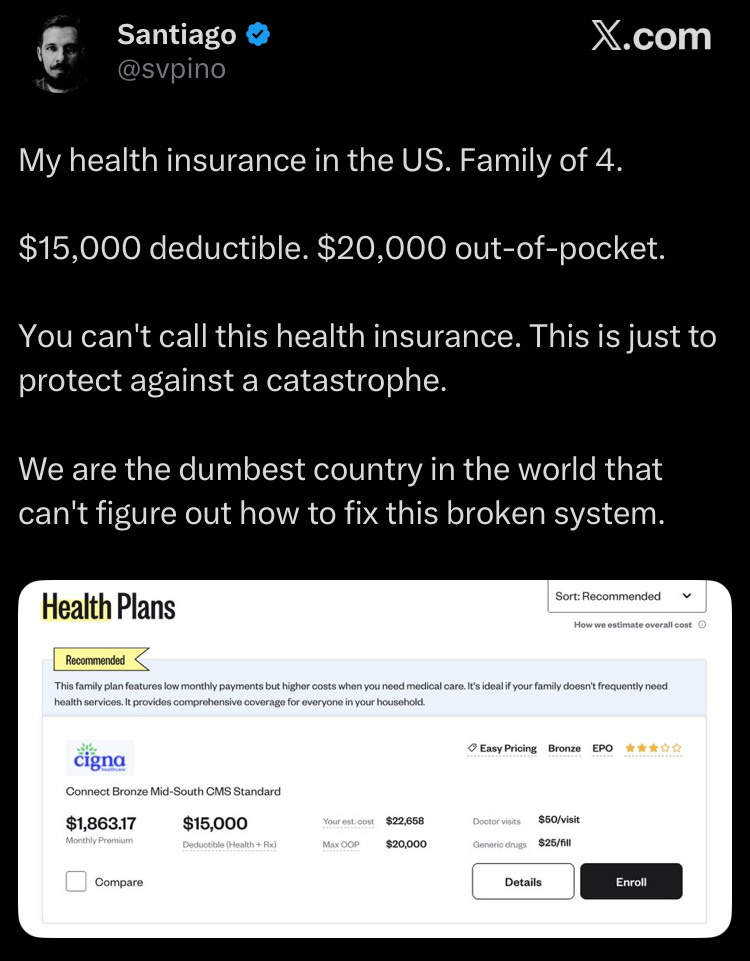

Healthcare costs: As I wrote two weeks ago, the average healthcare premium for a family of four is $26,993 per year. This is up nearly 6,851%, which might as well be infinity percent, from the $394 per year insurance premiums in 19802. Time-constrained workers with never-off-the-clock jobs struggle to maintain health, which only exacerbates the cost issue.

Elective 401(k) took place of pension: Most Americans are poor money managers. Even the ones that seem like they know what they’re doing, especially the traders. Pension plans, ethically managed and funded, used to serve as a forced savings mechanic for the ill-informed. Because the 401(k) requires an opt-in discipline, many disregard its importance to their own dismay.

But don’t worry, there’s a robust social safety net. A family just need to move down to around $45,000 to $50,000 in household income, depending on state of residence. Make it to this level and a household may qualify for Medicaid, SNAP, childcare subsidies, among other programs.

For the astute observer, you can see and issue with this picture. On one hand, I’ve demonstrated how it is quite possible for a family to struggle with an income of $140,000. On the other, it’s not altogether unattractive to just adopt a welfare dependent lifestyle.

The space in between is a mud pit, a slog of an obstacle guarding the rewards of middle-class life or better. Here, we find the battleground of today’s culture war replete with all the hallmarks of conflict. Indiscriminate misfortune, asymmetric advantage and dehumanization of the other. The conscripts do not know why they fight, only that they must so they pick their preferred banner and ignore what’s beyond the battlefield.

The picture is not likely to get better soon. Wealth dispersion will increase commiserate with government deficit spending, which channels inflation into financial assets. Deflation, the ultimate wealth redistribution tool, is still widely viewed as an economic crime. The only way to win is to own, and the only way to own is if you’re winning.

Fortunately, winning is still possible for anyone. It just may not be worthy of an Instagram chronicle. For me, it meant working door to door sales for a year and a half while I took the leap to start my business. Fortunately, it worked out but it was never and still is not easy.

Nearly every day I have the honor of working with regular people who have decided to make the same decision I did over a decade ago. They recognize that the world is lopsided to favor the wealthy and look for direction to remedy this within their own households.

They seek us out to help them make the tough decisions required and hold them accountable to their mission. And for most of them, it works but only over time and through application of discipline and sacrifice. Yes, it’s a tough trade to swallow in the face of unfairness. But such is life. At least you don’t have dirt floors.

Investment advice offered through National Wealth Management Group, LLC (NWMG).

The information presented in this article is for educational and informational purposes only and is not intended as a recommendation or specific advice.

National Wealth Management Group, LLC does not guarantee the accuracy or completeness of the information provided, and opinions expressed are subject to change without notice.

Harvard Study on Adult Development https://www.adultdevelopmentstudy.org/