Smells Like Stagflation

April PCE and GPD data gang up on markets.

The Personal Consumption Expenditure price index, otherwise known as the PCE, came in hotter than expected for the month of March. The data, released on April 26, points to stubbornly elevated inflation in both housing and healthcare as the main culprits. The reading came in at a 2.7% year-over-year increase in the PCE index versus 2.5% the month prior.

Think of the PCE as a more ‘flexible’ CPI (Consumer Price Index), another popular measure of inflation. The PCE can, and will, adjust over time to reflect changes in consumer spending habits. For this reason, it is the Fed’s favored measure for monetary policy.

The rationale seems sound. Some argue it gives policy makers too much cover from true inflation. Then again, there are not as many people buying expensive perms as we were in the 90s. Tastes and habits change, sometimes for the better, and this impacts inflation averages.

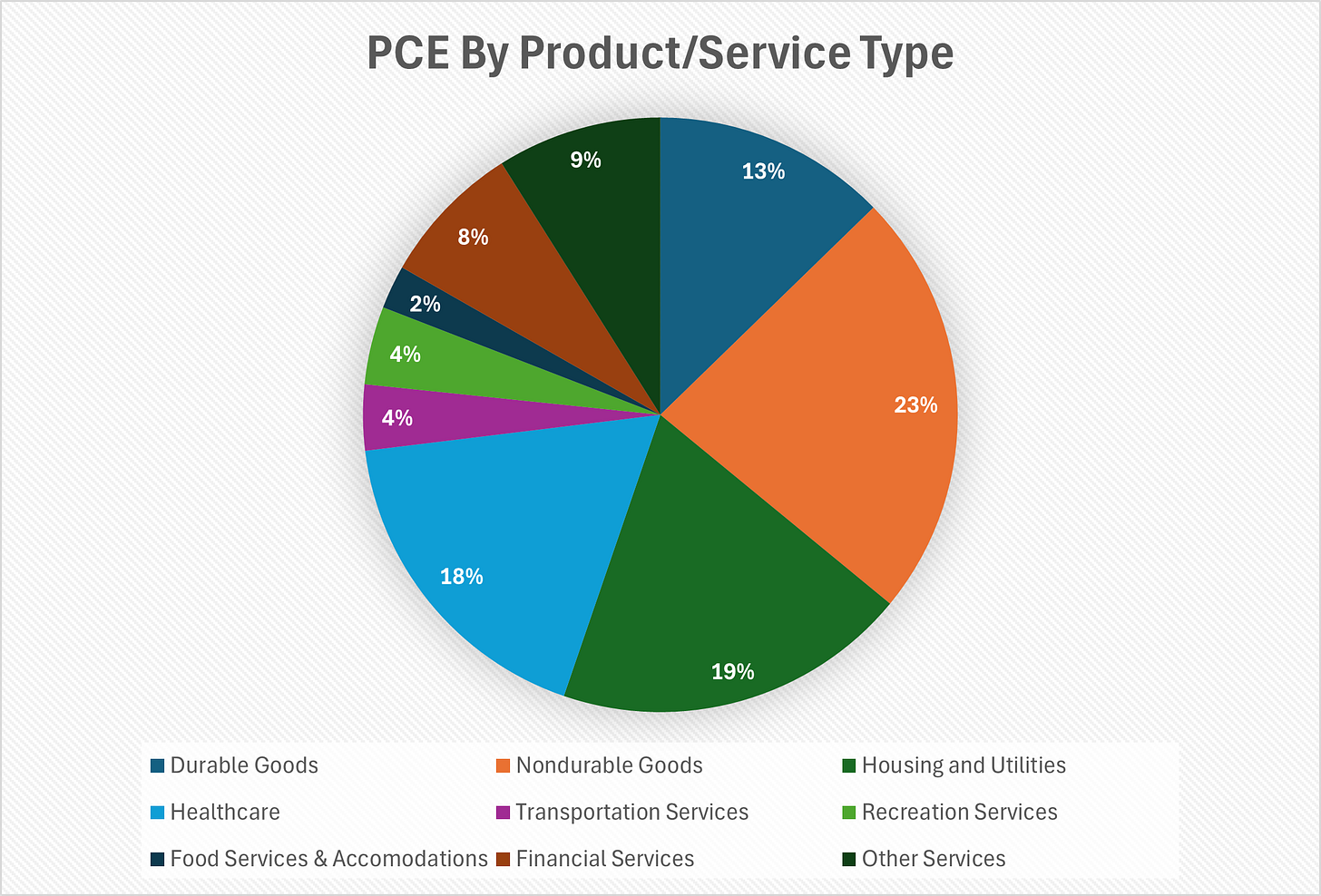

For the March 2024 reading, the PCE breaks down as follows:

Source: BEA.gov

Note: Gasoline is a nondurable good, not a transportation service. Nondurable goods are any product/commodity purchased with an expected useful life of less than 3 years.

So, prices are higher. Specifically, 2.7% higher than they were at this time last year. How about I tell you something new?

One day earlier, the Bureau of Economic Analysis released the Q1 2024 US real GDP data, and the news wasn’t good. The results failed to deliver on expectations, coming in at 1.6% annualized growth.

It seems you weren’t spending as much money as the economists wanted you to. The result is a significant slowdown in economic growth when compared to last quarter’s 3.4% reading. Shame on you, go to your corner.

Now the bulls are nervously shifting in their seats, refreshing their browser windows hoping more acceptable data will suddenly appear. Others, too impatient to wait another quarter for a trendline, want to plant their flags on this slope declaring ‘stagflation is here!’.

For the uninitiated, stagflation is the term given to the economic condition suffered by both inflation and declining GDP, an unholy combo. The key word in that last sentence is ‘declining’. Note that real GDP last quarter still grew, albeit at a slower pace.

One quarter of a slower pace of growth is neither abnormal nor is it a good reason to forecast gloom of any kind. Stagflation would be a worst-case-scenario.

It may smell like stagflation, but just because you smell something off putting doesn’t mean you’ve suddenly wandered into a sewage plant. You may just be downwind from an unfortunate burst of flatulence.

Bad jokes aside, logic mandates that we plan for higher probability outcomes. Stagflation is not one of them. Incomes are largely keeping pace with and have even outpaced inflation in the past 12 months. Unemployment is still low. Government spending is uncapped until January 2025.

Where is the decline in GDP going to come from? Well, it would have to come from the consumer. Signs of stress are beginning to show here, and this is where the stagflation alarmists are not entirely off base.

The excess savings accumulated during the easy money era of 2020-2021 has evaporated. We learned how to save for two years and dropped the habit quicker than Jerome Powell can say the word “transitory”.

The data is signaling that more and more Americans are throwing the napkin on the table, tapping out and declining desert. Is this because of indigestion or are they simply full from two years of bingeing? Probably a little bit of both.

Any pullback in discretionary spending, especially the necessary kind, can feel like a personal recession to the affected household. Anecdotal murmurs of discontent can be misleading, however. Inflation does impact lower income families more negatively than the upper class, but GDP doesn’t discriminate.

It’s important to recognize that a recession for one individual does not equal a recession for the whole. At the aggregate, the economy is still growing. And should this change, and we fall into recession through reduced consumption, the adage should hold true:

The cure for high prices is high prices.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.