Social Security | Part Deux

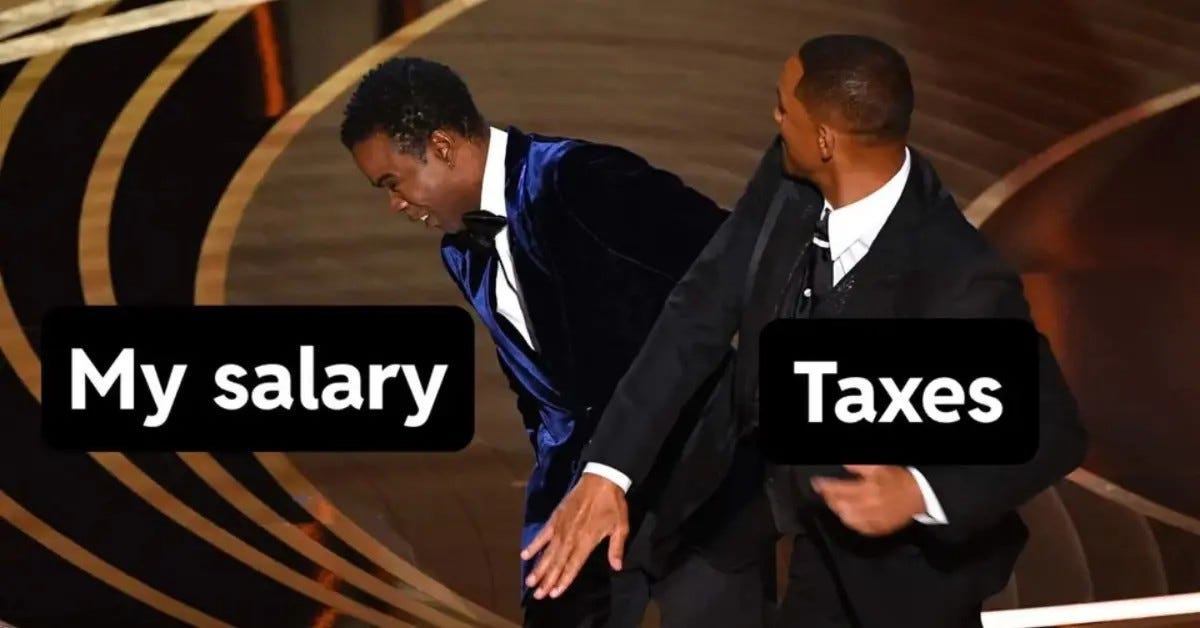

The same income, double the tax.

While the world is distracted by paltry spending cuts with sensational headlines, I shift your attention to the mountain of fiscal trouble towering on the horizon: Social Security. More questions orbit this program than Starlink satellites around earth.

One of the more convoluted questions pertains to benefit taxation, which consists of payroll taxes and income tax on the benefits themselves. If you’re curious why the government cut of your pay seems much larger than the advertised Federal rate, payroll taxes are the likely culprit.

These taxes are comprised of three components:

Social Security: 6.2% (up to $168,600 in 2025).

Medicare: 1.45% (no cap).

Additional Medicare: 0.9% (on income above thresholds, if applicable).

$200,000 for single filers or head of household.

$250,000 for married filing jointly.

$125,000 for married filing separately.

Excluding the additional Medicare tax, this amounts to a fixed 7.65% share of your income. Your employer matches this for a total figure of 15.3%. There’s no break for the self-employed. They get to pay the full 15.3%, which is often referred to as the “self-employment” tax.

Federal Insurance Contributions Act (FICA). These four words, when combined, created a taxing force so powerful it forced scientists to acknowledge the existence of fiscal black holes.

Originally, Social Security benefits were not taxable. Prior to 1984, recipients enjoyed the combined bliss of a libertarian-principled tax-free income within the comfort of a socialist safety net. The best of both worlds, until it wasn’t.

The bean counters got busy punching numbers into adding machines and before we knew it the good ole days transitioned into time served. Not only are benefits currently subject to income tax, but you also pay income taxes on your FICA payments. Wham! Bam! The one-two punch few retirees see coming until it hits them.

Maybe this changes. Several policymakers on both sides of the aisle have proposed ideas that reduce the tax burden on benefits or eliminate it altogether. In 2023, the Old-Age, Survivors and Disability Insurance (OASDI) Trust reported over $51B in receipts from benefit taxes alone. Seems like a lot of tax revenue to dismiss from a program supposedly running on fumes.

When you consider that the program paid out $1.379T in 2023, that $51B doesn’t seem so significant at 3.7% of the budget. Using government math, that sure looks like somebody else’s problem. And that is likely where things are heading.

With inflation playing a key role in elections, policymakers are desperate to position themselves as counterbalances. Removing the tax burden on Social Security would certainly be a change welcomed by anyone collecting benefits. So, what if it burns the fuel vapors a little faster?

It’s already the case that some do not pay income tax on Social Security benefits. To figure out if you are one of the lucky few, first you need to know the formula for Provisional Income:

PI = adjusted gross income + nontaxable interest + half of Social Security benefits

Next, you will need to know your filing status: Married Filing Jointly (MFJ) or Single.

Now use this table to see where you fall:

And just like that, you can calculate how much your government loves or hates you. Love used to be the default position with over 90% of all recipients receiving tax-free benefits. But the adding machines the bean counters used didn’t have a time value of money function, so they neglected to factor in inflation. Now, many pay taxes on their benefits.

Sneaky, sneaky.

If you ask me (nobody does), Social Security could be simplified by removing income tax on benefits but means testing recipients based on an inflation adjusted income phase-out. Heck, we could even use the same phase-out that the IRS uses for Roth IRA contributions.

It may be an unpopular position for wealthier Americans but they’re the ones with the money that can support the program. Otherwise, it’s inflation through deficit spending.

For those who haven’t paid attention, the Social Security Fairness Act rescinded the Government Pension Offset and Windfall provisions. Great news for public employees with pension benefits. Let’s see how this plays out because we’re likely to see more legislation touch Social Security this year.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.