Stacking Up Your Stacks

How does your nest egg compare to your contemporaries?

Let’s admit it. We don’t login to Facebook to see pictures of cute babies and animals. We’re not even all that interested in keeping up with old acquaintances, although this does provide convenient cover for our true intentions. We’re there to measure our lifestyle against our peer groups. Keeping up with the Jones’s, so to speak.

This drive to compare isn’t entirely narcissistic. Studies such as the Harvard Study of Adult Development routinely find that people who feel they are on similar or equal footing with their peer groups feel greater degrees of wellbeing and suffer less instances of depression – a good thing if you ask me. This is why it is not uncommon to find happy, often happier, people in non-developed economies. They may be poor, but they’re poor together.

In the first volume of Gulag Archipelago, author Alexander Solzhenitsyn expresses that one of the happiest periods of his life was when he was locked up in the gulag with his contemporary band of intellectual misfits, fraternally bound by their suffering at the hands of an oppressive Soviet State. Curious.

There is one thing sensible people do not plaster all over their Facebook page, and that is their net worth. If they did, well, a fool and their money soon part ways. While you can derive some information from lifestyle, it’s far too easy to fake, leaving us with unreliable reference points for comparison. Was that new Lexus your old college roommate bought on loan or with cash? I guess you’ll have to wait to see if the repo man shows up to find out.

This information may not be accessible for the everyday social media junkie, but it is available to the discerning researcher willing to dig through volumes of financial metadata. The friendly folks at Vanguard did exactly that, unleashing the power of no less than six big-brained finance nerds to answer your burning question: how do I stack up? I read the 31-page report, titled The Vanguard Retirement Outlook: A national perspective on retirement readiness, so you don’t have to.

The conclusion of the report is rather stark. Well more than two thirds of Americans will need to reduce their standard of living when they retire without a productive change in policy or savings habits. The standard age of retirement is 65, which was selected on account of it being the average for the past several years. Categories were created based on incomes and age groups.

The age-groups examined include:

· Late baby boomers (ages 61-65)

· Generation X (ages 49-53)

· Early millennials (ages 37-41)

For the sake of brevity, we will focus on the late baby boomers, given they are the closest to retirement. It’s important to note which income cohort you belong to. It makes a major difference when comparing your preparedness relative to your peers.

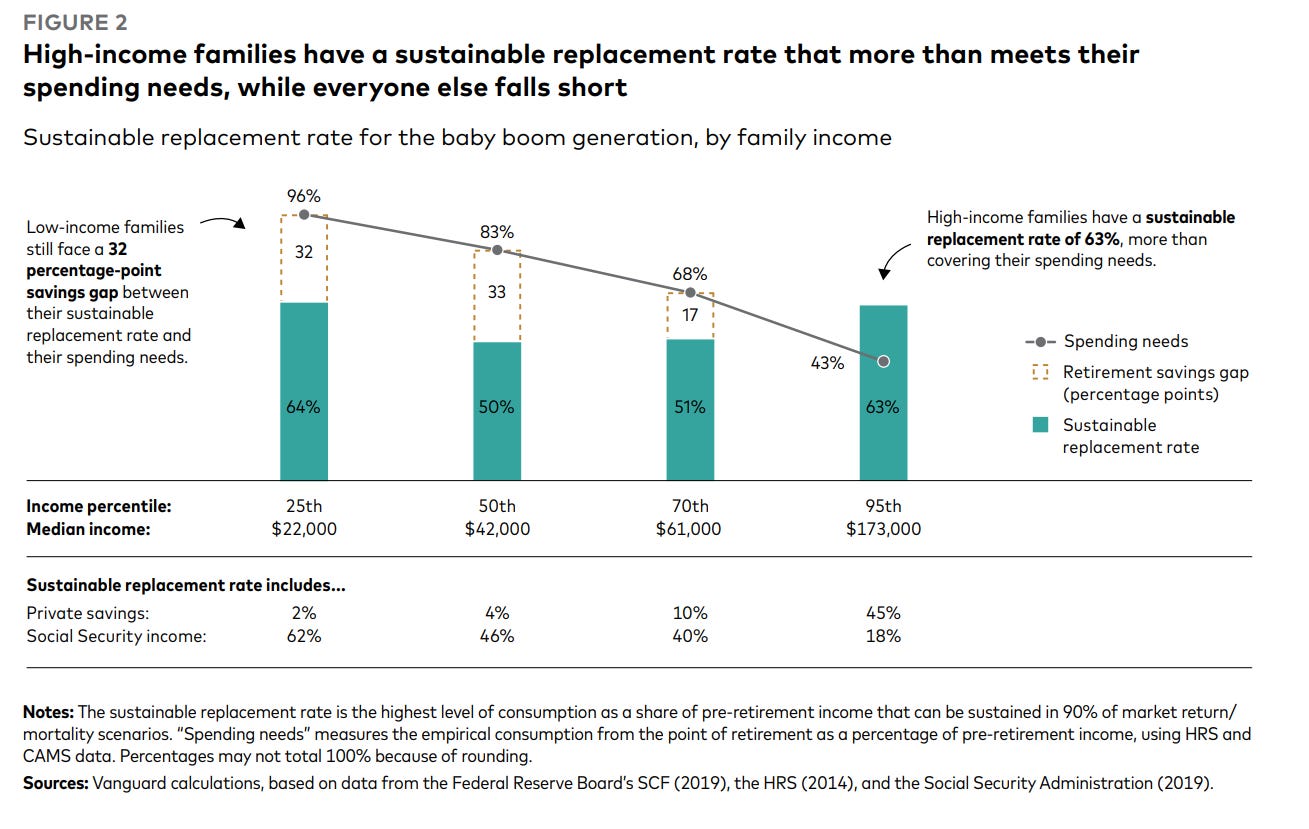

Looking at the income thresholds on the y axis of the chart above, find your age on the x axis and coordinate your percentile. Armed with that information, check out the chart below:

Bear with me here because this chart can be a bit counterintuitive to read. One important point to understand, and I can independently confirm its truth, is that higher income earners need to replace less of their employment income as a percentage in retirement. For example, a pre-retiree making $173,000 per year will likely only need 43% of this amount to fund their retirement lifestyle.

Conversely, a pre-retiree making $22,000 per year will need to replace 96% of this income to maintain their standard of living. Understanding this, you began to see the chart more clearly and quickly understand how good it is to be in the 95% percentile.

But that’s not the point of the exercise. We’re here to see how you stack up against your cohort. To do this, add up your Social Security Benefit and pension benefit(s), if applicable. Now take your investment portfolio balance and multiply this by 0.04 (4%). Add all these together and this becomes your post-retirement income estimate, which should account for inflation adjustment needs.

Now, take this total and divide it by your total gross income for the past 12 months, assuming this income is your current livable wage. This is your sustainable replacement rate (generically calculated – not a financial planning recommendation). Now compare this to the sustainable replacement rate within your income cohort highlighted in green in Figure 2 below.

If your sustainable replacement rate is higher than your cohort, congratulations you can now confidently launch that Instagram account to flex your newfound superiority. Perhaps a TikTok short shredding your AARP discount card will suffice.

Now, admittingly, this is just confirming whether you’re better than the averages. The averages, except for the 95% percentile cohort, are terrible. We here at Karat Stick aim to be better than average. Your ultimate goal should be to target a sustainable income replacement amount equal to your specific lifestyle, hence the need for a financial plan.

Take my word for it, every financial plan is different. How you compare to your peer groups should not be your gauge for success. You may not be an average person, a likely case if you’re reading my newsletter. You need a retirement income plan that considers your unique expense profile.

For those “elder” millennials and Gen Xers wondering what your age groups retirement income readiness looks like – it’s slightly better. Although, the exogenous risk of variables, such as the health of Social Security, only grow with time. This makes the longer-dated calculations more uncertain and subject to greater degrees of change.

Hopefully you stack up better than expected. If not, do something about it. If you don’t, you won’t be optionless but the options will resemble your local penitentiary’s long-term lodging selection.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

There is no assurance that the techniques and strategies discussed are suitable for all investors or will yield positive outcomes. The purchase of certain securities may be required to effect some of the strategies. Investing involves risks including possible loss of principal.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.