Suboptimal Optimization

Seeking balance over perfection

Life is slipping through your fingers. You cannot see it happen, but you feel it in punctuated moments of awareness. It’s the feeling that accompanies a task scheduled months out that suddenly appears on tomorrow’s schedule. Or that timeline photo from a year ago that seems like last week.

Nothing puts time into perspective more than observing the growth of children. Suddenly, they develop a taste for caffeine, sprout Red Bull wings and move on to reshape a world that was once yours. The subtle yet nagging awareness that your timelines are in sync yet not equal only accentuates the slippage.

The reaction is to squeeze every minute for what its worth. We optimize. Every dollar represents a finite minute, and to waste even one is a travesty. A desperate search for maximization can lead down many paths, each promising fulfillment of one kind or another.

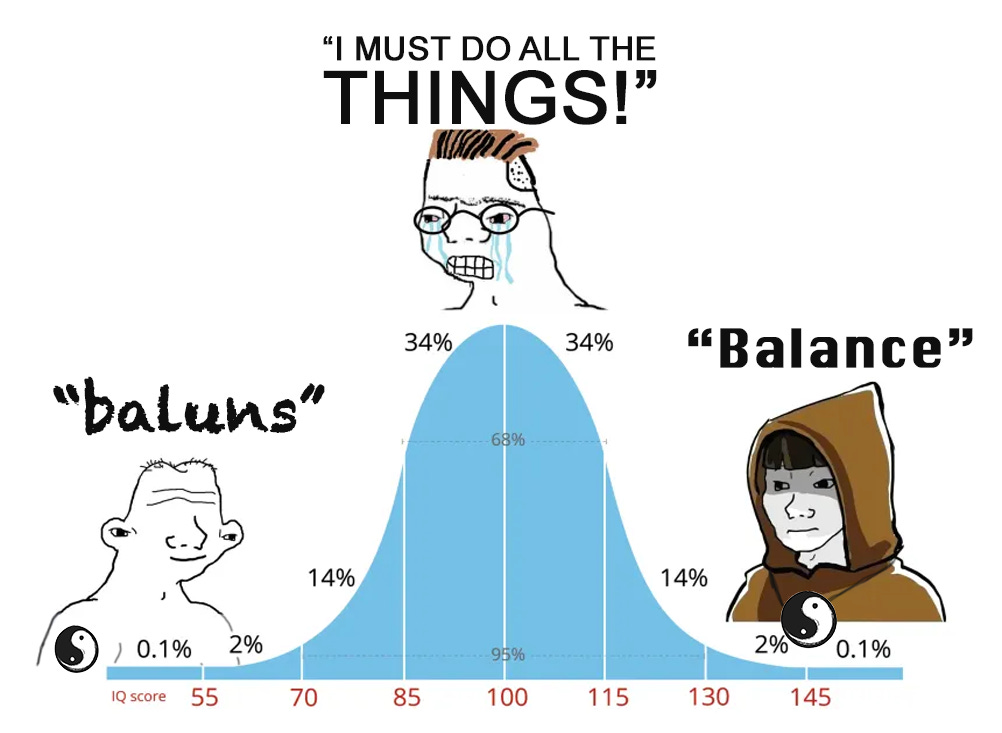

The high-time preference person will seek experiences offering sublime stimulation to crowd out negativity from the menu of possibilities. Suffering is suboptimal. Curating such an in-the-moment lifestyle can lead to obvious long-term consequences, both health and financial, yet seems logical to a mind living in the present. “YOLO” isn’t just a saying but a call to action.

Most of us are hyper-aware of our hedonistic tendencies with guilt complexes that act as a behavioral immune system. This has sparked recent counter-culture movements such as FIRE (Financial Independence, Retire Early), minimalism and a “sober curious” generation, all changes new to us but not to humanity. While generally healthier forms of ‘optimization’ than indulgence, they strike a lopsided bargain with the present.

Both lifestyles, the extreme hedonist and the extreme self-preservationist, are flawed solutions to the same insolvable problem: optimizing life with limited data. At first, it may seem the problem is too much data. We live in the information age within layers of dense networks. But too much information isn’t the problem, which I will illustrate with one hypothetical:

If you knew with precision in one year the complete state of financial markets, how would you conduct yourself? With this one data set, you could ignore all economic data as it would be utterly useless.

Much of the data swarming around our heads like gnats around a frog serve as errant variables to be consumed for cognitive guesswork. Some believe if enough is consumed, clairvoyance may be achieved. More data is needed. This is the theory underpinning the very notion of determinism. I happen to believe in free will which means the future is unknowable.

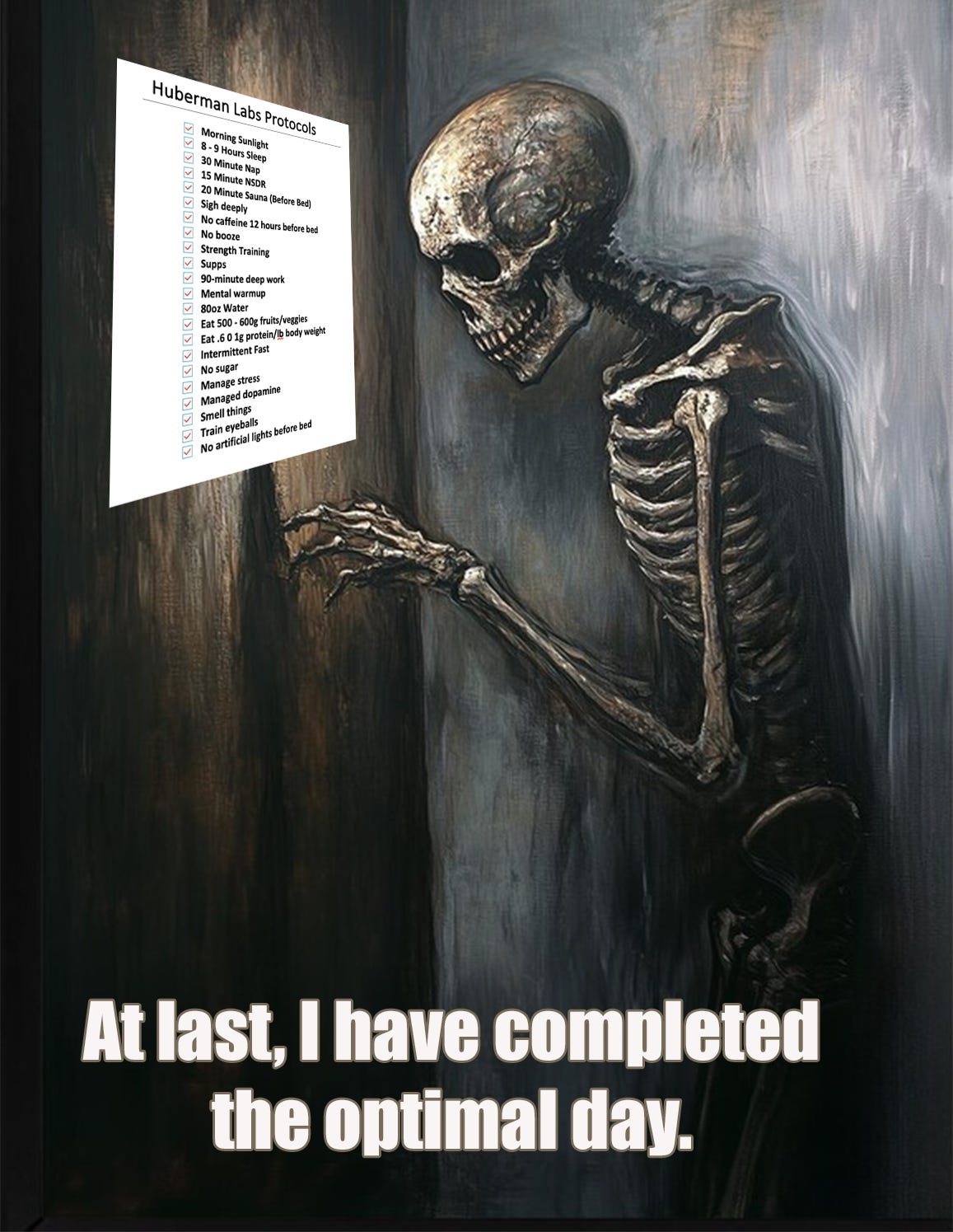

If we just understood the entirety of the tax code, financial markets, body chemistry, network effects and other important science, we could have the optimal life. Then again, chasing the comprehensive data set for a complete life would ultimately lead to suboptimization. At what point does the cost of the data processing exceed the value?

Something we’ll soon discover in the AI race.

Perfection is impossible, a paradox in and of itself. It is the state at which further improvement is impossible, not dissimilar to oblivion. That doesn’t seem like a vibrant condition, let alone an achievable goal.

At this point, you may be wondering, “ok, what does this have to do with money”? I’ll get to the point.

As we round out the year, you will receive messaging to max your retirement and health savings account, harvest your gains and losses and fill up the lower tax brackets. You’ll review what investments did well and which did not and strategize what you’re going to do different to find the winners moving forward. Lofty promises will be made with 2026 deadlines.

You will feel pressure to analyze the data and contort yourself in uncomfortable ways to optimize. Resist this and remember to never let perfection be the enemy of the good. Extreme positions are best left for games of Twister and revolutionaries.

The quest for optimization shouldn’t be a pursuit of perfection but a modest movement toward better. This requires balance and balance requires a constant but small shifts of individual muscle fibers and an awareness of the present.

Financial wellness is just one component of a balanced life. Trying to micromanage every second and every dollar does not bring you more in life. It brings you stress and anxiety. I think this is why more and more successful people are using financial planners today.

It’s never been easier to outsource sound money strategy to free up valuable time to discover your path to a more fulfilled life. It would at least be one less gnat buzzing around your head.

If you are in the search for such a financial planner, check out our recent episode on 401(k) plans for a sneak peek, now on YouTube and all major podcast platforms. Hopefully you’ll pick up some useful pointers on how to “easy button” your retirement savings. Our DMs are open.

“For what will it profit a man if he gains the whole world and forfeits his soul?”

The Money Alchemist Podcast | EP 42 Making the Most of Your 401(k)

Ben Jones, CFP®

Managing Director, National Wealth Management Group

www.nwmgadvisors.com

Follow him on X @thekaratstick

https://www.linkedin.com/in/ben-nwmg/

Matt Heitman, CFA, CFP®, ChFC®

Wealth Advisor, National Wealth Management Group

www.nwmgadvisors.com

https://www.linkedin.com/in/matthew-e-heitman/

Comments or questions? Call or text us at 513-438-0095!

Investment advice offered through National Wealth Management Group, LLC.

The information presented is for educational and informational purposes only and is not intended as a recommendation or specific advice. Consult with your financial professional for advice specific to your situation.