Taxable Roth Conversions That Make Cents

When paying taxes can help you pay less taxes.

It is said that it takes all types of people to make the world go around. I argue that the world would still rotate on its axis even if we were homogeneous and uninteresting, but that’s beside the point. There is one type of person entirely unwelcome on this planet, and that is the person who enjoys paying taxes. This person may exist, and it is quite possible that their mere existence slows the earth’s rotation on account of the sheer mass of inherent stupidity.

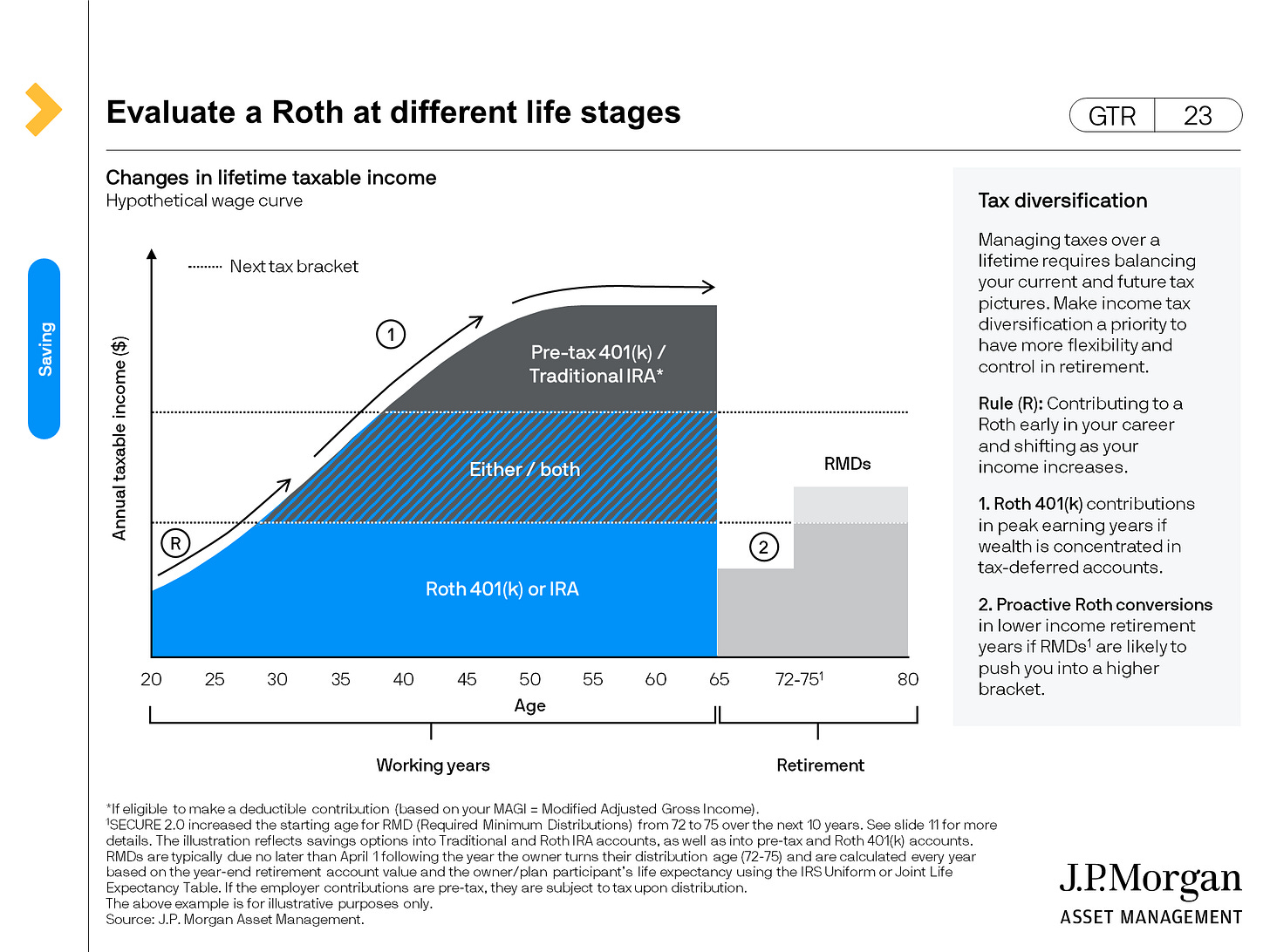

One of the many missions for myself and my clients is to minimize our lifetime tax bill. Counter intuitively, sometimes this means paying more taxes today to save on a tax liability tomorrow. Converting traditional, or pre-tax, IRA balances to a Roth IRA does exactly that. This is not a “no-brainer” transaction everyone should engage in, requiring the careful consideration of several variables.

· Current Taxable Income

· Projected Future Taxable Income

· Age

· Current Tax Rates

· Projected Future Tax Rates

· Return Assumptions

For example, if you are fortunate enough to find yourself in the nosebleed rung of the tax bracket ladder and you expect this to change post-retirement, a Roth conversion may work against you right now. Instead, you should wait until your earned income is lower, usually post-retirement, then engage in strategic Roth conversions.

The trick is to fill up your unused bracket space the years your taxable income is expected to be lower than your lifetime average. This could potentially keep you under the high-bracket radar in future years. A good thing if you can pull it off.

Source: Sample Roth Conversion Plan using RightCapital

For many individuals, an opportune time to process Roth conversions starts the moment you retire and closes sometime after your RMD age (73). Typically, you’re in a lower tax bracket during this narrow time window and can process planned conversions. The impact this can have on a lifetime tax bill can be substantial. You can still convert after your RMD age, but the added income the RMD generates may limit the amounts that make sense.

Business owners and individuals who work on commission may also want to process conversions during relatively low-income years. Business losses can also be harvested by using them to offset 1099R income from a conversion. Talk about making lemonade out of lemons. Now is the time to do this planning if your income contracted in 2023.

Another prime opportunity to convert from pre-Tax to Roth crops up between ages 18 through around 40 years old. It usually makes sense to convert pre-tax IRA balances to a Roth before reaching your peak income earning years. The more time your investments have to “cook” in a Roth, the better.

Generally younger investors should be contributing to a Roth plan over a pre-tax plan, assuming they’re not banking Mr. Beast levels of income. Even so, the employer match portion of your retirement plan will be pre-tax.

When you leave your employer, which is not uncommon for career starters, make sure you consider converting the pre-tax employer match to Roth. Your employment transition may come with a temporary income gap, making it the perfect time to flip the switch.

Most tax experts predict that Federal tax rates will revert to the higher pre-2017 rates in 2026. This is when the personal tax breaks provided by the Tax Cuts and Jobs Act will sunset. If you suspect your income will be stable from now throughout retirement, make hay while the sun is shining. You have three more years, including 2023, to realize income at these lower rates.

Paying taxes is dreadful. I get it. The tax bills that come along with conversions are enough to cause acid reflux, and this prevents people from making sound long-term strategic decisions. Just keep in mind that you are never going to escape the eventuality of paying taxes on your traditional IRA investments while alive.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Individual tax and legal matters should be discussed with your tax or legal professional.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.