The American Debt Supernova

Deficits DO matter…over time.

A star will burn for billions of years before its sudden and cataclysmic end. The immense gravity of a star’s mass, which initially consists mostly of hydrogen, is enough to fuse atoms within its core. This process creates heavier and heavier elements, the fusion of which releases electrons giving the star its brilliance. This process continues until the only element the star can consistently fuse is iron. I do not understand the quantum mechanics behind why iron cannot be sustainably fused into heavier elements within a star, but that’s beyond the scope of this letter anyhow. Suffice it to say that once a star reaches this point, and if it has a large enough mass, kablooyee!

A question that comes up often is, when will the US’s debt burden be too much to sustain? The correlations between the lifecycle of a star and that of our modern monetary system are uncanny. After a chaotic birth, a star’s state is relatively steady as it burns through its hydrogen fuel source, which I would equate to the period of the gold standard. The early stage of US fiscal tranquility ended, arguably, in August of 1971 when the US defaulted on its promise to sovereign central banks that the dollar could be redeemed in gold. This effectively finished the job begun by central bankers during the Great Depression which made private ownership of gold illegal, thus ending the dollar’s tenuous peg to gold at the institutional level. Since then, the US’s fiscal policy has been fusing the atomic equivalent of helium to sustain its operation with what is now a pure fiat monetary standard. Funny enough, as a star begins to fuse helium, it inflates in size and becomes a red giant. Scientists suggest that our own sun could grow in diameter enough to engulf earth!

Just as stars burn through heavier and heavier elements to sustain themselves, so do the issuers of currency by fiat burn through ways to back their currencies. In the case with stars, the consequence is the creation of heavier elements. However, the consequences of reconstituting a currency through financial chicanery are far less constructive. These can come in the form of inflation (with all its varieties), wealth disparity, trade imbalances, incentive distortions, to outright capital destruction. What exactly backs the dollar today is ambiguous, and many debate over exactly what is behind it. I will attempt to explain my opinion here because understanding this is critical to understanding where the economic shining star of America is heading.

“And this whole system works because there exists a diverse demand for US debt.”

The dollar is backed by debt, specifically obligations of the U.S. Treasury. This sounds very counterintuitive, and it is, because how can debt be money? Well, Treasuries are considered the safest asset for storing value for a few reasons; 1) the large size of the US economy generates a massive amount of wealth that can be taxed to pay these obligations, 2) they are the most salable asset which attract buyers like a gravity well, 3) established economic contracts are denominated in dollars, anchoring Treasuries to a more stable unit of account (think mortgages, car loans and futures contracts), and 4) the US still sits on tons and tons of gold. Treasures are preferred over currency for idle funds because they generate a positive interest, whereas currency generally offers less interest or even none. Additionally, Treasuries have historically been easy to convert back into dollars when liquidity is desired and can be used as collateral to back loans. Virtually anywhere in the world, you can take a $100 bill and exchange it for a good because the recipient maintains confidence that she can exchange the $100 for something else. And this whole system works because there exists a diverse demand for US debt.

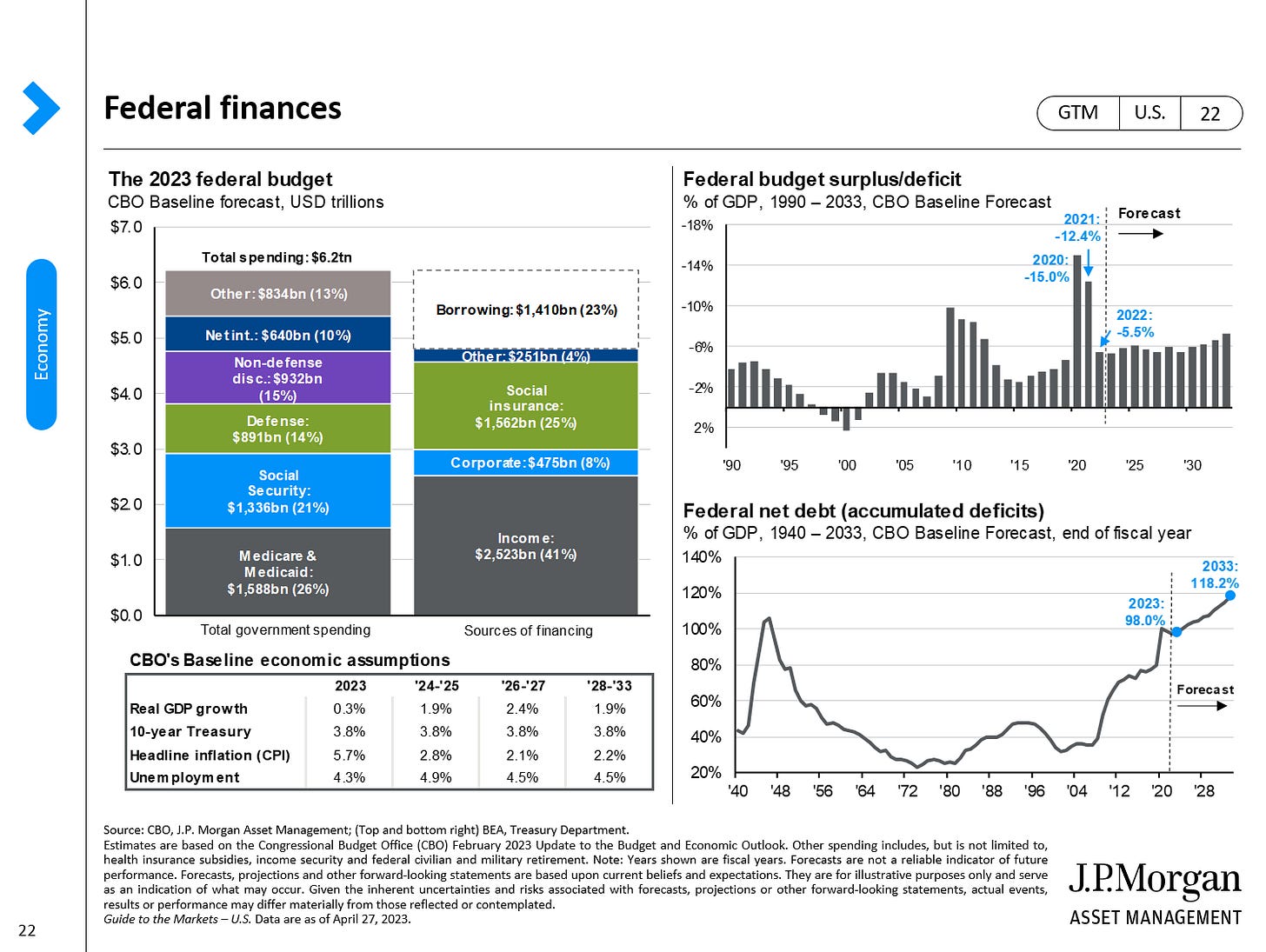

Now that we understand this, let’s get the crystal ball out of the bag and try to avoid Sauron’s gaze as we attempt to predict the future. A few years ago, I was on a conference call with JP Morgan’s Chief Market Strategist Dr. David Kelly and the question of US deficit spending came up. Dr. Kelly had a great response, “it becomes a problem when the US has a problem financing it.” In other words, when the US can no longer find willing buyers for its auctioned Treasuries, we have a solvency problem. As of today, it seems the US can’t sell its debt fast enough to willing market participants. In fact, they’re even willing to buy paper that doesn’t mature for 10 years at a rate well below the general rate of inflation! But it’s not just the presence of buyers that matters, it’s also who these buyers are. What if the buyer of the debt consists mostly of sovereign buyers, or even the Fed itself? Here’s a headscratcher, what happens if the Fed is the only buyer of US debt? Just recently the Bank of Japan became the primary buyer of Japanese government bonds to keep rates artificially low, so this isn’t just theoretical discussion anymore. My educated guess is that as the buyers of government debt become further removed from the fundamental forces of economic productivity (i.e. individuals), we will begin to see increasing levels of currency instability.

So, in the past few years have we not seen just that? Currency instability, albeit relatively minor compared to less hegemonic currencies in the form of inflation followed by unprecedented central bank intervention. US deficits and the salability of the dollar are linked, whether policy makers admit this or not. Once appetite for US Treasuries falls to near 0 and there are no more buyers other than the Fed itself, this will mark the iron stage of the American monetary star. Ironically, heavier elements, such as gold, are created in the very last moments (nano seconds) of a star’s life and only if it goes supernova. So, the analogy still works here. It is my belief that what will emerge from the inevitable debt supernova will produce a sounder monetary medium that will better promote capital accumulation, investment in human advancement, and economic productivity. What we have today, however, will be around for some time to come. I see little evidence that this “iron stage” I described above is imminent and the tight monetary policy adopted by the Fed lends additional long-term viability to the dollar, debt and all.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.