The Broker Who Cried Annuity

Annuities have become the easy punching bag for the champions of cheap investing.

“Annuity” is a word that brings out unnecessarily charged emotions where they are least useful, in major financial decisions. I’ve been party to initial consultations in which the conversation opened with something to the effect of, “if you recommend an annuity, we will be unhappy with you”.

There are also people who think the annuity as part of a financial plan is sacrosanct. Most of these people being financial professionals. Is it any wonder that the car dealership thinks very highly of their extended warranty program? The incentives seem suspiciously designed.

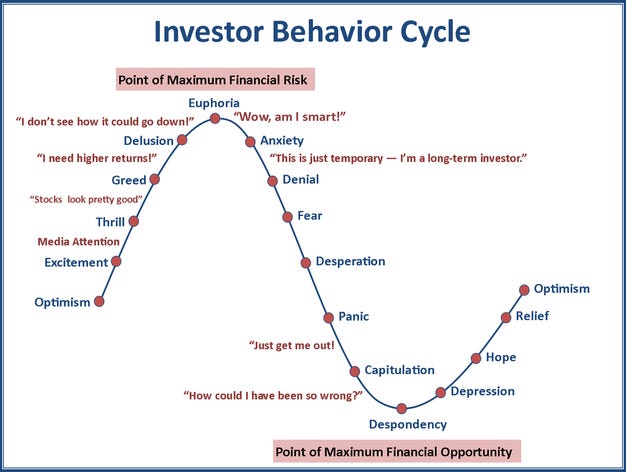

But let’s defuse our emotional response mechanism for the next five minutes and consider what an annuity is and why it exists in the first place. We typically see a pickup in annuity purchases when stock market volatility (VIX) increases, as people naturally seek more certain outcomes. Unfortunately, some investors will find themselves dissatisfied, and I’ll explain why.

First, think of an annuity as the polar opposite of life insurance. With life insurance, which is just death insurance with a better public relations manager, you pay an insurance company a module fee (premium) every year until you die. If you die while the policy is in force, the insurance company will provide your beneficiaries a lump sum. Better day for them, not so much for you.

Conversely, the annuity contract requires the insured to pay a lump sum to the insurance company upon initiation. The insurance company then proceeds to pay a regular income to the insured, also called the annuitant, until they die. Nothing gets your blood pumping like a high-stake bet between you and an insurance company on how long your life will be!

There is a myriad of different takes on this basic form of annuity contract, such as the flexible premium deferred annuity. Flexible premium means that the contract owner can pay premiums over time versus as a lump sum. Deferred means that the income start date is deferred until some point in the future, defined as the annuitization date within the contract. Most annuities today use this structure.

Then there are flexible premium deferred variable annuities, registered index linked annuities, fixed annuities, and all the migraine inducing array of available contract riders. Riders are add-on features you can elect to receive unique coverages, such as an increasing death benefit or a nursing home benefit. Like nearly every user-end agreement, there’s just too much for consumers to process.

The discerning investor, frustrated in his or her inability to find understandable information independent of the biased sales agent, just throws up their hands and agrees with the prevailing marketing mantra that cheaper is better. You know annuities are more expensive, this is clear, so that’s enough and it’s time to move on.

But all insurance is expensive when nothing happens. You want to waste money on insurance. That’s the desired outcome. Comparing a low-cost mutual fund to an annuity is like comparing a train to a car. They both function as transportation but are used for different applications. You wouldn’t take a freight train to get groceries, as flashy as that would be.

The difficulty in sourcing good information on what constitutes a “good” annuity only explains part of the story. How we make the leap from mild consternation to visceral repulsion is purely the fault of overzealous or flat-out ignorant selling agents.

The issue of contract misrepresentation is real, and I have had the unenvious privilege of dashing fairy tale dreams concocted by some sandman masquerading as a financial advisor. Most annuity contracts are complex, so we are bound to run into more cases of misuse at the margins.

So, when should an annuity be considered? That is a question that requires a nuanced answer, impossible to broadcast with precise application for all. Here are some broad planning topics where a good advisor may bring up an annuity as a possibility within a set of solutions:

1. Tax management

2. Estate planning

3. Income planning

4. Encouraging prudent investment behavior

The last one is a bit cryptic so I’ll explain. Some investors just cannot stomach the raw volatility of even a diversified mutual fund. They easily lose confidence in their investment policy and sell at the worst possible time. Some of this investor amnesia can be curtailed by certain kinds of annuities. If this is not you, then there is no problem to solve.

I generally do not advise considering an annuity contract outside of these areas.

I am not a fan of annuities any more than I am an adoring fan of surgeries. Starting a conversation with an unsolicited recommendation to go under the knife is a good way to avoid friendship. In fact, I’m not qualified to recommend surgery at any point in a conversation. However, I do know financial plans, and some are just better off with the right kind of annuity. Not all, just some.

I could write volumes on each of the planning topics herein. Putting together workable strategies people can understand and get behind is something I geek out on. For now, I’ll spare the details to those interested. Call me or shoot me a text message if you would like a deeper dive.

Call or text: 513.438.0095

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

There is no assurance that the techniques and strategies discussed are suitable for all investors or will yield positive outcomes. The purchase of certain securities may be required to effect some of the strategies. Investing involves risks including possible loss of principal.

Fixed and Variable annuities are suitable for long-term investing, such as retirement investing. Gains from tax-deferred investments are taxable as ordinary income upon withdrawal. Guarantees are based on the claims paying ability of the issuing company. Withdrawals made prior to age 59 ½ are subject to a 10% IRS penalty tax and surrender charges may apply. Variable annuities are subject to market risk and may lose value. Riders are additional guarantee options that are available to an annuity or life insurance contract holder. While some riders are part of an existing contract, many others may carry additional fees, charges and restrictions, and the policy holder should review their contract carefully before purchasing. Guarantees are based on the claims paying ability of the issuing insurance company.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.

I enjoy your weekly posts.

Math and I are sworn enemies, and this war carries over into my understanding of investing. My brain has a hard time with fully grasping how it all works.

You have a great way explaining the concepts of your topics.

Thanks and keep up the good work.