The Great Insurance Rip

The reason behind the P&C premium hikes.

Be careful when looking at your next auto & homeowners insurance bill to keep a cool head. Good drywall repairmen are hard to come by and they are not cheap. There’s an almost certain chance you will observe that things have gotten much more expensive.

As anger devolves into seething resentment and quite outrage, you will be sure to share your honest company review even when unprompted. That’s the kind of customer satisfaction a sudden and massive hike in premiums will get you.

Across the board, consumers are seeing unprecedented premium increases, even on policies they’ve maintained for years. The 2024 Home Insurance Trends and Predictions Report suggests an average rate hike of 10 – 15% year over year on homeowners’ policies. Other sources suggest even more aggressive rate hikes on automobile insurance with some estimates as high as 22% over the past 12 months.

But as they say, analysis of the averages is average analysis. While interesting to know what’s happening to homogeneous America, it means little to you. The statistic that matters is what rate adjustments were made to your policies. We don’t need to digest a research report to know you’re getting the screws.

We can forget that insurance is a for profit enterprise and the profit motive, like with all companies, is existentially important. Without it, there is no more insurance company. This is not to excuse price gouging, however.

Are we victims of price gouging? I mean, over 40% in total increases since 2020 is pretty extreme. Well, not exactly, although I’m sure there are insurance companies that have taken advantage of the situation. According to Kyle Kilburn, vice president of Moon & Adrion Insurance Agency, several factors have converged to create the current Death Star beam aimed directly at your checking account.

Most insurers did not significantly increase insurance premiums throughout 2020 and 2021.

Average claim amounts per incident have increased in inflation and incident frequency and severity.

Underwriting scrutiny has tightened substantially.

Let’s dig in a bit into the details. For the TL/DR crowd, skip to the last few paragraphs for our suggested remedies.

While it’s not your fault that insurance companies gave you too good of a deal the past couple of years, it wasn’t a viable long-term situation. It’s not uncommon to see companies underprice their services for a temporary period. Sometimes this is to stomp the competition. Other times, it’s because management underestimates the demand for all you can eat shrimp, which was now bankrupt Red Lobster’s fatal error. Eventually, economics matter and customers must foot the bill.

The average cost per claim has gone up across the board as inflation does not discriminate. It affects your insurers just as it does you. And as I said, insurance is a for profit enterprise. There are coverage caps that protect insurers from getting too far out over their skis, but claims have been inching closer to these caps and that makes the suits in the smoke-filled board rooms nervous. Houses and cars just don’t cost what they used to.

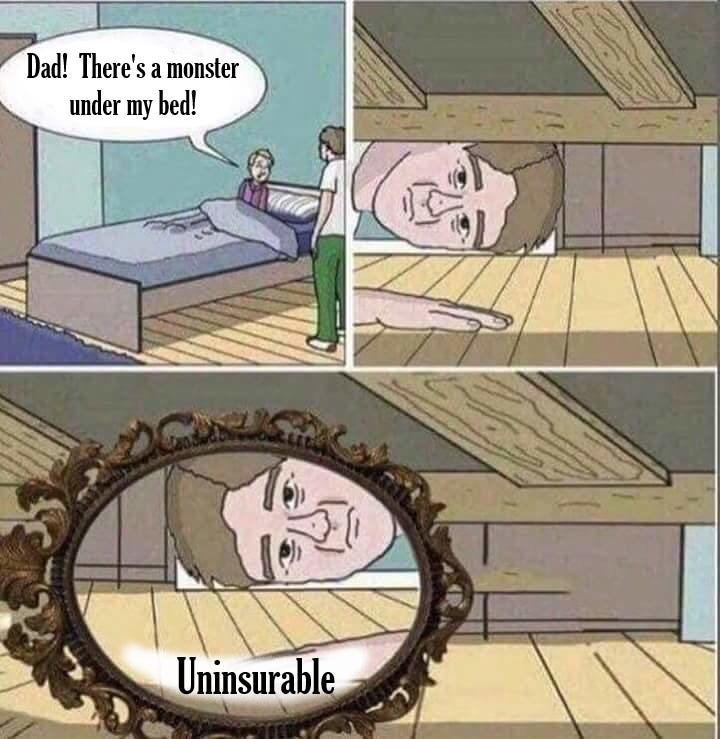

Lastly, insurance companies maintain a naughty list like Santa. Instead of coal, the undesirables get stuck with the high-risk, and therefore high-cost, insurers. Or they just go without, which is the worst option of all.

This trend is due to a variety of reasons with one of the biggest being the thing in your pocket. Our data is very accessible and very useful to entities with interests unaligned with ours. With the right amount, anyone can buy this data from our ‘trusted’ data custodians. I guess we should pay more attention to the EULAs we accept.

There’s much more to be said about the “why” but you’ll need to DYOR for more. I have readers to entertain here! Let’s dive into what we should do about it.

What to do.

If you find yourself the unwitting victim of exorbitant premium increases, a thorough policy review is the next logical step. Unfortunately, most consumers are not insurance experts and it’s easy to unknowingly cut out coverage you need for the sake of savings.

Again, Kyle comes in to provide some valuable insight. Consulting with an experienced independent agent with access to a variety of carriers can help to pinpoint the right coverage and to shop for the right insurance company. Not all are created equal.

He has found that the most competitive companies tend to be regional (Midwestern), something he accredits to more limited exposure to costal and other higher risk regions. This is not to suggest that a national insurer would be a bad fit, per se, but it is a trend he’s observed.

Next, make sure your deductibles increase at the cumulative pace of inflation. A $1,000 deductible might have been reasonable two decades ago, but it may not be so today. Increasing the deductible to retain the less catastrophic risks can reduce the premium meaningfully. It’s generally a bad idea to file small, incidental claims if you want to stay off the naughty list to keep premiums low.

Lastly, and this tip you may not like, acknowledge when your property has increased in value. Your insurance coverage should be enough to cover you in the event of a total loss. Everything is more expensive now but does your policy reflect this?

Insurance is always getting more expensive, like most things. But as comedian Chris Rock puts it, “Insurance. You got to have insurance!” Best we can do is manage our coverage and shop smart.

If you do not already have a trusted insurance agent, I’m sure Kyle with Moon & Adrion can help with both:

513.422.4504

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through National Wealth Management Group, LLC, a registered investment advisor and separate entity from LPL Financial.