The Healthcare Donut Hole

The challenge early retirees have finding good coverage options.

When referring to the healthcare “donut hole”, most minds zero in on the Medicare drug plan hole. This refers to the Part D insurance gap that appears between the coverage limit ($4,660 in 2023) and the point at which catastrophic coverage kicks in ($7,400 in out-of-pocket expenditures). While this issue is important for retirees, it is far from the number one problem plaguing the US healthcare system.

Fact is, most Americans will realize comprehensively better healthcare coverage once attaining age 65, the age of eligibility for Medicare. Assuming you can prevent popping an artery dealing with all the Medicare adverts. To say that comprehensive healthcare coverage is expensive for working age Americans is to say almost nothing at all.

Insurance premiums have skyrocketed the past two decades, surpassing the mortgage as the most expensive line item in the family budget. According to the 2021 Kaiser Family Foundation study, the average annual cost of health insurance in the US was $22,221 per year for a family of four. Keep in mind, this is just the premium cost and does not include other out of pocket expenses.

Here’s a figure that will consume your mind with infuriation, $22,221 invested for 20 years with an 8% average annual return would be $1,120,448. This doesn’t even account for an annual inflation adjustment. We all know insurance premium increases have outpaced CPI. While most would agree that it is not fun getting older, at least there’s a silver lining at age 65.

The average annual healthcare cost for retirees post age 65, according to a Fidelity national healthcare study, is $6,145 per person. Of course, this varies by individual, depending on health status and the type of care needed. Also, this figure does not include long-term care expenses, which is a whole different animal altogether.

Needless to say, it’s better to be on Medicare than the vast majority of privately available plans. That is, unless, you are fortunate enough to work for an employer with a generous group policy subsidy. I could argue that your compensation would be higher without the expensive employer sponsored healthcare coverage, so is it really as good a deal as you think? But I digress.

What happens if you do the responsible thing and save for an early retirement? Retiring prior to age 65 is substantially more difficult due to the high cost of healthcare outside of an employer subsidized plan or Medicare coverage. This is the donut hole in healthcare coverage that is most unfortunate.

Every year that health insurance premiums increase beyond the average rate of inflation, the dream of early retirement drifts more out of reach for the average saver. Would be retirees are forced into unhealthy employer-dependent relationships that make being married to Dr. Henry Jekyll seem like a walk in the park. There are patchwork solutions to the problem, even though none are ideal.

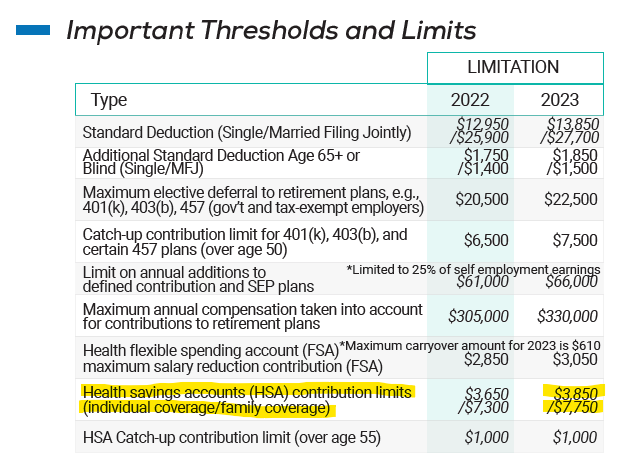

The first, and most obvious solution, is to plan early and consistently save into a Health Savings Account (HSA). An HSA is a tax qualified account available to members of high deductible healthcare plans with individual deductibles of at least $1,400 per year.

In 2023, an individual can contribute up to $3,850 per year. If you’re over 50, the IRS lets you throw in another $1,000 as a reward for your long-term citizenship. Families can contribute double this amount. HSA contributions are tax deductible, and all interest and earnings are withdrawal tax-free if used on qualified medical expenses. Now, if we could only get the government to make it so with all of our savings and investments.

This is of little consolation to those looking at the prospect of early retirement now, especially if unvoluntary. For those looking for more immediate solutions, here are several alternatives to consider.

Option 1: Seek part-time employment with an employer that offers a viable insurance plan. While you may not be officially retired in the truest sense, at least your work/life balance should improve marginally. Fortunately, the job market for part-time workers remains robust. You may have to search outside of your field of experience, even seeking a position you would otherwise be overqualified for. Eating a slice of humble pie will not lead to diabetes and may even improve your health, if consumed in moderation.

Option 2: Search for individual coverage options on healthcare.gov. While these plans have become sparse in both availability and provider acceptance, they are still viable. The government subsidy may help retract your eyes back into their sockets after the initial price tags inevitably pop them out of place. Open enrollment begins in November and ends January 15th. These plans will cover pre-existing conditions, an important detail if considering the next option.

Option 3: If healthy, you can negotiate with healthcare providers using up-front cash payments. This strategy is best coupled with supplemental alternative coverage, such as a short-term healthcare plan, a share-cost healthcare network, or even a healthcare indemnity plan. This option should not be considered for those dealing with high-cost chronic health issues. For others, this may be the ticket as paying out of pocket for healthcare directly with providers is refreshingly easy and more affordable than you would think. Next time you go in for a procedure or checkup, just ask what the cash rate would be to gauge what your costs could be.

Option 4: Get your coverage from your spouse or domestic partner. Of course, this also means you will need a partner that’s ok with you rubbing your luxurious early retirement in their face every workday. See option 1 if domestic peace is of some concern.

Of course, there are other ideas out there, but these are the ones that most people I know in this situation have found to work for them. The topic of healthcare in this country has been unnecessarily polarized and what we’ve been left with is a Frankenstein’s monster. A monster that is scientifically advanced, cumbersome, ugly, and often harmful to those that engage with it. Plan accordingly.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.