The How’s and Why’s Back-Door Roth IRAs

How to properly process a back-door Roth IRA contribution and why you would need to.

It’s that time of year again. The tax filing deadline of 04/18/2023 is fast approaching and the responsible taxpayers get to laugh at all the procrastinators caught by the local news rushing to the Post Office for the all-important current day postage time stamp. This used to be a bigger deal back in the pre-electronic filing days, but I imagine that procrastination is just as prevalent today. This happens to also be the deadline to make IRA contributions for the previous year, so I felt the topic of back-door Roth IRAs would be timely.

First, “back-door Roth” is industry slang for contributions made to a Traditional IRA (pre-tax) then converted to a Roth through a process that transfers the balance from the IRA to a Roth so that taxes are paid on the balance transferred without penalty. Since there are income caps placed on households that prohibit contributions directly to a Roth IRA, this has become a popular planning tool for high income savers. The Roth plan was a feature sponsored by late Senator William Roth as part of the Taxpayer Relief Act of 1997. Policy makers did not properly account for an obvious loophole, which is surprising given that the bill was not of the “omnibus” variety that we see today, which are generally complex and cover a massive range of issues. Here’s the loophole in a nutshell:

There are no income limits associated with contributions to a Traditional IRA. Only the tax-deductibility of these contributions are subject to income threshold elimination, not the contributions themselves.

There are no income limits on conversions from Traditional IRAs to Roth IRAs. Anybody can do it regardless of income status.

Therefore, just contribute to the IRA then convert to Roth. Easy, peasy, tax-dodge squeezy.

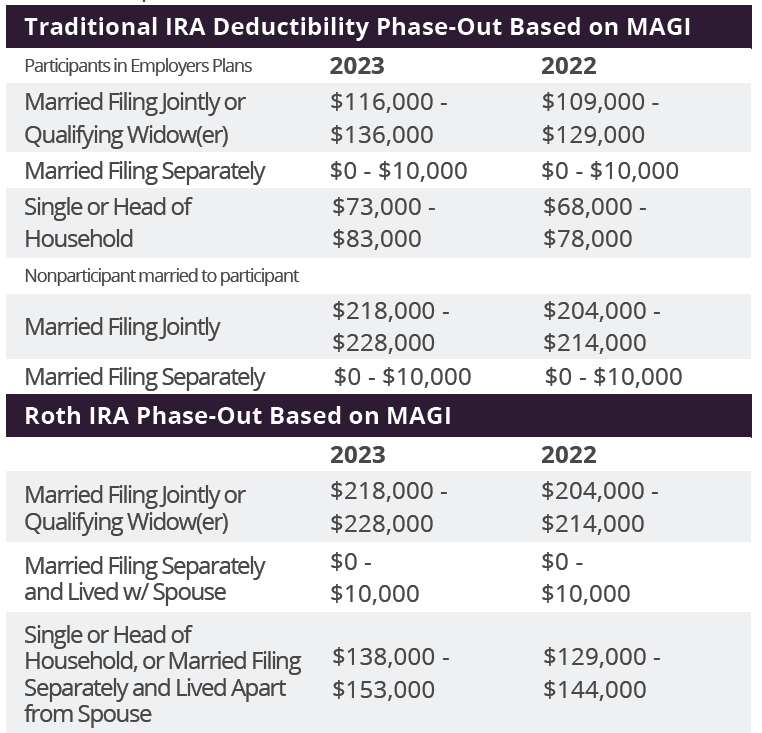

It sounds super easy, but there are additional steps and caveats that must be addressed. For example, if you make too much to contribute to a Roth IRA and you are also covered under an employer sponsored plan, then you make too much to deduct IRA contributions. You can make the contribution, but you just can’t deduct it from your taxable income. The threshold for tax deductible IRA contributions on household income is less than the threshold for Roth eligibility. In 2023, the eligibility for tax deductible IRA contributions for a married filing joint return is a MAGI (modified adjusted gross income) of $116,000. The phase-out for Roth eligibility for the same tax filing status begins at $218,000 MAGI. This leads us to:

Caveat 1: If you are covered by an employer plan and you are processing a back-door Roth contribution, make sure you are filing a Form 8606 with your return every year. Failing to do this could result in a double taxation event! This is unfortunately too common a problem and is a major area of focus when I help people with this strategy.

Source: irs.gov

Next, it is important to know that while your IRA may be divided into several accounts and investments, the IRS considers all IRAs you own to be one large IRA. What this means is that all your Roth conversions are converted from pre-tax to Roth on a pro-rata basis. In other words, your pre-tax and after-tax* IRA contributions convert to your Roth using the same ratio as your total pre-tax to after-tax total IRA allocation. Here’s an example:

Rollover IRA 1 Balance (pre-tax): $100,000

Contributory IRA Balance (after-tax): $6,000

Roth Conversion Amount: $6,000

Portion of conversion subject to taxation: $5,660.37

* After-tax IRA contributions are not the same as Roth, these are the IRA contributions that are recorded on your Form 8606.

Caveat 2: If you hold pre-tax IRA accounts outside of employer sponsored plans such as a 401(k) or 457 plan, then you could be opening yourself up to an accounting nightmare. You will need to manually track your remaining after-tax balance of your total IRA plan post conversion, indefinitely, or until your IRA is liquidated. This is VERY difficult to do without mistakes. So much so that I do not advise engaging in back-door Roth contributions unless 1) you do not have access to an employer plan, or 2) if all your pre-tax funds are held within an employer plan.

Then there is the final caveat.

Caveat 3: To keep things simple, make lump sum contributions to your IRA then convert the entire amount at the same time and in the same year. It is possible to defer the conversion step to a later date but then you would need to pay tax on any interest and earnings realized during the deferral period. Best to just avoid this altogether. This also streamlines your tax filing process through the simplified workflow, which you can count on to be the same every year. (i.e. your Form 8606 and 1099R should have the same, or very similar, dollar amount on them).

No matter your financial status, funding a Roth IRA is highly recommended. As a financial planner, I can attest that households with meaningful Roth allocations have a good deal more flexibility when it comes to post-retirement tax planning. Still, any balance held within a Roth should be helpful.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Consult with a professional tax advisor before engaging in any of the strategies discussed herein.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.