Tax Breaks for Tricky Business

Why Small Business Owners Pay Less in Taxes

One of the most common requests I get from higher income earners is advice on how they can pay less in taxes. My response to them is the following: max out your pre-tax retirement plan contributions, be generous to charities, have or adopt lots of children, and/or start a business. Like Waldo on a blank page, there are not a lot of good places for W-2 wage earners to hide from the insatiable tax collector. If your interest is maintaining sovereignty over your wealth, making pre-tax retirement plan contributions is about all you can do outside of pursuing entrepreneurship. I’m afraid having lots of children and giving to charity do not accelerate your net worth, at least not in the financial planning sense (I do not discourage either).

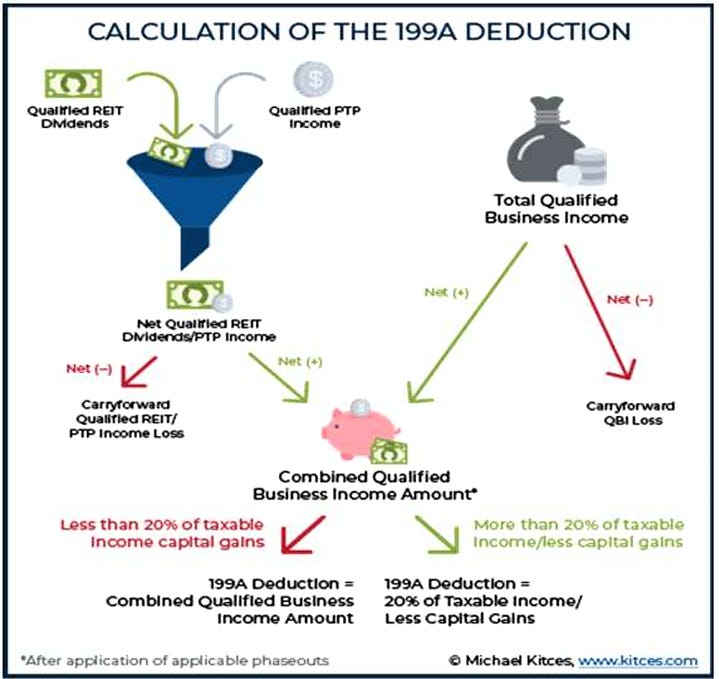

So how does your self-employed neighbor with the landscaping business keep such a low tax profile? One of the answers lies in an obscure benefit called the 199A deduction, or more specifically, the qualified business income pass-through deduction. While most focused on the sweeping changes to personal and corporate tax rates in 2017, few paid attention to what could be the largest deduction opportunity for middle class Americans ever.

The deduction calculation is complex, and I will only attempt to summarize the concept here. There are plenty of detailed articles online, but I advise seeking the advice of a qualified financial planner or tax advisor to discuss specifics in your situation. As always, I am at your disposal to discuss applications in greater detail.

Owners of sole proprietorships, LLCs, S-Corporations, partnerships, and other pass-through entities may deduct up to 20% of their Qualified Business Income or taxable income, whichever is less. Here’s the kicker, the deduction is available to “low” income earners which the IRS defines as any joint filing household making under $364,200 or single filing making under $182,100. Sometimes, it’s ok that Washington is out of touch.

Unlike most, this deduction applies on top of the standard deduction on line 13 of the IRS Form 1040, your personal return. You do not need to itemize to get it. To understand the power of this deduction, let’s consider an example.

Susan is a dentist that works for a large company, and she is paid a fixed W-2 salary of $250,000 per year. She is married, her partner is a starving artist and they do not have any children. With the standard deduction of $27,700, Susan’s household has a taxable income of $222,300, an effective Federal tax rate of 16% and a bill of $40,152.

Susan then takes a leap of faith and launches her own practice, or simply becomes a 1099 contractor. Either way, she is now self-employed. To account for the “self-employment tax”, which is the employer’s half of the FICA tax everyone pays, let’s increase Susan’s pay by 7.65% to $269,125 to offset the difference.

As a side note, I argue that no employer truly pays half of the FICA tax on behalf of the employee since they simply reduce what the employee would have been making by a commensurate amount. But I digress.

With Susan’s new situation, her taxable income drops from $222,300 as a W-2 wage earner to $187,600 as a self-employed business owner. This drops her effective Federal tax rate to 11.8% with a tax bill of $31,824, a full $8,328 less. That’s almost enough for a month of groceries at Whole Foods! Working for the man has never looked so bad.

There are numerous planning opportunities around this tax code provision alone and the scenarios are rarely as simple as above. If you are a small business owner, own rental properties, or are considering moving into a self-employment role, it’s best to have your tax advisor and financial planner coordinate on this.

Leveraging the pass-through deduction to its fullest extent can involve complex decision making that neither party can monopolize, such as whether to engage in Roth conversions or calculating how much to contribute to a self-employment retirement plan. It may even involve changing how you pay your employees. Regardless, this is not something you want to assume has been optimized for you.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Individual tax and legal matters should be discussed with your tax or legal professional.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.