The Unexpected Reason Your Advisor Owns Bitcoin

Using BTC as a case study on the value of personalized asset allocations.

A quick search this week on Grok, the latest craze in the LLM madness, yielded Bitcoin (BTC) as the most popular current financial topic. Apparently, this is what everyone is talking about and for good reason. The price of BTC has moved from its $16,459 low in November 2022 to a mouthwatering recent high of $47,927. The January 11th SEC approval of a spot price Bitcoin ETF, as predicted in my December “5 Predictions for 2024” article, is adding to the momentum.

That’s a total return of 191%! Eat your heart out NASDAQ. Wish I had a time machine. Returns like these are eye catching, especially when the broader stock market, as measured by the MSCI ACWI, has been nearly flat over the same timeframe. It begs the question, “why not?”.

The opinions for and against owning Bitcoin are polarized by politics, being more divided than the Korean DMZ. One side favoring transactional freedom, the other government oversight and scrutiny.

Proponents correctly argue that BTC is a less popular choice for illicit activity than the dollar, while critics suggest it undermines the ability for the state to encourage desired economic behaviors. Attacks range from its energy consumption to its use in illicit activities. Never mind the fact that every financial asset can be used illicitly in some way.

Suffice it to say that policy makers generally dislike BTC because it circumvents bureaucratic control points. Influence is the lifeblood of a statesman, and it must be maintained at all costs. For this reason, bitcoin will always be contentious.

But that does little to educate you on the merits of BTC as an asset class. At its core, it is not a tangible asset, but rather a ledger of recorded transactions distributed globally across a network of computers. Some are sophisticated, most not. In fact, you could run a BTC node on your laptop, if you so desired. This ledger simply records who owns what, similar to how your bank’s internal systems operate.

On the BTC ledger, there is no hiding. All transactions are publicly auditable and can be traced to IDs known as public keys. In essence, if you know who owns a public key, you know who is behind the transaction.

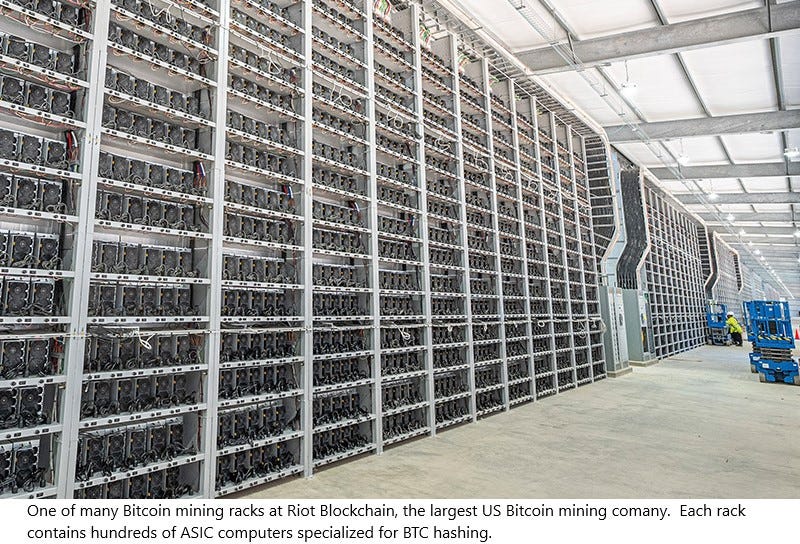

What makes the whole system work is the mining mechanism, otherwise known as hashing. Miners compete to solve a complex cryptographic puzzle, which requires specialized computers using Application-Specific Integrated Circuits (ASICs). The first to solve the problem gets to ‘mine’ the next block in the blockchain, thus earning the transaction fee and minding reward.

This is a strong incentive to keep the network up and running, which it has been doing without interruption since 2009. The process is energy intensive thus underlying the most reasonable argument against it: grid burden.

Because miners are incentivized to use the cheapest energy available, the free market mitigates most of the downside. Nonetheless, it is still there, and it adds demand to the global grid, albeit much less than the massive surge in EVs now on the road and more efficiently distributed.

Importantly, there are only 21,000,000 BTC that will exist. Ever. The network would essentially need to fail to change this crucial element of the protocol. This gives the network a unique characteristic not found in most other assets: digital scarcity. Digital scarcity combined with a healthy network size advantage and a globally distributed ledger without a central point of failure is what makes Bitcoin the current king of digital currencies.

That said, concentrated investment into BTC is pure speculation. The primary value proposition for the network is to provide a low cost and fluid way to store and transfer value. Well, you can currently do that in the dollar, and it has a longer track record with an enormous economy to back it. Not to mention a network size that dwarfs BTC like the sun dwarfs the International Space Station. Why in the world would you convert your assets to BTC?

Most do it because they are making a bet that inflationary pressure will motivate more people to convert, thus increasing the demand for each of the 21 million bitcoins and their value. Of course, bets can go south. Just ask Pete Rose. He’ll agree. Don’t gamble what you cannot afford to lose.

There is a possibility that global confidence in fiat currencies could wane, especially as deficit spending irresponsibly accelerates. In this world, consumers may prefer to store wealth in scarce assets with social utility.

Last I checked the ability to transfer value electronically is a massive utility used by most of us multiple times per day. We use this feature much more often than gold (excluding my wife’s wedding ring which she adores daily).

If you derive a portion of your income helping consumers curb the constant inflationary attrition of fiat currency, a major shift in consumer preference for Bitcoin would be a disruption to say the least. Therefore, your advisor may have an allocation in BTC to hedge this risk, albeit small, and it would be a sound financial decision made outside speculative greed.

Do not misinterpret this as a call to invest in Bitcoin. It is certainly not that. Rather, I stress that you align your portfolio to shore up risks that have the potential to devastate your finances. Another obvious example of this would be to not have all your retirement funds invested in the company stock of your employer, or even the sector of your employer. Enron anyone?

Sometimes, this can lead to unconventional allocations. As always, only invest in what you understand. For this reason, a good financial educator can broaden your scope of competent investing.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

There is no assurance that the techniques and strategies discussed are suitable for all investors or will yield positive outcomes. The purchase of certain securities may be required to effect some of the strategies. Investing involves risks including possible loss of principal.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.