This Year in The Markets

A snapshot of where markets have moved in 2023.

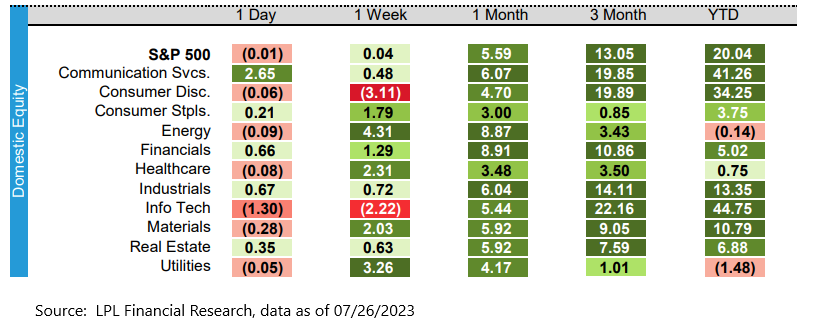

Now that we’re nearly through the first month of the second half of 2023 and the three major US indexes (S&P 500, DOW & NASDAQ) are approaching the all-time-high watermarks of early 2022, it’s interesting to inspect the rally with greater fidelity. Looking back, it seems obvious that a rally was imminent given just how depressed consumer sentiment seemed to be despite the thriving retail environment. Often, the contrarian position is the correct one. The S&P 500 year to date total return of 20% proves to be no exception.

NOTE: Meta (Facebook) and Alphabet (Google) are considered Communication Services. Amazon is considered Consumer Discretionary.

It is very easy to fall into hubris when conducting historical analysis because all the hard work of collapsing uncertainty into reality has been done. Hindsight may not be 20/20, but it certainly doesn’t need lasik. One can be forgiven for falling into the vortex of doom spun up by the inflation frenzy of last year. After all, eggs were getting hard to come by making celebration cake became a palpable uncertainty.

But to call this a rally would be like calling a jumbo jet landing with one functioning engine a “safe landing”. Yes, the S&P 500 is approaching its all-time high of 4,793 reached in January of 2022 but with only a handful of companies providing the thrust. If it were not for the “Magnificent 7”, which are Apple, Amazon, Alphabet, Meta, Microsoft, NVDIA and Tesla, the index would only be up a mere 4% so far this year. This reality is also reflected in the DOW, an index of only 30 components containing just two of the Magnificent 7 names, Apple and Microsoft, which is up only 6.5% YTD by comparison.

The rally has been robust only for those fortunate enough to be concentrated in those seven Juggernauts of American technology, which includes the S&P 500 index with nearly a 30% weighting. Diversified investors have continued to shake their fists at the sky cursing their portfolio allocations as abominations of prudent capital deployment, especially the ones who dared to have exposure to small cap or emerging market equities. No one likes to be left behind.

But, as I said, it’s easy to fall into hubris when analyzing history. Narrow performance leadership creates a fragile staging position should economic conditions deteriorate. This may or may not prove to be a problem, but it does increase the overall risk profile of the market right now. When looking up details on the Magnificent 7 stocks, I came across this little ditty, “Cramer says to stick with his ‘Magnificent Seven’ tech stocks…”. Oh boy, I wasn’t all that worried about a sell-off but endorsements like this could signal peak optimism.

investing entails greater risks, and prudent planning attempts to minimize unnecessary risk. In fact, even NASDAQ acknowledged this on Monday with a rare special rebalance of the NASDAQ 100 index, which reduced its top 7 names from 56% of the index to 44%.

While the future of the markets is a far more impactful topic than the past, it’s ultimately unknowable. While I remain confident that equity investing will be a viable long-term strategy for building wealth, I wouldn’t be surprised to find out several months from now that this rally was too much too soon. Until then, we will gaze into the shifty crystal ball like awkward wizards.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

There is no assurance that the techniques and strategies discussed are suitable for all investors or will yield positive outcomes. The purchase of certain securities may be required to effect some of the strategies. Investing involves risks including possible loss of principal.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.