Trick or Treat - What’s Next for Stocks

Scary stock valuations dampen optimism

“Do I buy Treasuries when the government owes $38 trillion, corporate bonds with spreads at 20-year lows, stocks trading on a 40x CAPE, or gold that’s just gone vertical? Tricky.”

Michel Hartnett, Bank of America Chief Investment Officer, writes in an October note to investors. Mr. Hartnett isn’t the only one spooked by frothy markets and the prospect of making a catastrophically wrong investment allocation.

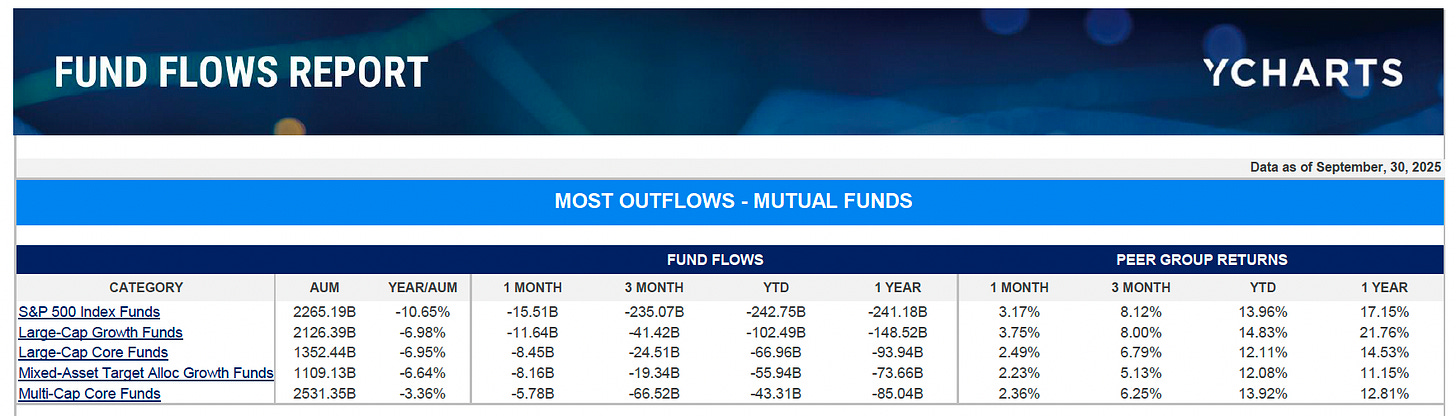

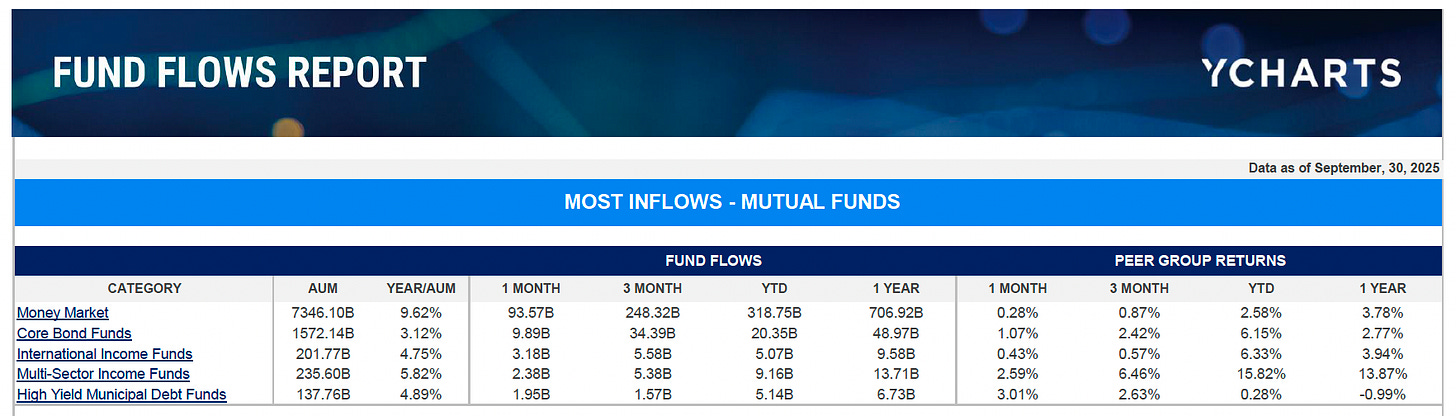

Those old enough to remember 00’ – 03’ and 08’ – 09’ know that slashers aren’t just a movie genre. In the September Y Charts Fund Flows report, investors are hungry for stability as money market and bond funds draw in $357B year-to date to absorb some of the -$510B in equity fund outflows.

Mutual fund investing is the territory of the retail investor, specifically within retirement plans such as 401(k)s. The numbers imply main street America is bracing for impact. This jives with many of the conversations I’ve been having, usually coupled with the question: “should I buy gold?”. More on that later.

Every Halloween we roll out the macabre décor and flirt with horror to entertain that primal side that is fascinated by terror. It may keep us sharp, but it can also camouflage opportunity. It’s important to look through the temporary facades to see reality for what it is.

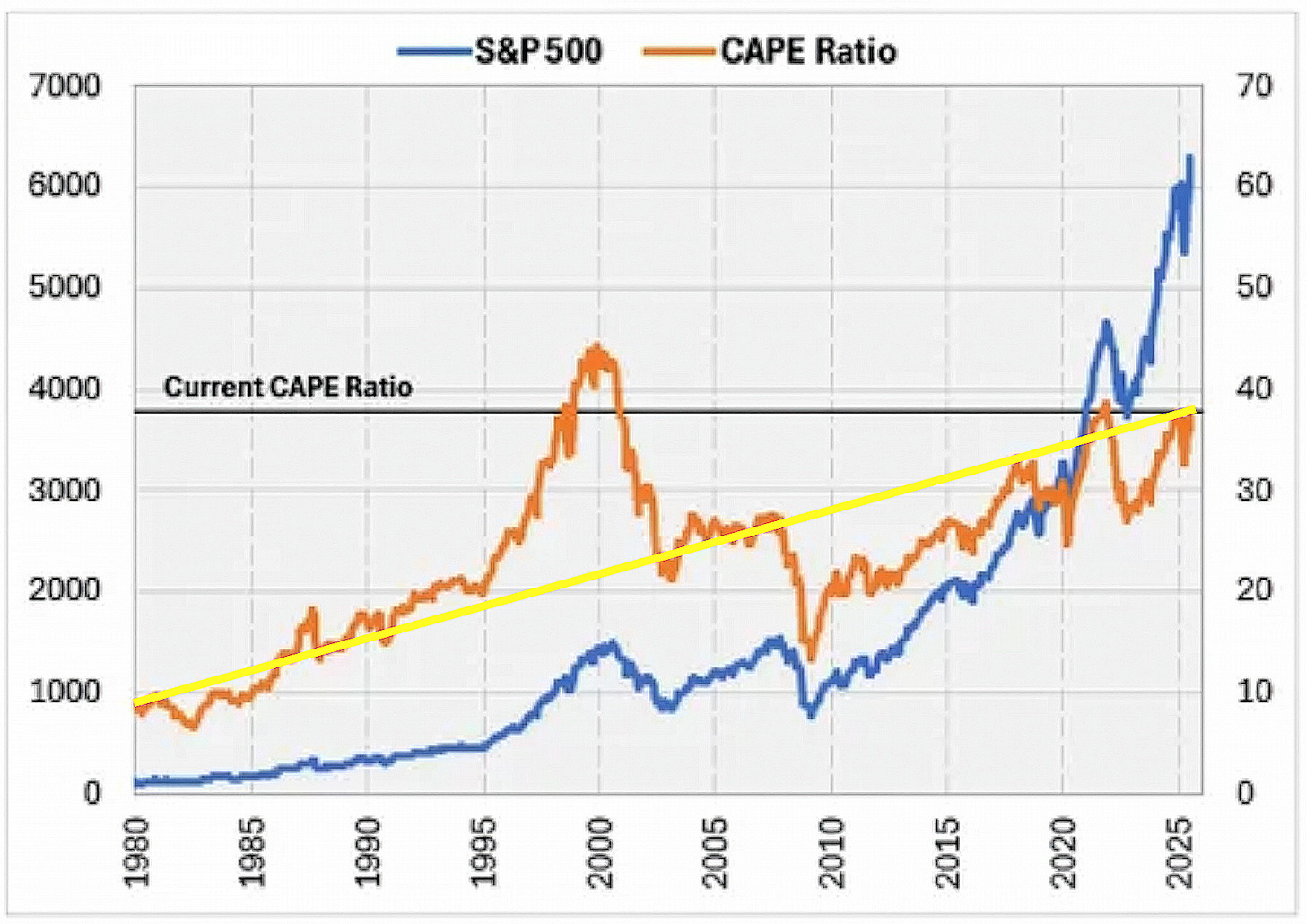

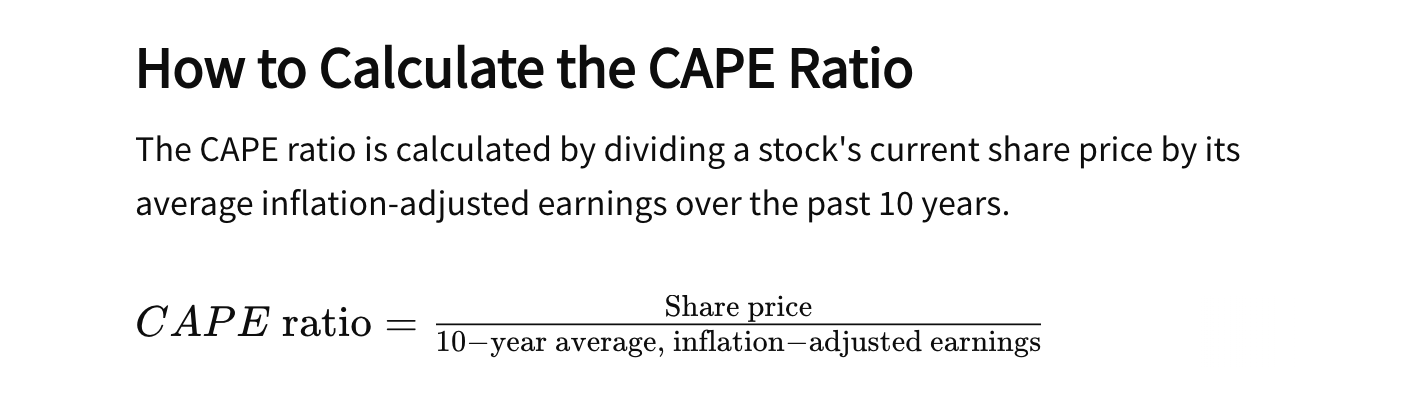

One of the scary masks used today to dissuade equity investors is the CAPE ratio (Shiller PE ratio), which currently sits at a near historic high of 40. CAPE ratios above 30 have traditionally implied that stocks are too expensive and should therefore be curtailed. The long-term average for the U.S. stock market is around 16 – 17.

Frightening indeed. But the devil is in the details. An important variable for calculating the CAPE ratio is inflation. Can you guess what measure is commonly used? That’s right, the Consumer Price Index (CPI). The same index that completely ignores asset price inflation, favoring manipulated goods and service cost inputs instead.

Financial assets, such as equities, play a critical role in the economy as we rely on them to store wealth and finance major objectives such as education and retirement. It is difficult for households to function without them. So why are they not included in the CPI?

While I cannot answer that question, I can offer one partial argument why CAPE ratios have been drifting higher over the past four decades: incomplete inflation assumptions. Narrowly defining it as CPI artificially discounts inflation-adjusted earnings, resulting in a higher calculated number.

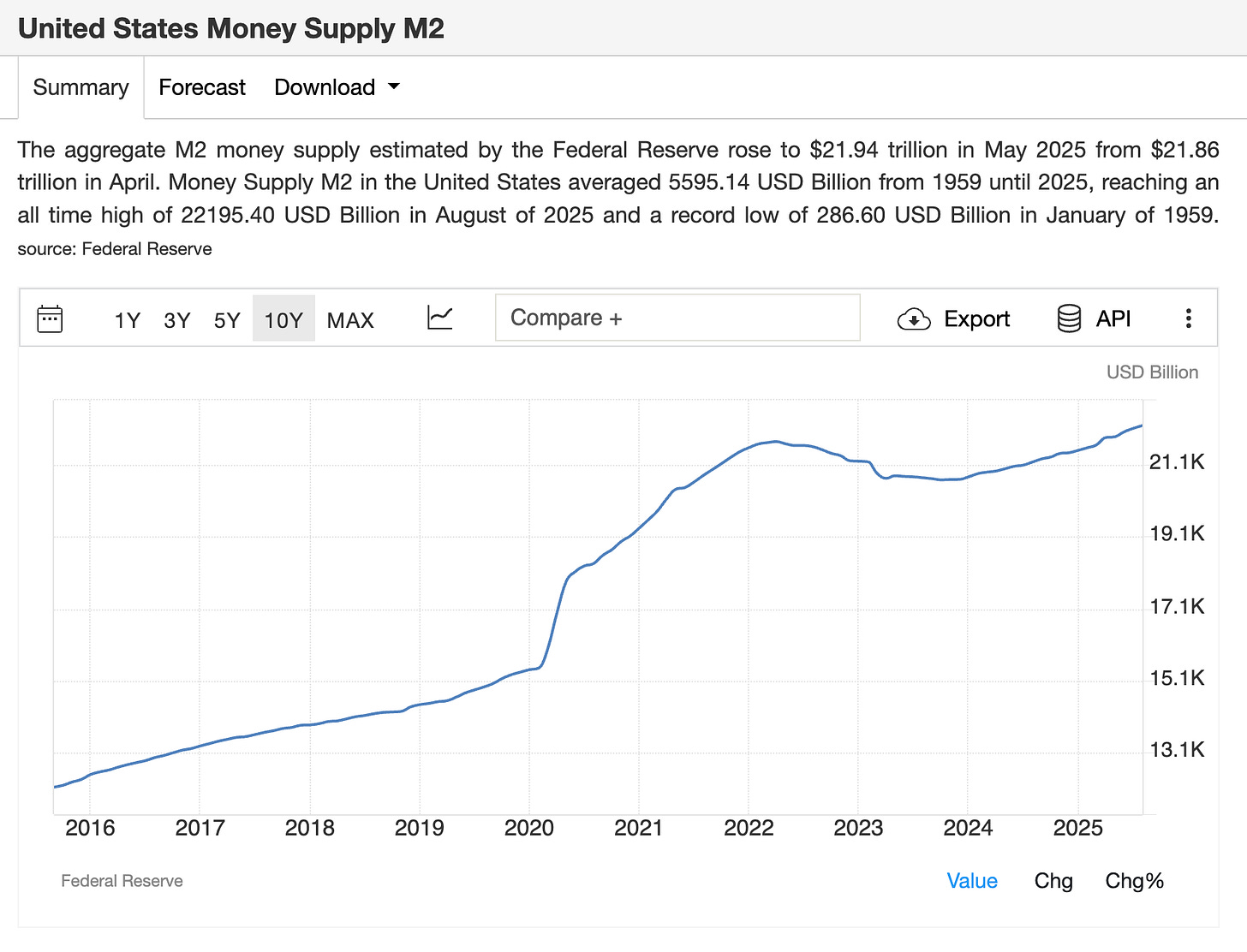

If instead of using CPI (3.1% as of the most recent reading) let’s use 7% to factor the more comprehensive cost of the American Dream. This is not unreasonable considering the US M2 money supply has grown from $12,195B to $22,195B this past decade, a compound growth rate of 6.17%. This would give us a CAPE ratio of around 28 on the S&P 500 vs 40.

Hardly a cheap market, relatively speaking, but let’s consider the context. The top 9 constituents of the S&P 500 are technology companies investing massively in AI, a major cost drag. These nine companies represent 37% of the index. Like it or not, AI is a game changer and America’s best companies are making informed decisions to allocate capital to develop it further.

Alternative assets, such as gold, have historically preserved purchasing power but with major short-term price movements. The driving force behind much of the recent runup in gold is central bank demand followed by a retail investor fueled by FOMO.

The long-term case remains as solid as fiat currencies can be diluted. However, it wouldn’t surprise me to see imminent price disruptions as trade and monetary policy politics play out at the global scale. I certainly wouldn’t feel great about subjecting my sailboat to the winds of that sea. Spanish galleons have sunk in calmer waters.

I view the flight to gold as being reactionary and discourage concentrated trades into the asset. Instead, investors with at least a five-year view should maintain an optimistic stance towards equities and maintain allocations sensible for their liquidity needs.

Dare I suggest we will have a positive 2026? I cannot say but my optimism is high. Despite all the scares, more treats are distributed on Halloween than tricks. Treats are only given to those that knock at the door.

Investment advice offered through National Wealth Management Group, LLC.

The information presented in this article is for educational and informational purposes only and is not intended as a recommendation or specific investment advice. All investments carry risks, including the potential loss of principal.

Past performance is not indicative of future results. Investors should consult with a qualified financial advisor to determine the suitability of any investment strategy based on their individual financial situation, goals, and risk tolerance.

National Wealth Management Group, LLC does not guarantee the accuracy or completeness of the information provided, and opinions expressed are subject to change without notice.