Wall Street Discovers Anti-Gravity

Deficit spending is a precursor to financial asset inflation.

What goes up must come down. This phrase succinctly summarizes Newton’s law of gravity without all the mathematical jargon. Anyone who carelessly spits straight up into the air knows firsthand the consequences of ignoring this fundamental truth.

Confidence in human ingenuity abounds these days and some have convinced themselves that maybe, just maybe, gravity can be discounted as a historical inconvenience. The most direct manifestation of this exuberance evident in the aspirations of some of the wealthiest individuals in the world.

Content with their terrestrial financial conquests, they look to the moon and say to themselves, “why stop there?” It seems this sentiment is contagious because this is the same question bouncing around in the minds of large-cap tech perma-bull investors. Their mantra: to the moon and beyond!

In financial markets, the equivalent to the law of gravity is reversion to the mean. Gravity is the merciless force that compresses our matter into a singular point. It is a constant reminder that cloud-9 level dreams can only be temporary and you must eventually return to terra firma, sometimes with fatal effect. Revision to the mean is its equally prejudiced cousin.

As valuations expand into unprecedented territories, investors are reminded of the tech bubble in 2000 and search for reasons why this time is different to justify over-extended positions. Like a dog chasing the car, the returns are just too good to ignore. Confirmation bias must be satisfied!

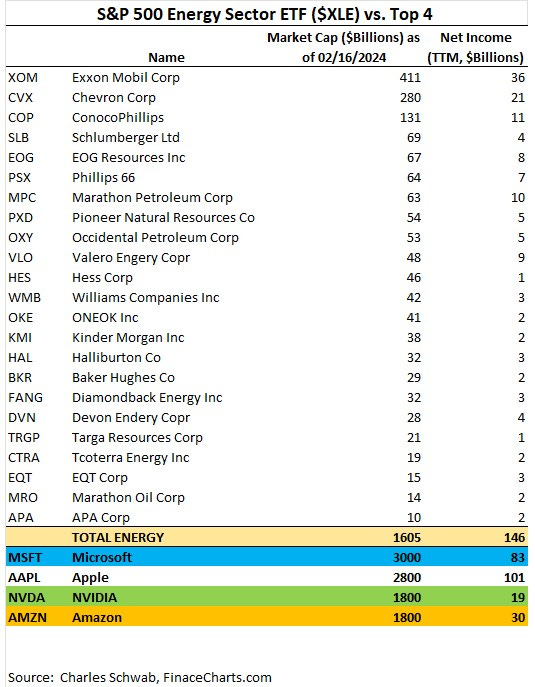

To give you a reference point for just how optimistically priced large-cap technology stocks are, each of the top four names in the S&P 500, Microsoft, Apple and NVDIA and Amazon, are individually larger than the entire US energy sector combined.

It’s a notable observation since all four tech names draw in less net income than the comparison. It should be noted, however, that not all earnings are treated equally. The market favors companies that demonstrate greater earnings growth potential through higher multiples. Energy, arguably, is a disrupted sector at the moment whereas tech is seemingly limitless in its growth potential.

I’m afraid that eventually a reversion to the mean will occur, which is only a problem if you’re not diversified. However, hidden in the runup in Large-Cap tech stocks we find some interesting observations that could mean these lofty valuations are not as unreasonable as historical average comparison suggests.

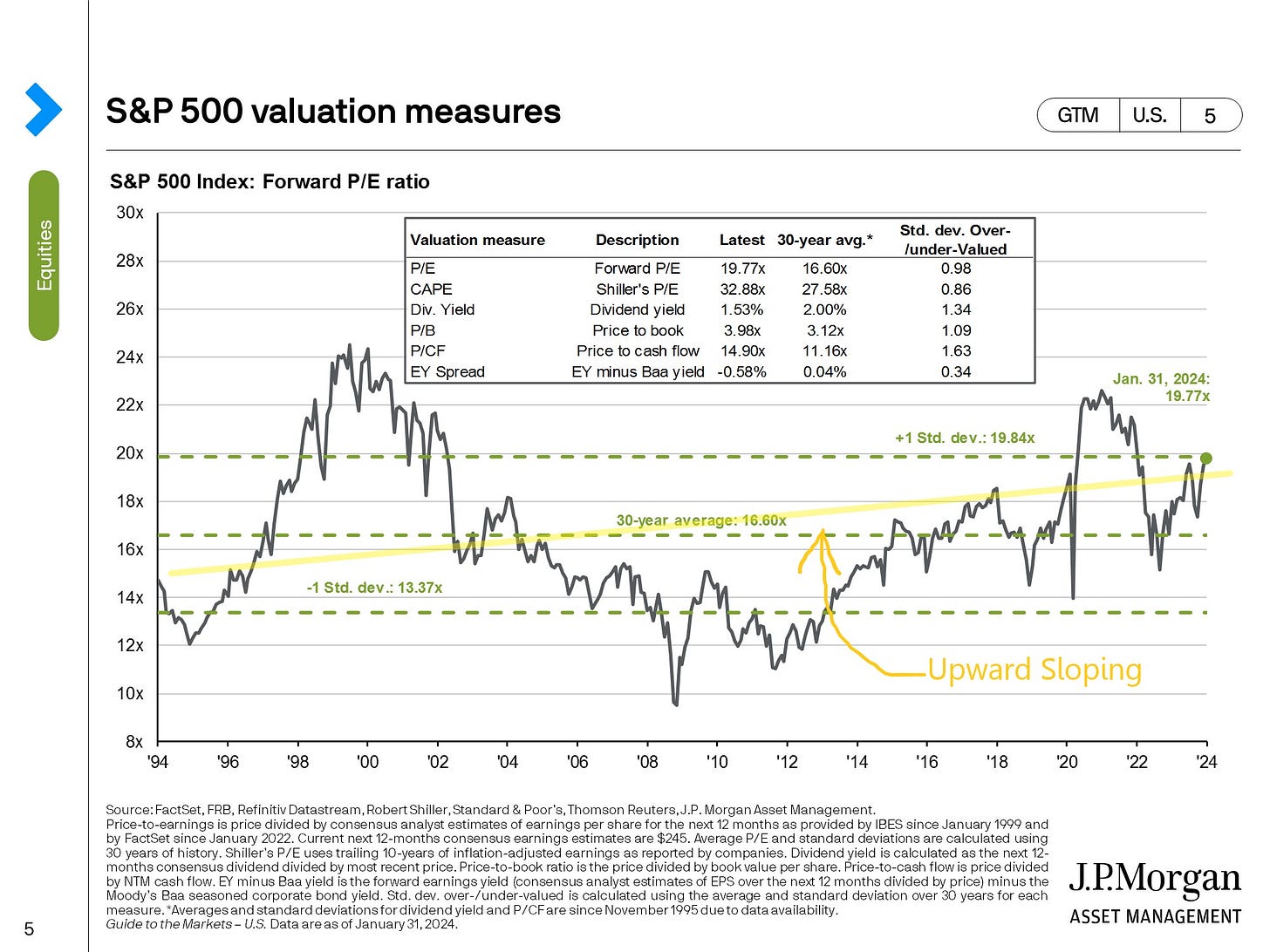

It’s not just the large tech names that are riding the frothy wave of abundant valuations. We have witnessed a general inflation in valuations over time writ large, as measured by Price to Earnings rations across the S&P 500.

Once accounting for the dot com anomaly, the trendline becomes rather clear. What this suggests is that there has been a general increase in appetite for stocks over the past 30 years.

Don’t get me wrong, earnings still matter in the eyes of investors, however we now see a premium placed on quality stocks relative to alternatives independent of earnings. I believe this to be a function of scarcity. The Fed can create unlimited quantities of dollars but shares of companies aren’t as easy to duplicate. The market will account for the dilution relatively quickly, which discourages the act.

Now, let’s add a layer of analysis to this observation, government spending. Take a step back and look at who benefits most from US Federal spending. While all citizens benefit from spending programs to varying degrees, institutions and wealthy individuals benefit the most simply by way of having a greater share of economic participation.

I’ve highlighted the programs for which most US citizens are not the direct beneficiaries. The one spending program specifically designed to pay citizens directly is Social Security. Social Security makes payments indiscriminate of wealth. In fact, the more money you make, and pay Social Security tax on, the greater your benefit.

Take National Defense spending for example. Who exactly is Uncle Sam writing the checks to? Mostly military contractors. Who owns the military contractors? Probably not your Starbucks barista. While some of this spending is directed toward compensation for rank-and-file workers, the majority of the spending benefits corporate shareholders and decision makers.

Some of this spending must terminate somewhere and at some point. And just like all roads lead to Rome, the destination for most spending is some form of savings or investment. Given wealthier individuals are much more likely to save a greater portion of their income, it stands to reason a good portion of this finds its way into financial assets.

Deficit spending, especially those enabled by QE programs, injects additional dollars into the national coffers at a higher velocity. And we know what happens next: massive checks are written and cashed before the ink dries. It also creates government bonds that generate interest that directly benefit, you guessed it, the bondholders who are predominantly wealthy individuals and institutions.

You must wonder, doesn’t this cause inflation? Well, yes, yes it does. Inflation isn’t just too many dollars chasing after too few goods, it’s too many dollars chasing after everything. This includes goods, services and scarce financial assets. So, we can conclude that deficit spending diverts inflation into financial assets.

There are only so many yachts the wealthy can buy before it becomes blasé. Perhaps it even gets so boring to accumulate financial assets that at some point, you begin to think that Mars looks like a good location for a 25th home.

If this situation persists, I believe we will continue to see a push higher and higher in justifiable valuations. It could even be the driver behind sustained growth in commodity and digital asset prices. This is just a theory, of course, so fundamental analysis should still apply to all your investment decisions.

In the end, the Piper must be paid and revision to the mean is inevitable. Gravity wins every argument where matter is applied. What this means in the grand scheme is what many in the money business debate, including myself.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

There is no assurance that the techniques and strategies discussed are suitable for all investors or will yield positive outcomes. The purchase of certain securities may be required to effect some of the strategies. Investing involves risks including possible loss of principal.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.