What a 10% Average Return Feels Like

How lumpy market returns do not match expectations.

Much has been said on the importance of staying the course when markets get rough. We’ve all heard the sage advice from legendary investors such as “buy low, sell high” or “it’s about time in the markets, not timing the markets”. Both statements imply a requirement to disconnect emotion from pragmatic investing. Unless you are a descendant of Robocop with unusual levels of emotional control, it is difficult to severe your money from feeling. It is an aspirational goal, for sure, but let’s not set the expectation that volatility does not matter. It does, and it affects your quality of life. In fact, it seems to be something we all fundamentally understand at the subconscious level: large swings in value equal bad. Why is this? Well, let’s think about what your money is for a second. As the saying goes, ‘time is money’, but this is only a half truth. Not all time equals money. For example, does the time you sit on your couch binge watching Netflix equal money? It is for Netflix but that’s beside the point. Only your productive time equals money. Every bit of wealth you own is because either you or your benefactor was productive and stored this productivity across time within an asset that you now own. Money isn’t just time; it represents sacrificial time. And the more you sacrifice to earn money, the more emotionally entwined you are in its preservation.

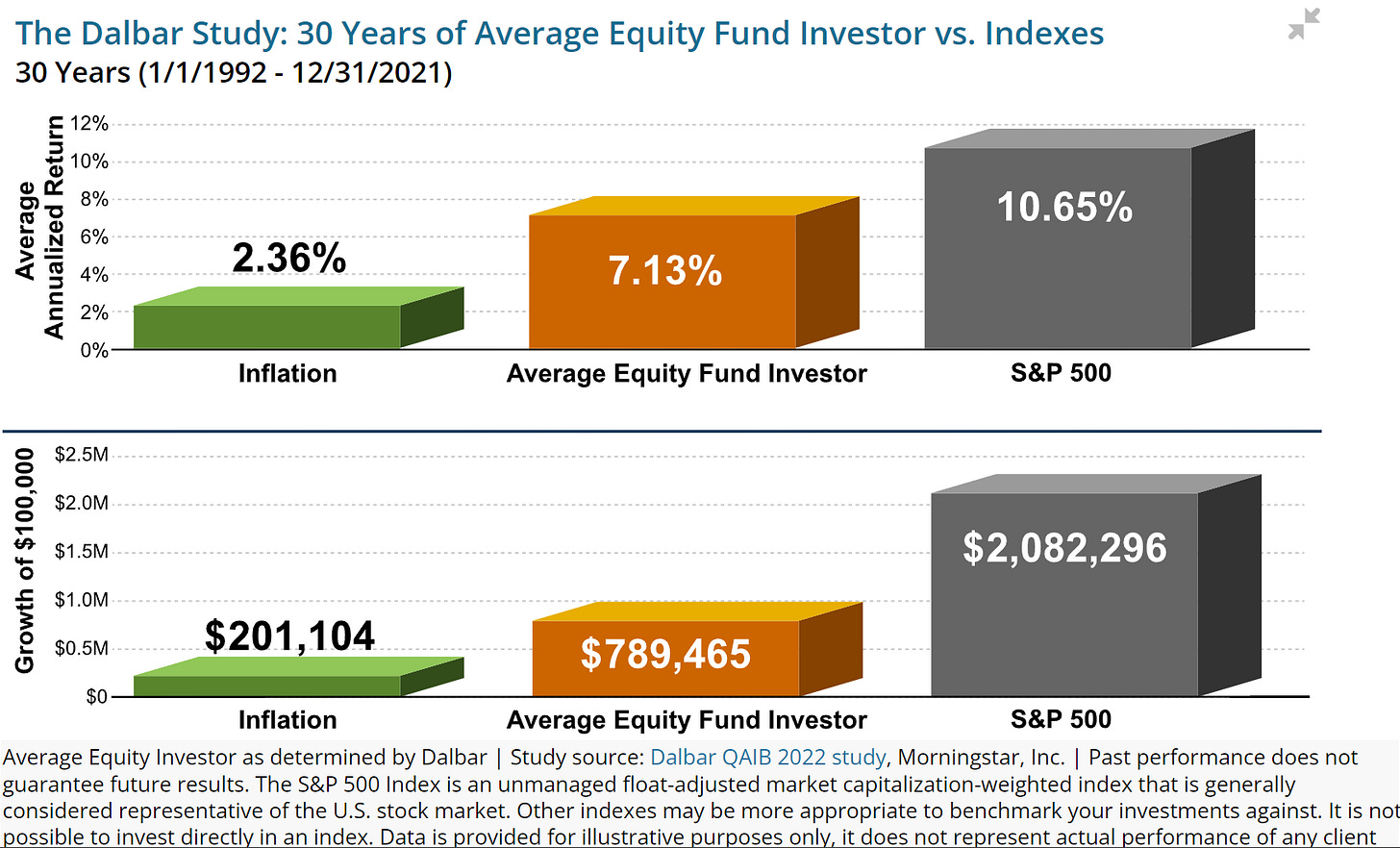

It is true that the stock market has delivered outsized returns relative to more stable investments such as cash or bonds over the past decades. In fact, over the past 30 years, the S&P 500 has delivered an average compounded return of 10.7% per year. Some may read this and feel left out because this does not feel like their experience, and they would probably be correct! According to the 2022 QAIB study conducted by Dalbar, they found that the average retail equity investor has only seen an annualized return of 7.13% over the same time period. Furthermore, time frames matter. The average return of the S&P 500 from calendar year 2000 through the end of 2009 was negative, albeit slightly. That is a full ten years of negative return. Just think about how difficult it would be to “stay the course” for ten years with nothing to show for it. However, the following ten years from 2010 through the end of 2019, the S&P 500 delivered an astounding total return of more than 250%! Talk about from zero to hero.

It's no wonder we see so many financial commentators suggest that all an investor needs to do is buy an S&P 500 index fund and call it a day. Only if it were so simple. Let’s investigate why it isn’t. Here’s what peak to trough value swings would have felt like in the S&P 500 from the beginning of 2016 through the end of 2020 with a $500,000 portfolio:

· You lose -$60,000 and now you have $440,000

· You gain +$242,000 and now have $682,000

· You lose -$68,200 and now have $613,800

· You gain +$85,932 and now have $699,732

· You lose -$139,946 and now have $559,786

· You gain +$223,914 and now have $783,700

· You lose -$266,458 and now have $517,242

· You gain + $351,725 and now have $868,967

From beginning to end, this period represents an average compounded return of more than 11%. My guess is that anyone employing this strategy certainly would not have felt like a successful investor in 2020 when their portfolio value was only $17,242 higher than the original investment. In less than twelve months, however, they experience an all-time high!

This level of volatility is unsettling for most people and it’s easy to see why. Your money represents your productive energy and nobody likes to see their life’s work evaporate into meaningless oblivion. It’s akin to the curse of Sisyphus being forced for eternity to push a rock up a hill only to see it fall back into the valley, endlessly. We like to see regular progress because it provides positive feedback that we are employing our efforts appropriately. The frequency requirement for this positive feedback is different for everyone and this is what most financial advisors are trying to get at with their tedious risk tolerance questionnaires. Sticking with the Greek theme, the aphorism “Know Thyself” is apropos here. Successful wealth building means you must understand your positive feedback need. Can you spin in the mud long enough to break lose or do you fear the Sisyphean trap too much to wait? If you do not know this answer then you should find a trusted advisor that can help you find it. Certainly, understand this before investing in any stock fund and calling it a day.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.