Why Inflation Exists

Understanding the core causes of inflation and its varieties.

The subject of inflation has been all over the headlines the past few years, even though it really didn’t need to be. It doesn’t take the skills of an investigative journalist to discover that your money has been finding bigger and bigger holes in your pocket to escape from. Nearly every consumer good and service has either gone up in price (inflation) or has had a reduction in consumer value (shrinkflation) for as long as you have been alive. This effect has accelerated in recent years but few of us understand why this is. The simple answer is, “well, this is just the way it is, and it’s always been this way”, which is true but lacking edification. Some may suggest it’s caused by governments ‘printing’ money. Close but incomplete. The truth is more complex but not impossible to pinpoint.

Many companies cut service quality to stabilize costs to the consumer.

First, let’s define inflation. Simply put, it’s the effect that describes the reduction in user-end value through a deterioration of purchasing power. A contemporary explanation that I find to be somewhat accurate is “too many dollars chasing after too few goods.” This explanation isn’t complete because inflation isn’t exclusive to dollar-driven markets. Inflation is caused by mismatches between supply and demand. For example, let’s suggest that Congress decides to issue direct payments of $10,000 to taxpayers just because. After all, does Congress need a reason? This directly increases consumer wealth, which encourages additional spending. However, nothing is done to increase the supply of goods and services to meet this additional demand. The end result is that prices will systemically move higher as free markets match consumers with goods and services according to idiosyncratic values. This version of inflation is caused by one thing: currency debasement. I like to call this artificially induced inflation. For currency debasement to affect inflation, it needs to be counted in the pockets of consumers. This is why the quantitative easing (QE) programs conducted by the Fed did not spur inflation, because non-consuming financial institutions were simply swapping balance sheet assets to enhance liquidity. In other words, JPMorgan Bank didn’t need to order an espresso maker for its kitchen.

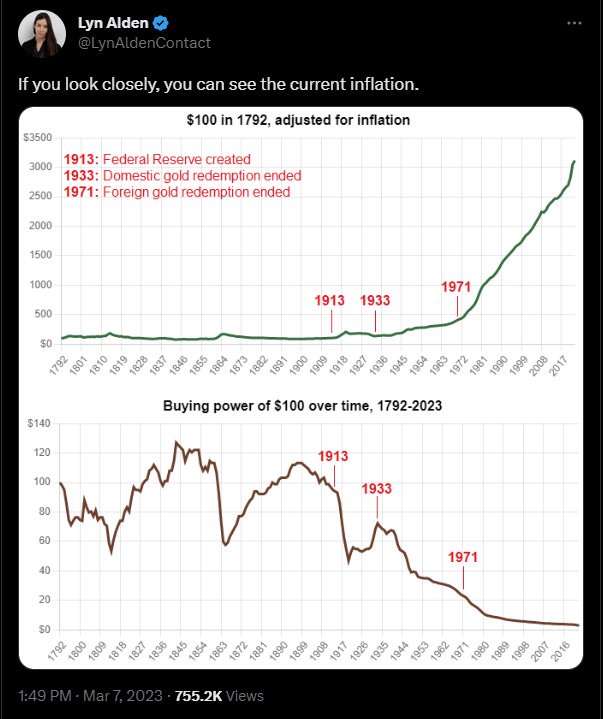

ABOVE: Lynn Alden points out the correlation between currency creation and the declining value the dollar over time. The gold standard put physical limitations on how many dollars could be arbitrarily created.

As eluded above, supply side factors also weigh in on inflation. It is entirely possible for monetary authorities to print indiscriminate amounts of money and for there to be no inflation, even deflation. This would require that the quantity of goods and services desired to fall in scarcity by a corresponding amount. Increasing the supply and availability of goods and services is far more difficult than ‘printing’ fiat currency. It requires work on a societal scale and appropriate incentive structures, which are natural functions of a working economy. For this reason, we tend to see the availability of supply lagging behind artificial causes of inflation (i.e. currency debasement). This became painfully clear to anyone with eyes during the COVID-19 lockdowns. Do you remember the fights in supermarkets over toilet paper? That was pure American insanity triggered by cost-push inflation. Simply put, prices move higher as the available supply of goods and services increase in scarcity. It’s the reason why not all of us fly private chartered flights to Tahiti every year.

There are also terms such as stagflation, disinflation, and deflation that need to be explained. Stagflation is inflation coupled with declining wages and/or demand. This is a rare phenomenon, but it can happen for a multitude of reasons which would be a topic for another newsletter. Disinflation is a phrase recently used by government officials, such as Jerome Powell, to explain a slowdown in inflation. Deflation is the opposite of inflation. This is what we regularly experience thanks to technological innovation. Did you know that in 1975, IBM was selling its 5110 ‘microcomputers’ for as high as $18,000? That $1,200 iPhone price doesn’t look so bad by comparison.

The true nature of inflation is incredibly complex, involving nearly every variable that makes up our global economy. It is impossible to point at one thing and say, “Aha! There’s the problem.” So long as we have changes in monetary policy, population, productivity, and technical efficiency, we will have mismatches between supply and demand that will cause price fluctuations. Store your wealth accordingly because this phenomenon isn’t going away.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.