You Are Getting Hacked

Poor cyber hygiene can cost you thousands.

While we’ve figured out many of the essential archaic problems, modern humans are encumbered by a greater variety of stressors than our ancestors. Pollution, contaminates, overcrowding, financial uncertainty, career obsolescence, scaled military conflict, and follower counts, just to name a few.

Cyber security muscled its way onto the lengthy list sometime in the 90s. As modern and complex threat, most of us our woefully under evolved to address it with a modicum of competence. In some ways, we are better equipped to deal with saber tooth tigers. How we pine for the days when a sharp stick was the apex of threat protection.

But here we are, as you read this on your digital device connected to the same internet as countless bad actors targeting the naivest among us. The primitive thing to do is to plug your computer into the wall and ignore what cannot be seen. There are no cave paintings of humans fighting viruses.

Every year, and at an increasing rate, advisors are intervening in situations that no financial planning software has ever forecasted. In one case that occurred this past week, an advisor affiliated with our firm discovered his client was the unwitting target of an elaborate scam.

It all started when his client received a phone call from an alleged Microsoft security analyst. For the uninformed, know that Microsoft will never call you unsolicited. It’s near impossible to make in inbound call to anyone at Microsoft when you want to.

The scammer impersonating a Microsoft official warned the victim that their PC was filled with all kinds of nasty files, including evidence of human trafficking. At some point, an email was sent by the scammer with a link, which the client clicked under the impression it was valid.

The malware installed through the link provided the fraudster with ample information to expand the deceit. It now involved fabricated calls from financial institutions and government agencies. The flood of fake validation overwhelmed the victim’s logic function, so the only thing they could reason was to follow the advice of the perpetrator.

To protect their capital, the client was instructed to transfer funds by wire to “safe” accounts where the money would not be confiscated in the event legal authorities found out about the legally compromising files on the computer. As you can guess, the “safe” accounts were black holes, funneling the money to the dark abyss of criminal enterprise.

The injured party suffered a 5-figure loss until the advisor short-circuited the hack. Unfortunately, he did not have discretion to oversee the client’s local bank accounts, which were the first to be accessed.

This is just one of millions of cases that fly under our radars every year. Partly because victims are embarrassed to talk about it. Things seem humiliatingly clear in hindsight. “I’m such an idiot!”, is an introspection. Easy to say when not in an emotionally compromised

Mostly, we ignore risks that go unseen just as cavemen didn’t wash their hands with soap and water to prevent common colds. Ignorance like this cannot be afforded as your wealth increases alongside your dependance on technology and the sophistication of AI.

Good thing there are some things you can do to improve your digital hygiene. Keep in mind that there is no way to completely immunize yourself from cyber threats, but you can make yourself the equivalent of a digital porcupine. The goal is to be a discouraging target.

Tips to Follow

Set your phone to only permit phone calls from your contact list

On iPhone – go to settings > Focus > Do Not Disturb > People > set Allow Calls From field to Contacts Only

Use a throw-away email address for all marketing and non-essential convenience needs like loyalty programs.

Services like Simplelogin are fantastic for this – I can’t recommend Protonmail enough.

Never respond to emails sent to such addresses.

Do not rely on your Internet Service Provider to maintain an adequate firewall

Minimum: supply your own router with automatic updates enabled.

Better: install a dedicated firewall, like Firewalla, to function as your router.

Use unique, complex passwords with Multi-Factor Authentication (MFA)

Never store passwords on your computer in an unencrypted format.

Services like Keeper Security, 1Password and Bitwarden have good reputations.

Be careful what you post on social media – the less personal, the better!

Posting vacation photos while on vacation is an obvious no-no.

Do not volunteer your information to the world.

Never, under any circumstances, click links or respond to unsolicited emails or text messages. 9/10 chance they are phishing attempts.

When in doubt, look up the name of the company that sent you the communication and reach out using verified contact information.

Be familiar with what to do if you or someone you know becomes a target of a scammer:

Visit the Federal Trade Commission (FTC) resource

Working with a financial advisor familiar with your finances adds a layer of verification that could potentially prevent your life savings from being drained. I’ve personally seen this protection activated with effect in four separate situations over the past five years. One of the many ways advisors add value that is difficult to quantify.

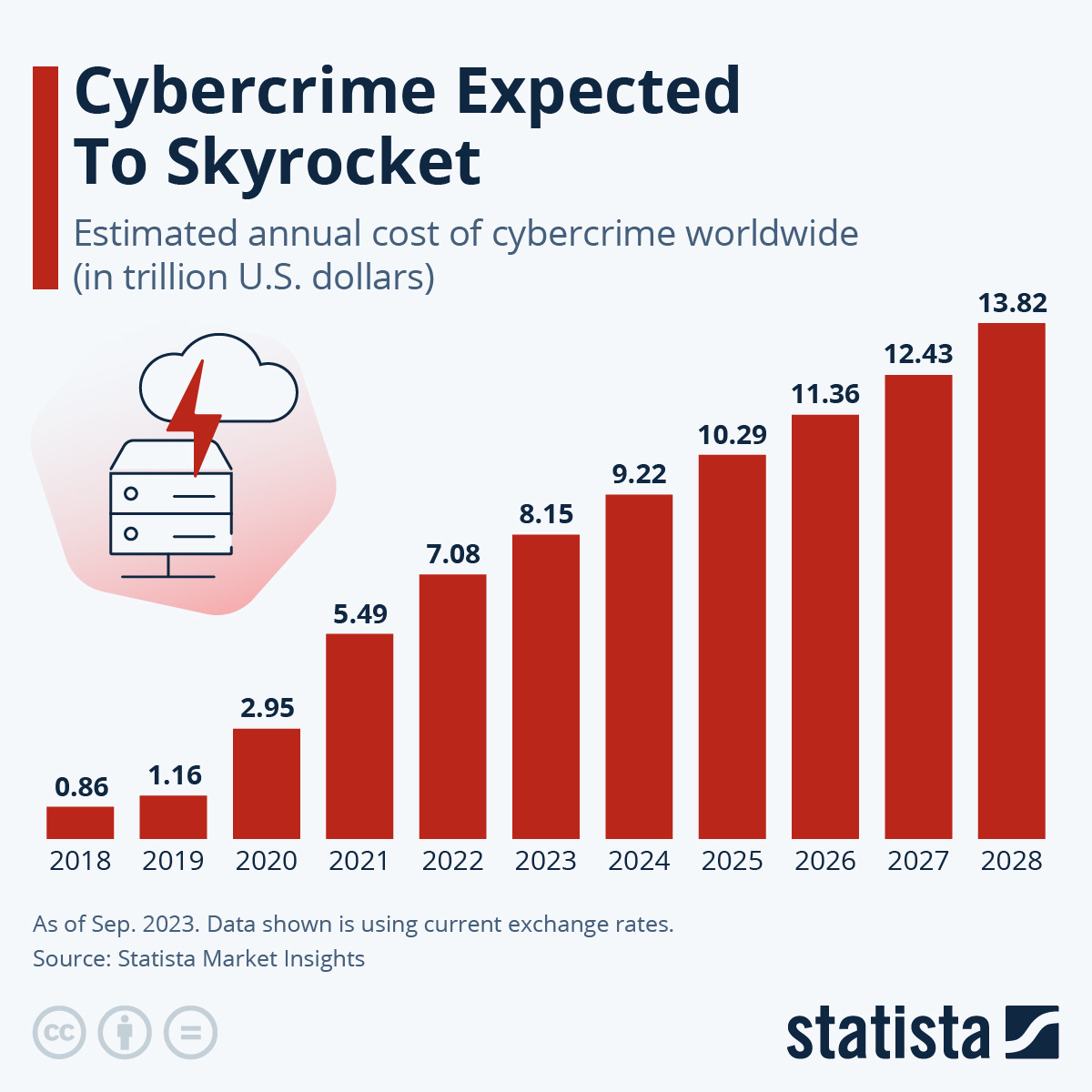

The FTC reported that American’s admitted to losing $12.5B in 2024. The FBI reported amount for the same year is $16.6B. The true amount is unknowable as many chose to not report their losses due to fear, ignorance or embarrassment.

Yes, it is one more thing to worry about in life. Yes, it requires effort to monitor proactively. No, you cannot rewind the clock to 1990 where this concern didn’t exist. Don’t make it easy for scammers to turn you into a statistic.

Assume you are being hacked and act accordingly.

Investment advice offered through National Wealth Management Group, LLC.

The information presented is for educational and informational purposes only and is not intended as a recommendation or specific advice.