Your Health for Insurance

Why health insurance is so expensive and what people are doing about it.

Two healthcare administrators go for a walk in the park when they come across a man grasping his chest in pain.

One says to the man, “good sir! How can we help?”

The man pleads, “please, take me to the hospital!”.

The other administrator replies, “that will be twenty thousand, billed to your insurance, of course”.

The man replies, “but I don’t have insurance…”

“Ah, in that case, it will be two hundred”, says one.

“No, possibly five hundred”, retorts the other. “We must get a second opinion.”

While the administrators quibble, the man keels over and expires. One healthcare administrator exclaims to the other, “what misfortune, a complete loss!”.

The other replies, “nonsense, we can still sell the twenty thousand to the debt collector.”

So imparts the general spirit of the American healthcare industry: bureaucratic, impersonal, opaque, and brutal. Front-line workers occupy the unenviable position of fulfilling both their Hippocratic oaths and appeasing a management increasingly concerned with profits and efficiency.

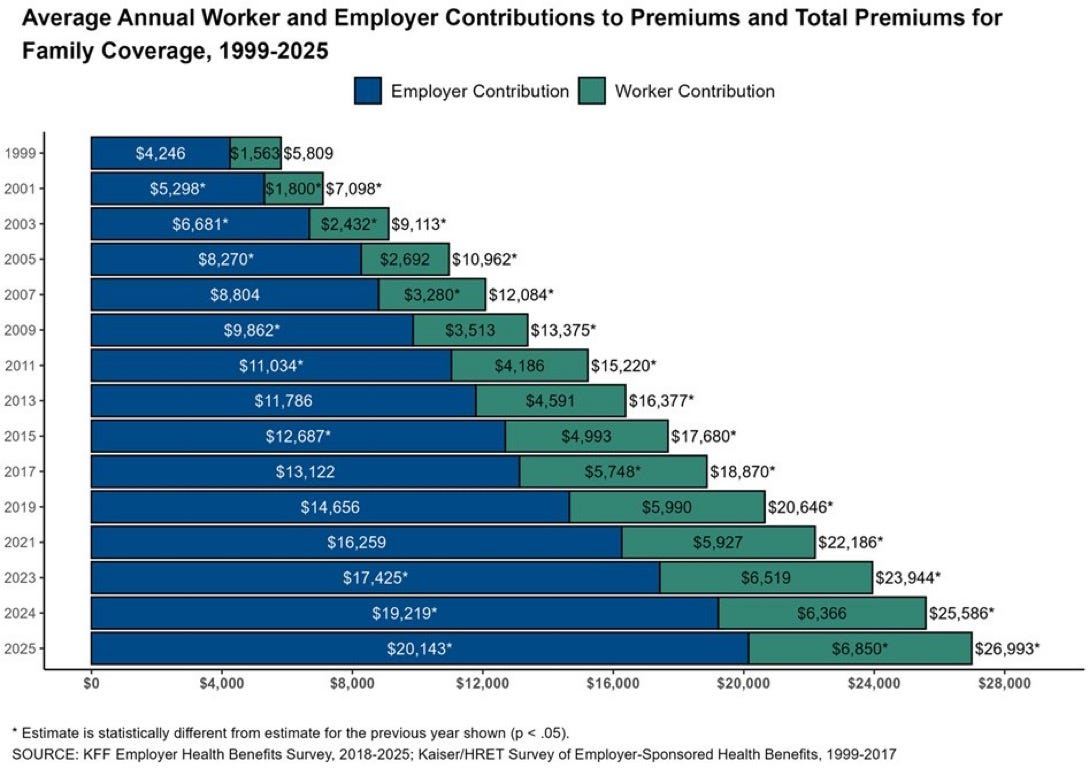

It’s never been tougher to be the face of one of America’s most dreaded industries. Patients are losing patience, and many much more than that. The average health insurance premium in the US for a family in 2025 is nearly $27,000 per year. And that’s before coinsurance and deductibles!

Some point the finger as insurance providers, others at government, and others at the healthcare providers themselves. As with most things, blame is never as simple as pointing a finger. What we do know for certain is that it’s not working for many Americans and you may be one of them.

Twenty-seven grand per year for coverage for a healthy family is just bananas. Perceptive Americans recognize this and chose to exit stage left, not sure where to go next but sure that their part in the show is over. They’re done being the spectacle and thumb their noses at the onlookers that once benefited from their financial circus performance.

Large employers in the US have mostly insulated their rank and file from untenable healthcare premium hikes over the past two and a half decades. A situation that is likely to be sustained so long as employers are incentivized to provide healthcare. If employees are healthy enough to work, they likely comprise a much healthier risk pool for insurers. This results in lower premiums for large group plans.

For small employers, the self-employed and the unemployed things are a little more real. When no employer or government subsidy is involved, the choice to disregard traditional health insurance is getting tough to ignore. If you’re healthy.

This trend has triggered a cascade effect degrading into an ailing risk pool available to insurers. Left unchecked, eventually the only ones left in the small employer and individually purchased marketplace plans will be the sick. Voila, there’s the recipe for a bodily fluid colored snowball effect on premiums. Nasty.

Uninsured explorers navigating the complex medical coding, billing and referral system are discovering that distorted risk pools are not the only problem. They are shocked to find most medical providers do not maintain a simple price menu.

If you want to make your physician receptionist’s head explode, ask them what something they do costs next visit. One of the most un-American things a business can do is not explicitly disclose prices to end consumers beforehand. The healthcare industry, to my knowledge, is the only one that gets away with it.

Why do you think they do this? It’s not by accident. In an unholy alliance bound by profits, insurers and healthcare providers have managed to completely disconnect the end consumer from pricing signals, short circuiting our instinct to shop for services. The result: a bunch of quasi-monopolies and runaway costs.

As more consumers abandon the traditional insurance marketplace and move to non-traditional options (more on that below), healthcare providers are being forced to adapt. Now it is possible, albeit still difficult, to negotiate effectively at the consumer level.

Unfortunately, these non-traditional options are mostly unworkable for individuals with significant health problems. Securing insurance through the Affordable Care Act (ACA) marketplace, a partner with access to employer sponsored health coverage, or your own employer’s health plan are your best options.

If you’re lucky, you made it to 65 and qualify for Medicare or are a veteran with access to the VA. If not, and your income is not substantial, you may qualify for a subsidy or possibly Medicaid benefits.

Websites like healthcare.gov and healthsherpa.com are useful for shopping marketplace plans.

For everyone else, here are some ideas to consider before committing to an ACA plan this open enrollment season:

Cost-Sharing Networks (HCSMs)

Originally known as health care sharing ministries, these organizations pool member contributions to cover medical expenses among the community. They are typically a fraction of the cost of ACA plans and provide access to broad health networks. They function almost like a ‘black market’ for health insurance without government regulation. This means no guaranteed coverage for pre-existing conditions, prescription drugs, or critical services you might rely on. Lifetime benefit caps may also apply so do your homework. The largest and oldest include Medi-Share, Samaritan Ministries, and Christian Healthcare Ministries (CHM). Popular demand has also made way for secular-leaning options like OneShare Health, Crowdhealth and Altrua HealthShare.

Direct Primary Care (DPC)

One of the new options gaining traction is the doctor by subscription model. The idea is to pay your primary care physician a fixed fee directly, cutting out the grubby insurance middleman. It is not something you could rely on for all health emergencies but could make a lot of sense for the vigorous individual looking for a maintenance plan. Consumers love the predictability of the expense, and the physicians can rely less on transaction volume leaving more time for quality patient connections.

Indemnity Plan with Critical Illness Coverage

These provide a flat dollar benefit, usually daily, for services received. Anything over that benefit is up to you to pay. These plans can work well, however are susceptible to surprise diagnoses with massively expensive treatment regimens such as cancer. This is why you should couple the indemnity plan with a critical illness plan. As with most non-ACA plans, pre-existing conditions could be excluded, and you are not guaranteed policy issuance. Otherwise, they’re a great option at about 1/3rd the cost.

Catastrophic Plan with HSA

These more traditional style plans comply with the ACA and are available on the marketplace, but only if you qualify. Unfortunately, they can only be purchased by households that meet one of three specific criteria. The most common being if the lowest cost silver plan available is more than 9.02% (2025) of gross household income. They are typically 30 - 40% less expensive and can be coupled with HSAs with great effect. It’s a shame qualification guidelines are complex and stringent because this could be a great option for anyone.

Nuclear Option

No insurance is an option but so is going to work naked. Under specific conditions, it might play in your favor. However, the risk is great. The consequences of not paying medical bills can include late fees, collections agency involvement, credit report damage, refusal of non-critical care and legal escalation. In many states, it is possible to have up to 25% of disposable income garnished, or bank account levies and property lien judgements issued against you. Some of your assets are protected but not all.

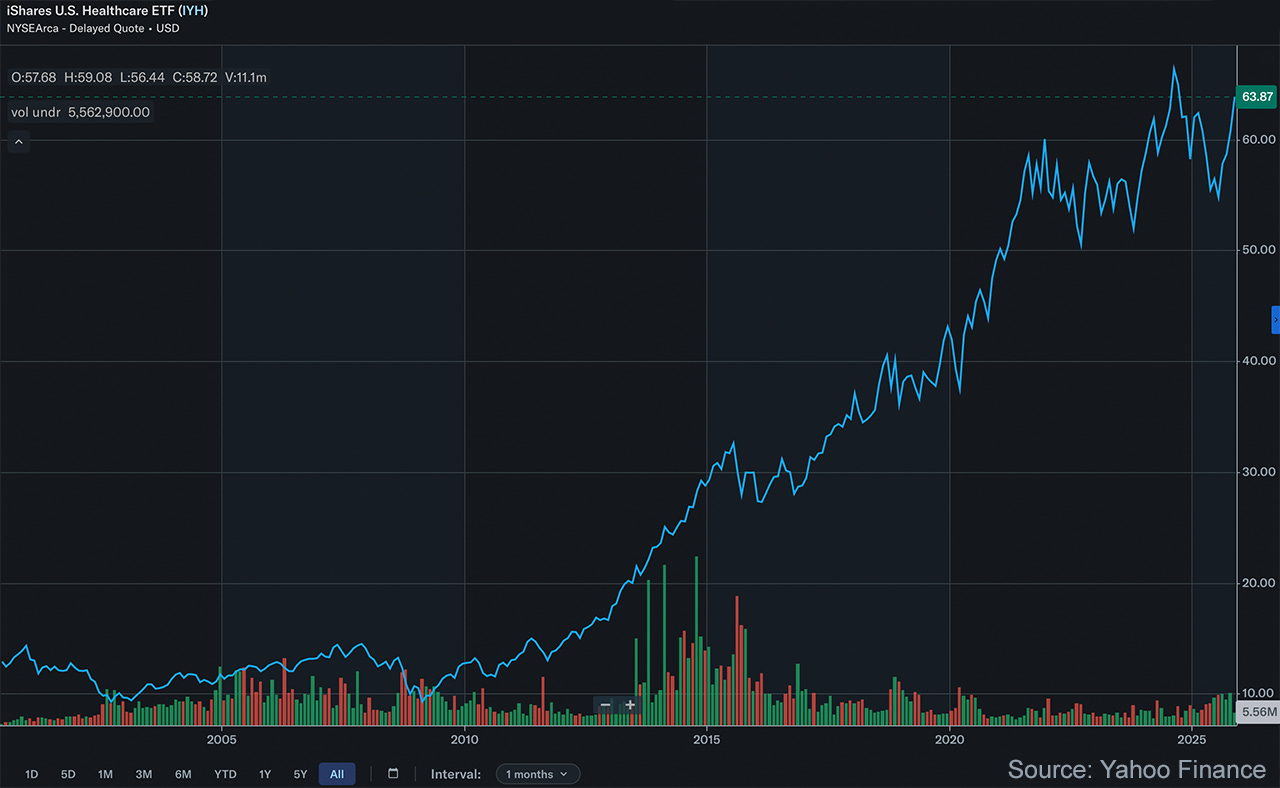

There are a lot of problems with the way Americans pay for healthcare. Premiums and service costs have gotten out of control while profits in the industry have soared. Anger is justified.

Fortunately, we are seeing innovation in the industry as providers are motivated to serve those patients the insurers have priced out. Advancements in artificial intelligence and robotics promise to drive down costs by increasing the availability and quality of care.

While we cannot celebrate just yet, signs of improvement are peaking through. A brighter future is ahead. And as always, contact me if you would like to discuss your situation personally. We do advise on healthcare plans and can offer solutions.

Check out our recent EP 44 of The Money Alchemist Podcast

What To Do About Healthcare

Investment advice offered through National Wealth Management Group, LLC (NWMG).

The information presented in this article is for educational and informational purposes only and is not intended as a recommendation or specific advice. All investments carry risks, including the potential loss of principal.

Past performance is not indicative of future results. Investors should consult with a qualified financial advisor to determine the suitability of any investment strategy based on their individual financial situation, goals, and risk tolerance.

Alternative health insurance options involve various risks, complexities, and considerations, such as coverage limitations, eligibility requirements, costs, and potential tax implications, which may vary significantly by individual situation, location, and market conditions. Experiences or general outcomes discussed are not indicative of future results, and NWMG makes no representations or warranties regarding the suitability, performance, or availability of any insurance products or strategies mentioned.

National Wealth Management Group, LLC does not guarantee the accuracy or completeness of the information provided, and opinions expressed are subject to change without notice.