4 Rules to Increase Your Income

Saving more means making more.

Check out our latest episode of The Money Alchemist, How To Increase Your Income, on your favorite podcast app!

Saving 20% of your income is a simple idea, one that just may cure your future financial woes, but it’s about as easy as fasting on a cruise. Gluttony is undeniably more fun. Although, I suspect the issue preventing us from saving more isn’t just excessive discretionary spending.

Let’s do some math to see what I mean.

The median 2023 household income in the US was $80,6101. Just for giggles, let’s shave off 30% for housing, 7.65% for FICA, 9% for Federal Tax, 3% for State and local, 2% for property tax and about 5% for healthcare. This leaves us with disposable income, at the median, of $2,912 per month.

Now, let’s save $1,344 of that every month.

I don’t know about you, but $1,568 isn’t much for car payments, childcare, food, energy and entertainment for an entire household/month. Hence the challenge of saving 20%. It’s easy to see why so many throw up their hands and ignore the future.

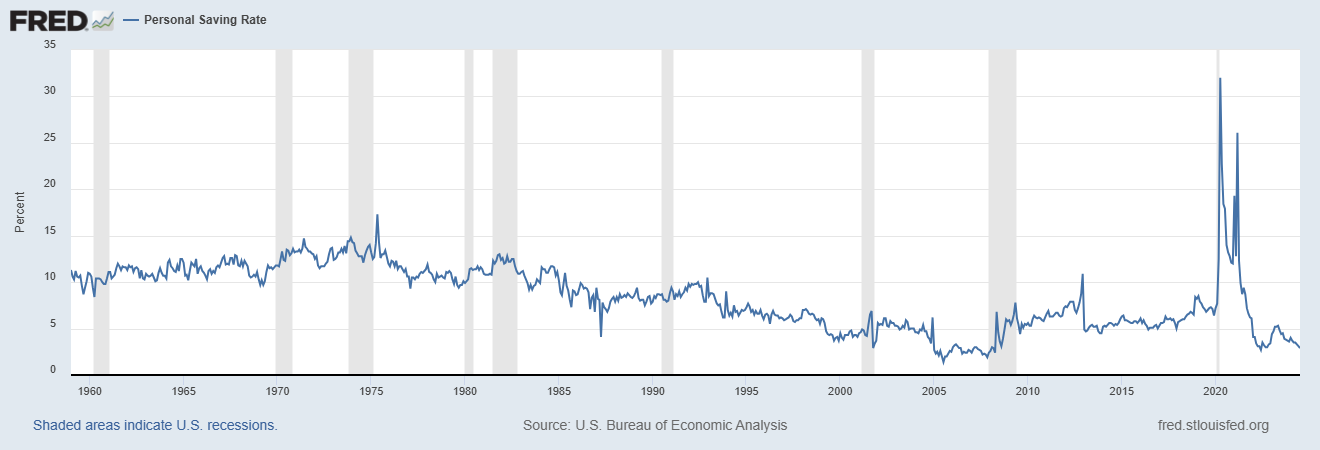

The US Savings rate per the St. Louis Fed reflects an increasing economic inertia for the rank and file over the past several decades. It’s difficult to build wealth with a 2.9% savings rate and the brutal truth is most will not. We can sit here and point fingers at the possible causes all day long, but this will not make you wealthier.

We’re here to move the needle.

Cutting expenses is the typical default response when people are faced with the prospect of saving more. Budget cutting is formulaic, and therefore easy to conceptualize. There’s no open-ended ideation or difficult conversations to have with your employer. You just assess whether something is needed and eliminate it if not.

Problem is, there’s a limit to how much of this can be done and inflation fights you every step of the way. Best to focus on the income component of your cash flow statement. Since this can be an intimidating process, here are some rules to follow I’ve gleaned from real life experience working with hundreds of people.

RULE 1 – Invest in yourself. Knowledge is your most marketable product and a greater command of it can only help your income. Think certifications, degrees, and skillsets relevant to your career track. Keep in mind that while credentialing (degrees) can be costly, valuable skills can be learned cost effectively through resources like Udemy, self-study or apprenticeships. Always Be Learning, even if you think it beneath you.

RULE 2 – Know your market value. Rule 1 wouldn’t be very useful if what you know doesn’t translate into economic value. I don’t know too many wealthy Playdough® sculptors. Sources like Glassdoor can be useful but it’s best to get competitive bids for your skills adjusted for your qualitative demands. This means applying for open positions while still employed. In fact, that’s the best time to do it. If you’re lucky, you may discover your market value is highest by employing yourself.

RULE 3 – Communicate*. From the day of your interview to your upcoming review date, clearly communicate your income goals. Your employer/manager needs to know if you are distracted by discontent, especially if you are important to the function of normal operations. The conversation should be approached from a position of option, hence rule 2. This shifts the tone from desperate pleading to confident negotiation. Assuming you applied the other rules, a higher income is your choice, not your employers.

*For the self-employed, rule 3 translates to business planning.

RULE 4 – Apply all the rules. This may seem redundant, and it is, but I feel it’s important to reiterate that the formula does not work if you neglect a rule. Fact-check: true.

4 steps you can read in one minute. Simple but far from easy. The merit that separates those that do from those that do not is action. You do not get from your bed to your job with one impressive leap. You break it down one step at a time, clothing before outdoors on a consistent basis.

In my experience, households with an income level of $250,000 or higher seem to have achieved an escape velocity. They save more as a percentage of income, are less sensitive to inflation, have lower debt to income ratios, and generally seem more satisfied with life and career. Efforts to increase your income below this threshold can make a huge difference.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.

2023 U.S. Census Bureau