Bear Repellent

A basic guide for derisking your portfolio.

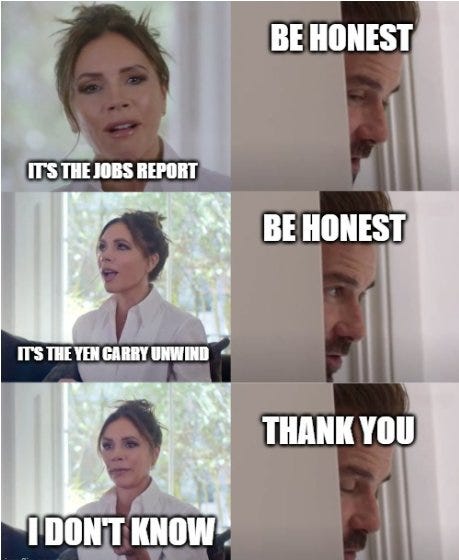

Last week we found out that the macro data wasn’t great. BLS jobs numbers were abysmal, albeit subject to revision, and US PMI is firmly in contraction territory (48.5). The NASDAQ is now in a correction while the S&P 500 is down over -6% from its recent peak.

Has the AI bubble finally popped or are we just experiencing pre-election FUD? Worse, it’s anchored in something only the crafty finance engineers on Wall Street understand: the Japanese yen carry trade.

Don’t have a deep understanding of FX markets, interbank loans, cross-border lending and central banking? Maybe in time AI will fix that but for now you have me.

In summary, financial institutions borrowed a lot of Yen at artificially low rates, some ¥250 trillion worth ($1.7 Trillion)1, typically by shorting Japanese government bonds. Traders would then convert the yen to a currency with higher yielding bonds (i.e. dollars) and the trader would benefit from the spread.

Borrow at 0.5% and invest at 5%.

Easy peasy free-money squeezy. Until the BoJ decided to change rates, signaling to markets that it is willing to accept higher bond yields for a stronger currency. Anyone in on the ‘carry trade’ panicked that the gravy train was coming to full stop and began unwinding positions before it was too late, spiking market volatility in the process.

The story isn’t over yet. Events will continue to unfold as few things in financial markets happen in isolation. Even the most bullish prognosticators are starting to whisper the “r” word to one another, but not before knocking on a solid piece of wood. Some are even calling for emergency Fed rate cuts, as if that would solve anything.

Recessions are the inevitable consequence of market excesses. Whether it be speculation, leverage, currency supply or over/under regulation, excessive deviations from market norms have consequences.

To suggest markets have been abnormal the past several years is the understatement of the century. This does not mean, however, that a recession is imminent. No one, not a soul, can predict when the downturn will occur or how deep it will be.

Just be prepared for it.

Which brings us to the point of this newsletter. How should you prepare for a potential recession? Your response will depend on your financial situation and disposition.

Every dollar in your portfolio has its own lifespan. Most of these dollars will live under your roof for a period longer than three years. Knowing this, you shouldn’t shelter all your money in temporary housing.

Sure, you may be able to pick up your financial tent and move out of a storm’s path (typhoon in this case). It does give you the perception of safety, but it is hardly a quality way to live.

For most, the best course of action is to shut the storm shutters, turn on a Netflix series and ignore the commotion. Ask your mom to wake you when it’s over.

But what if you’re approaching retirement, in retirement or need to fund an immediate financial goal. Better get the camping gear ready because we’re heading outside. Make sure to pack some bear spray.

Prep Guide:

Step 1: calculate how much you will need to provision from your portfolio for the next three years.

Step 2: position this amount in a risk-hedged allocation.

Step 3: draw from your risk-hedged allocation when markets are depressed to satisfy your distributions needs.

Step 4: wait for a recovery and rebalance

Most people get hung up on step 2. There are numerous ways to hedge risk, but for the TL;DR crowd I’ll summarize two of the most popular.

Lower risk assets – one of the most common strategies is to simply buy T-Bills or cash equivalents such as CDs. Both T-Bills and cash equivalents are negatively correlated with equities and may offer stability in times of volatility. Also, they currently generate positive real yields.

Reducing Correlation - structuring your portfolio in a way where all of the positions move in the same direction increases potential volatility. It is possible to mitigate some of this by seeking out investments that seem to move in uncorrelated, or we believe, negatively correlated ways. This is generally the point of diversification but can also be achieved through prudent use of certain options contracts.

The name of the game is to avoid selling into losses. The higher the losses, the greater the quantity of shares you will need to liquidate to satisfy your fixed financial needs. This means less shares to participate in the eventual recovery.

While I do not think recent events signal an imminent recession, they certainly have the hallmarks of a market correction with the potential to degrade into a bear market. Recession fears will become much more meaningful after the election.

At this point, we should have a good idea how much and sudden the personal tax increases will impact US taxpayers as part of the automatic TCJA sunset.

Now is a very good time to revisit your financial plan.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

All performance referenced is historical and is no guarantee of future results. All indicies are unmanaged and may not be invested into directly

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk

There is no assurance that the techniques and strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal.

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.

https://www.wsj.com/livecoverage/stock-market-today-dow-sp500-nasdaq-live-08-05-2024/card/why-the-yen-carry-trade-unwind-has-further-to-go-SYsvxWxTvLGLCUsDTDM5