Fees

Another 4-letter word starting with "F"

‘Fees’. The word rolls off the tongue like an expletive drenched with consequence. Money managers and bankers would rather blurt out profanities than utter the word in relation to their services. Their mantra: discussion of cost should be avoided at all costs.

To spice up your life, I suggest opening your next conversation with a financial professional with the question, “what are your fees?”. This woefully underused strategy has the potential to trigger more acrobatics than a Cirque du Soleil ticket. The result may be as hilarious as it is sobering. Use with an audience for best results.

The epistemic challenge of discerning cost and worth discourages transparency for industries with complex value propositions. Popular opinion is to assume the price of professional financial advice is too high, reflected by a 2022 Statista report showing 57% of Americans opt to DIY1.

Jack Bogle, the founder of the Vanguard Group, once stated, “In investing, you get what you don’t pay for. Costs matter.” This message resonates with many because price is easy to understand. Value, especially that which cannot be immediately quantified, is not.

For this reason, Vanguard has become one of the largest investment managers in the world with its flagship low-cost index funds representing the majority of $9.3T under management. Index investing, with its bare-bones approach to overhead and management, now represents 51% of US fund equity share2.

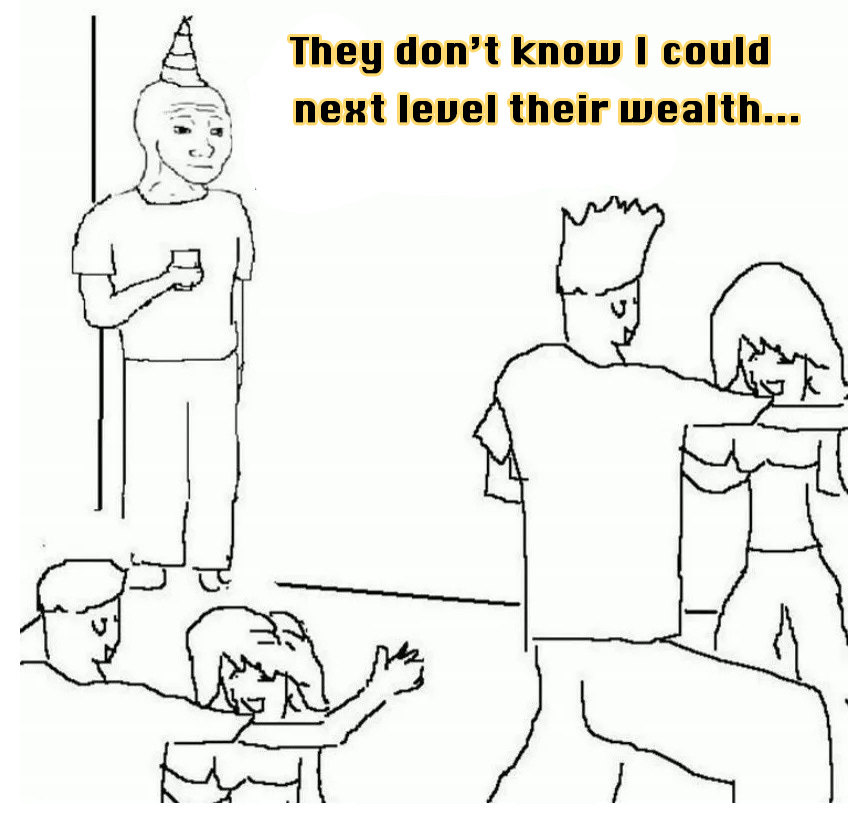

People flow like water, through the path of least resistance. This channels us to avoid conversing with anyone who makes a living dispensing financial advice for a fee. Partially because it’s awkward to value a person, but mostly because it limits unknown variables.

So we think. We don’t know what we don’t know.

Unfortunately, the professional response to this natural consumer bias is to obfuscate costs. It’s so pervasive that I’ve encountered investors that believe their investment fees are zero. Here’s a clue: your investment costs are never zero.

As the saying goes, there’s no such thing as a free lunch. Anecdotally, to refute this aphorism, I once paid for a stranger’s Chipotle burrito in the line behind me. The cashier mistakenly placed his burrito into my bag.

Instinct took hold of the man, and he thrust his hand into my bag with fingers volleying like artillery rounds to retrieve what was his. A thumb penetrated the thin aluminum armor protecting my lunch with catastrophic results.

The lesson: there actually is no such thing as a free lunch.

In a complicated economy where everyone is forced be an investor to outpace inflation, we must address the interconnected problems of security analysis, capital allocation, tax optimization and monetary purpose. So, what do you do?

1. Use low-cost resources available to DIY, or

2. Hire a qualified financial professional?

A DIY investor can save thousands in fees over a lifetime of investing. But all these savings can be undone with one careless oversight: an emotionally compromised trade, death or disability, a tax error, etc. Danger comes in many forms, most of which one person alone cannot surveil or identify.

The prudent move is to investigate option 2. Surprise, surprise, fees drive a major part of this decision. Getting clear cost comparisons from different providers is tricky but not impossible. First, a couple service model distinctions you should be aware of are:

Brokers– a broker is a ‘fire and forget’ solution. This individual works on commission and is not suitable for a long-term planning engagement. Costs vary wildly and can be difficult to understand, one reason we see this model waning.

Fee-based and Fee-only (FB/FO) – advisors are bound by a fiduciary standard of care with an ongoing service model defined by an agreement. “Fee-based” simply means the professional also has the capacity to work as a broker.

While it’s possible to compare costs between brokers, it will be time consuming and probably not worth it in the end. Like compact discs, they still exist but there are better options.

FB/FO advisors work under negotiated contract arrangements and assume a fiduciary standard of care. While it is the most transparent way to pay fees to an advice professional, there are no standard service offerings making it difficult to compare.

Most charge a fee as a percentage of assets they manage, otherwise known as an AUM (Assets Under Management) fee. The most common AUM fee I encounter is 1.25%, although I typically see name-brand firms charge more. The fee range under the AUM model hasn’t budged much in the two decades I’ve been in the industry. Rather, I’ve seen advisors add more services to combat competitive forces.

A more niche arrangement, although it is growing in popularity, is a net-worth fee. I personally dislike this method as it discourages clients from disclosing assets or overstating debts, which has the potential to cripple the effectiveness of a financial plan. Nonetheless, it may be right for you.

Then we have the hourly consulting or flat-fee agreement which is popular among ultra-high-net worth households. I’ve seen fixed fees range from $250 per hour the $12,000 per month. This model is best adopted when both client and advisor have a clearly defined engagement with little to no ambiguity in service load. Otherwise, more time will be spent on negotiating the fee, which only adds to the fee.

I also commonly see flat fees for advisors that offer planning only services or charge separately for planning. The latter being something to watch out for when comparing costs between advisors using the AUM fee structure.

Regardless of how you agree to pay your advisor, you should know what that amount is and what you are getting in exchange. Here’s a checklist to help you get started with your research:

This is not all-inclusive but should arm you with enough information to guide your decision. Investors should interview several advisors before committing and this checklist can help standardize the decision matrix.

In any event, attempts to deflect the “what are your fees” question usually means they are not worth the service, and the advisor knows it. Cartwheels are entertaining when your 5 but now they are more likely to hurt you.

Investment advice offered through National Wealth Management Group, LLC.

The information presented is for educational and informational purposes only and is not intended as a recommendation or specific advice.

Investment advice offered through National Wealth Management Group, LLC.

The information presented is for educational and informational purposes only and is not intended as a recommendation or specific advice.

https://www.statista.com/statistics/1176393/financial-advisor-usa/, Statista, Shares of Americans Who Work With A Financial Advisor

https://www.ici.org/system/files/2025-03/per31-01.pdf , ICE, Trends in the Expenses and Fees of Funds 2024.