Nothing is on Sale

Monetary premiums are placed on quality assets.

Like the old sweater from your college days that’s tattered and a little too snug, you feel that your current living situation needs an upgrade. So, you power up the Macbook, understanding the Macbook gives you a distinct advantage. Everyone knowns this. That’s why you paid the markup.

But excited interest quickly transforms into frustration, then ultimately into despair as you investigate your alternatives.

There is a property for sale in your preferred area but it’s a corner lot and the seller wants double what it sold for in 2021. You call the realtor on Monday to see if there’s any wiggle room only to find out it’s sold. Forget it. Looks like Christmas will be tight again this year.

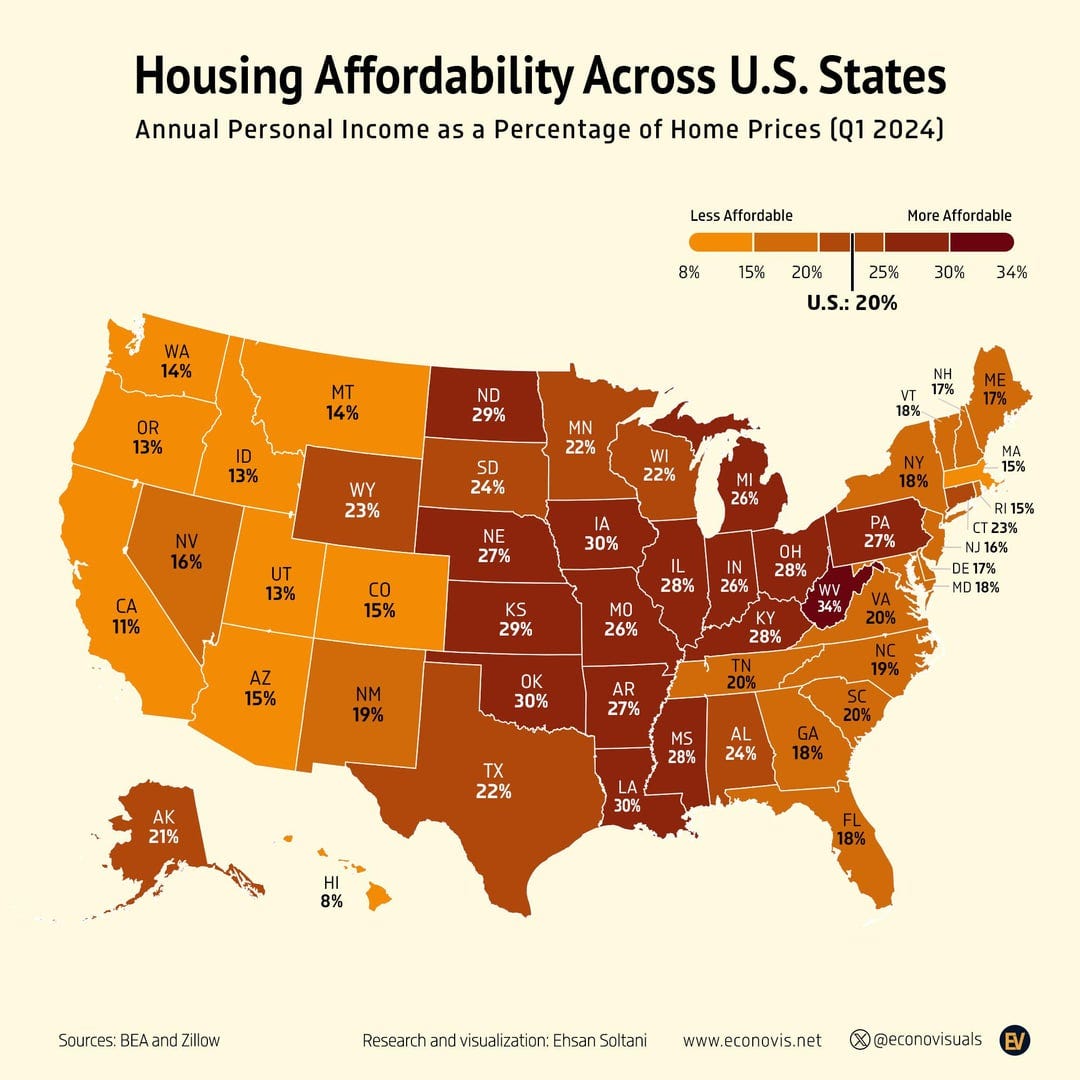

The S&P 500 is at all-time highs, investment grade bonds now flirting with negative real yields, gold at all-time highs, and even Bitcoin seems to have established support at $50k. New and existing homes are hitting record levels of unaffordability.

What is the deal and who are all these dang people bidding up your future homes? “These dang people” are people just like you, either a little more desperate or further along in their stages of inflation grief.

Bills are not the only thing impacted by inflation, which is caused by too many dollars chasing after a limited quantity of anything. We also see inflation in investable assets.

Dr. Kelly, the Chief Economist for JPMorgan spoke to a small group of FPA members in a conference I attended last year and said the following,

“deficit spending diverts inflation into financial assets”.

Couldn’t have said it better myself.

When the Treasury auctions bonds to finance Washington’s over-the-budget spending, the dollars flow through established spending channels, most of which terminate into institutional pockets.

For example, Medicare and Medicaid represent 25% of the annual $6.8T in Federal spending. Most of this being paid directly to healthcare providers with healthy profit margins and top-heavy payrolls. That’s $1.7 trillion, with a “T” per year.

Who are the primary stakeholders of these institutions? Asset holders. And asset holders really like to add to their portfolios.

This brings us back to why nothing is on sale. Ask yourself, as an investor, why don’t you simply keep all your wealth in your checking account?

Because you don’t like poverty, that’s why. Same goes for anyone else with means to save.

The values of financial assets are not just a reflection of projected future cash flows. If that were the case, the valuations of many S&P 500 constituents would be considered wildly unacceptable.

Asset prices also reflect the value of money itself. Using industry jargon, they reflect a monetary premium. Bitcoin, for example, reflects nearly all its value in the form of a monetary premium.

There’s no commercial use for it nor is it entirely speculation. Bitcoin’s value is largely derived from monetary utility. Few understand this concept. Fewer still understand that monetary premiums are priced into all quality assets, including homes.

Here’s a puzzle to rattle around in the ole’ noggin: Why is it your home grows in value when it deteriorates more and more every year? Even the IRS lets you depreciate buildings owned as investment. Strange indeed.

Monetary premium is the answer.

As confidence in the dollar decreases, so does the incentive for people to sit on quality assets, thus further restricting available supply. And as home shoppers are well aware, a restricted home supply is about as much fun as a panda’s diet.

As policy makers continue to sail into the unknown abord the ship Fiscal Dominance, I believe we will see monetary premiums placed on quality financial assets increase. People will naturally gravitate toward assets they feel are more likely to hold value over time.

Markets are complex and this doesn’t even come close to explaining all the economics of price action. But it certainly is an important piece.

It’s true. Nothing is on sale right now, but is anything ever truly on sale?

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

All indicies are unmanaged and may not be invested into directly. Economic forecasts set forth may not develop as predicted.

Investing involves risks including possible loss of principal. The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.