Once Upon a Time...

The fairytale of long-term plans.

Financial planning isn’t a popular activity because we all know deep down inside that it’s a flawed process. Close your eyes and imagine your life 5, 10, 20 or even more years from now. Unless you’re the Lisan al Giab, all you see is the distorted reflection of your present self at a distance. Yeah, let’s sit down for an hour and squint at that image.

I harbor a deep secret, dear reader, and it’s a risky one to admit. I am a financial planner who does not follow a clearly defined long-term financial plan.

It’s not that I’m lazy. I have completed the formal, garden variety kind of ‘financial plans’ for my family and I, but then we do what everyone else does: ignore them.

Plans, goals, grand visions of the future, these we have in abundance. Once formed, we attack them with the precision and ferocity of Imperial Storm Troopers. Close range attacks only. The funny thing is it works. Our financial position has improved steadily over the years, and I’ll tell you why I think that is.

First, let’s run an experiment.

Note your responses because they’ll matter a bit further down.

Most goals of mine are measured in weeks, not years. To save for retirement, my wife and I aim for a clearly defined target such as fully fund our 401(k) plans for 20XX. We then automate our savings through monthly automatic contributions into an investment plan.

Done. That’s our retirement plan for the next 12 months. No Monte Carlo simulations. No long-term forecasting or haruspication. No animals are harmed in the process.

We wanted to buy a new house, so we spent the last 24 months squirreling away any unallocated income. There was no targeted amount, we just committed to save whatever was available for this purpose. It was an open-ended commitment like tending to a produce garden.

These ‘plans’ are most often created through a series of informal discussions between my wife and I, with multiple such plans all working in concert. Sometimes the concert sounds like the high school band warm up. Messy, but real.

What makes this effective is that our target is close enough to be clearly visible, making feedback from our actions immediate. Ready, aim, fire, look.

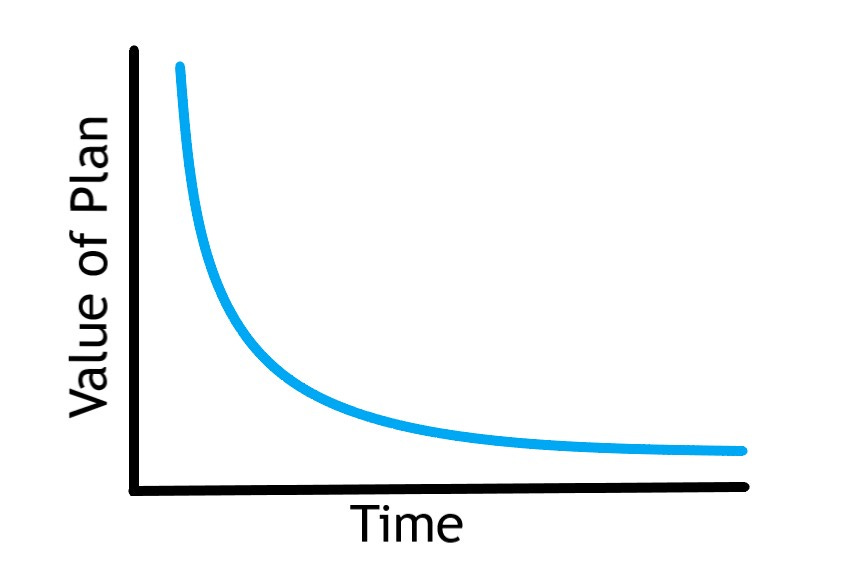

The further out we forecast our future, the more uncertain things are. The law of diminishing marginal returns applies to planning as your timeline extends.

It’s not just because the things around you are changing. You are changing, a lot in fact. Let’s recall your answers to the questions above. If you’re like most, the answer to the first was less than the answer to the second. Even though they are essentially the same question. What would your answers look like ten years ago?

A 2013 study conducted by Quoidbach, Glibert, and Wilson published in Science1 demonstrated that people value their present preferences projected into the future much more than they do their historical preferences. They surmise that our contemporary bias obfuscates our vision of the future.

Conclusion: we massively underestimate the degree to which we will experience change.

The retirement you envision today is not likely to be your reality. I am reminded of the time I sat with my grandfather in his skilled nursing home room, and he just spontaneously began laughing. “What’s funny?” I asked. He thought it hilarious how his imagination failed to predict his present circumstance. Must have been an inside joke.

Saving money is important. Money narrows the scope of future uncertainty because it gives you option. With option comes flexibility and with that comes quality of life.

Anchor your motivations in what excites you presently. I find that people are rarely inspired by visions further out than three years. Be a visionary if that’s the thing that propels you, but even visionaries have milestones.

Instead of targeting ephemeral goals years into the future, aim closer with a specific target. At least that way you can see if your shots are on the mark.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisory and separate entity from LPL Financial LLC.